[Estimated time to read: 4 minutes]

![]() The course for destruction is set.

The course for destruction is set.

We are merely skittle targets as the bowling ball of recession thunders down the Brexit alley…

That’s right. From Eddie Izzard to David Beckham to Bob Geldof, the oracles have spoken.

So we better assemble our hunting knives and order in enough croissants and chorizo to keep us going for a decade.

Admittedly, preparing for a zombie apocalypse could be hysterical, but there are very real rumours of economic recession now that the Brits has passed judgement on the EU.

It is true; the pound hit a 35 year low recently, shares in UK banks and housebuilders have taken a nosedive, the GfK consumer confidence index has seen a sharp drop and Ellie Goulding said on that fateful Friday…

“I felt a fear I've never felt this morning”

Whilst J.K Rowling was altruistic calling for “more magic” before giving up the ghost and describing the 52% as follows:

Brexiteers like the cheating man shocked he can't stay in the spare room for 2 years while he sorts himself out. https://t.co/Xvjfr6ifPv

— J.K. Rowling (@jk_rowling) June 24, 2016

Anyway, enough of the politics.

How should we, as savvy investors, react?

Prepping Tip #1

Whilst assembling vital meds, tourniquets and IV stands for the impending influx of trauma cases as tribal warfare spreads – invest too, in ensuring that you are not paying over the odds for products and fund selections.

Individual investors under-perform the market by approximately 7.3% per year largely as a result of hidden charges (Source: 2015 Dalbar study of US equity investors).

For expats, the risk of running into a smooth-talking, unscrupulous financial salesman has been high – I am sure they will be the first to get mauled by zombies post-Brexit – but there are a few simple steps which will help you dodge the costly products a few may continue to peddle.

In the long run, hidden fees and zombie salesmen will do far more permanent damage to your portfolio than market volatility.

See this checklist from independent bestselling author, Andrew Hallam and make very sure your adviser is not infected… I mean unqualified.

Prepping Tip #2

As ever, diversification is the key.

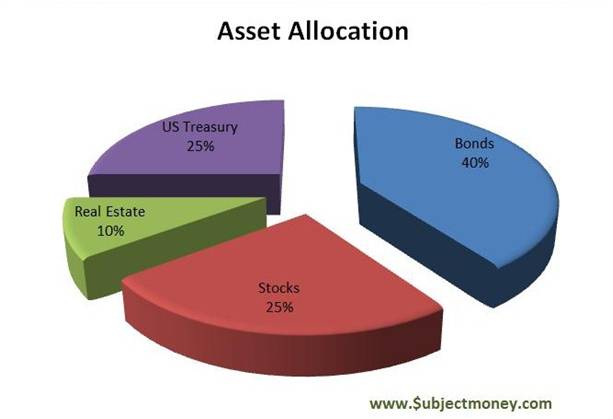

Not only should you consider loaning your uncle’s 12-bore (an automatic set-up wiring the trigger to the front door will do the trick), but you must also stick to your guns by remaining invested in the same asset allocation you and your adviser settled on months or years ago taking into account your appetite for risk.

“About 90 percent of the variability in returns of a typical fund across time is explained by [asset allocation] policy.”

This applies to the underlying performance of your portfolio too. If you have a 70/30 mix of equities and bonds, then ignore the noise. Stay proportionately invested 70/30 in the same top-line asset classes.

Prepping Tip #3

Sit tight and baton down the hatches – don’t be a hero by venturing out on day one of the apocalypse (possibly put back to Q4 now).

Playing your cards right means keeping track of developments and holding your own in the long run from secure foundations – not heading over to your horrible boss’s apartment across town guns blazing.

Besides, he’ll very likely have his PA on the roof ready and waiting.

In the same vein (with a little artistic licence), invest passively.

Passive or evidence-based investing aims to track the overall performance of indexes (often using ETFs) rather than attempting to beat market trends. Not only is 80% of share price movement down to overall market movements, active fund managers pit their wits against millions of other market participants who, collectively, know better what the true value of a security is.

Just look at the performance of actively managed funds below.

- 86% of European active funds failed to beat their benchmark over ten years;

- 98.9% of US-focused equity funds under-performed;

- 97.8% of global equity funds under-performed; and

- 97% of emerging market funds failed to exploit market inefficiencies.

Although past performance is no guarantee of future performance, the markets are likely to recover as they have done consistently over the past century or more.

On the whole, markets grow.

Humanity will restore order and you’ll kick yourself if you got picked off just as the Zombies made a miraculous recovery.

Track the market but don’t believe anyone who claims they can predict the future.

To conclude…

The first step for anyone wishing to come out of this alive / with most of their pension intact, is to manage your behaviour and avoid panic. If you have already decided to invest in the markets, make sure you are not exposed to the panicked whims of active fund managers – stay passive.

Equally, if you are already invested, you should have decided on your asset allocation and therefore have already factored in the risk of market volatility.

In the event, AES International has the basics covered (even if we can’t offer you radios and army surplus jackets).

So what should you do NOW?

Watch these quick steps to better investing. Whether you have money invested or you are looking to set up a portfolio, get in touch for a free and impartial initial assessment.