[Estimated time to read: 2.5 mins]

Because of the growth of the internet, and online social networks in particular, the traditional media plays a smaller part in our lives than it once did.

But it remains very influential.

Indeed, many investors still look to the media for guidance when deciding what to do.

Is it a good idea?

For most people, regrettably, it’s not.

In his book, The Four Pillars of Investing, William Bernstein wrote:

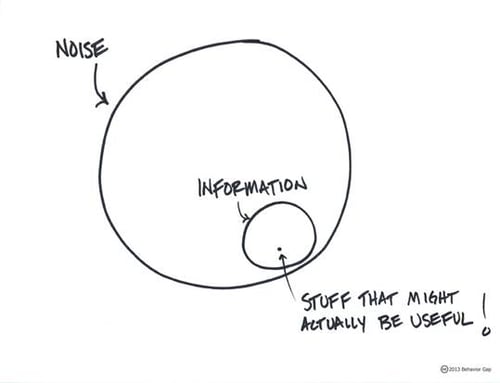

“99% of what you read about investing in magazines and newspapers, and 100% of what you hear on television, is worse than useless.”

That may seem like a sweeping statement, but it’s far closer to the truth than you might imagine.

By television, Bernstein is referring to financial news channels like CNBC and Bloomberg.

These channels generally do not help investors; in fact they hinder them.

They appeal to viewers’ emotions, tempting them to do things that aren’t in their long-term interests.

When markets tumble, for example, watching a financial news programme is likely to spark physiological responses inside you.

Your brain’s amygdala floods your bloodstream with corticosterone and fear clutches at your stomach.

You instinctively want to sell, to get out of the market before it collapses.

Similarly, when markets soar, watching the likes of CNBC can fire up the reflexive nucleus accumbens in your brain.

Suddenly you’re excited at the prospect of big gains and you start to convince yourself that you need to buy, to pile in now before the opportunity passes.

These are natural instincts that serve us well in other areas of our lives.

But almost always, for investors who have the right investment strategy in place, the best course of action is inaction.

In that sense, financial television can be very harmful.

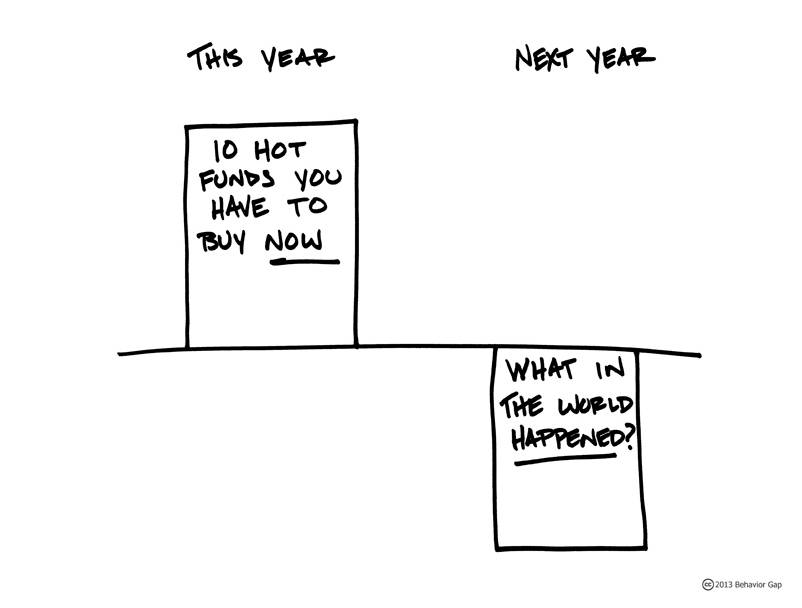

Also, these channels love their pundits — people who claim to be able to forecast future price movements, and to know which stocks, sectors and funds are tipped to outperform.

Again, the evidence shows that the track record of financial media pundits is dreadful, and that all such tips and forecasts are best ignored.

What about newspapers and magazines?

Well, think about how those publications are funded.

Without advertising revenue from asset managers and fund retailers, most newspaper money sections and investment magazines wouldn’t even exist.

However principled individual journalists may be, however determined to protect editorial independence, it’s very hard in the real world to bite the hand that feeds you.

The fund houses, of course, are all too aware of the clout that journalists have, and the benefit of having reporters write in positive terms about their products.

So, for instance, they fund glitzy awards nights where the winners are often the journalists and publications who’ve been the most “on-message”; they also offer journalists expensive lunches, tickets to sporting events and even junkets overseas.

How much impact all this has is very difficult to say, but it raises important questions.

In particular, what is the benefit for end investors?

After all, they’re the ones, ultimately, who are picking up the bill.

But there’s another, and perhaps even bigger, conflict of interest to consider.

The financial media relies on the fund industry not just for the revenue it provides, but also because, without it, there would be precious little to write about.

Let’s face it, recommending every week that readers simply buy and hold a widely diversified portfolio of low-cost index funds is not a great way to boost circulation.

The fund industry knows there’s an insatiable demand for news and comment, and with active fund management, there’s always something new to write about — new funds, new managers, new trends and so on.

So fund houses pay PR agencies to produce a constant stream of “stories”, many of which end up in print.

Indeed, with editorial budgets increasingly stretched, and ever smaller teams of journalists having to churn more and more material, it’s noticeable that some stories contain passages that have simply been cut and pasted from a press release.

So, what are the lessons to learn for investors?

In short, they need to become much more discerning consumers of financial media.

Whenever you read an article that tempts you to act, always ask yourself

- Who is the author?

- Why are they saying that?

- What’s in it for them?

Also, be especially wary of financial TV.

Watch it, by all means, for entertainment value.

But don’t act on it.

And try to avoid it altogether when, as inevitably happens from time to time, markets turn volatile.

To quote William Bernstein again:

"The sooner you turn off CNBC, get out into the bright sunshine, and take a walk, the sooner you'll feel better about your investments"

Let us meet in the comments. What financial media do you enjoy, or ignore?