Bitcoin is the Marmite of the financial world.

Love it or hate it, it’s going to be around for some time.

But rather than debating whether it should or should not exist, here are three things to consider…

Described as “everything you don’t understand about money combined with everything you don’t understand about computers”, crypto only emerged in the past decade.

It’s receiving intense media coverage, prompting many investors to wonder whether it deserves a place in their portfolios.

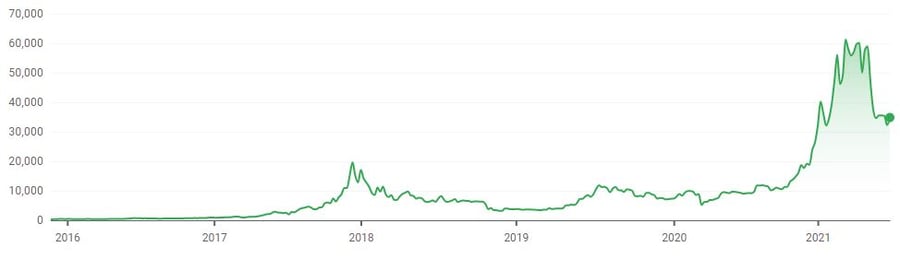

In its short existence, bitcoin has proved extraordinarily volatile, sometimes gaining or losing more than 40% in price in a month.

And as you know, no central bank issues the currency, and no regulator or nation state stands behind it.

Instead, cryptocurrencies are a form of code made by computers and stored in a digital wallet. In the case of bitcoin, there is a finite supply of 21 million, of which more than 18.5 million are in circulation. Transactions are recorded on a public ledger called blockchain.

There’s been a sharp rise in the market value of bitcoins over the past weeks and months.

So what are investors to make of it?

1. Expected returns

By investing in stocks and bonds today, you expect to grow your wealth and enable greater consumption tomorrow.

One important role these securities play in a portfolio is to provide positive expected returns by allowing investors to share in the future profits earned by corporations globally.

Holding cash does not provide an expected stream of future cash flow. One pound in your wallet today does not entitle you to more pounds in the future.

The same logic applies to holding other fiat currencies (government-issued currency) - and holding bitcoins in a digital wallet.

So we should not expect a positive return from holding cash in one or more currencies unless we can predict when one currency will appreciate or depreciate relative to others.

It might be argued that holding bitcoins is like holding cash; it can be used to pay for some goods and services.

However, most goods and services are not priced in bitcoins.

A lot of volatility has occurred in the exchange rates between bitcoins and traditional currencies.

That volatility implies uncertainty, even in the near term, in the amount of future goods and services your bitcoins can purchase.

This uncertainty, combined with possibly high transaction costs to convert bitcoins into usable currency, suggests that the cryptocurrency currently falls short as a store of value to manage near-term known expenses.

2. Supply and demand

The price of a bitcoin is tied to supply and demand.

Although the supply of bitcoins is slowly rising, it may reach an upper limit, which might imply limited future supply.

The future supply of cryptocurrencies, however, may be very flexible as new types are developed and innovation in technology makes many cryptocurrencies close substitutes for one another, implying the quantity of future supply might be unlimited.

Future regulation adds uncertainty.

While recent media attention has ensured bitcoin is more widely discussed today than in years past, it is still largely unused by most financial institutions.

It has also been the subject of scrutiny by regulators.

For example, in a note to investors in 2014, the US Securities and Exchange Commission warned that any new investment appearing to be exciting and cutting-edge has the potential to give rise to fraud and false “guarantees” of high investment returns.

Other entities around the world have issued similar warnings.

All these factors suggest that future supply and demand are highly uncertain.

3. What to expect

So, should you expect the value of bitcoins to appreciate?

Maybe.

But just as with traditional currencies, there is no reliable way to predict by how much and when that appreciation will occur.

However, people should not expect to receive more bitcoins in the future just by holding one bitcoin today.

They don’t entitle holders to an expected stream of future bitcoins, and they don’t entitle the holder to a residual claim on the future profits of global corporations.

When it comes to designing a portfolio, a good place to begin is with your goals.

This approach, combined with an understanding of the characteristics of each eligible security type, provides a good framework to decide which securities deserve a place in your portfolio.

For the securities that make the cut, their weight in the total market of all investable securities provides a baseline for deciding how much of your portfolio should be allocated to that security.

Unlike stocks or corporate bonds, it is not clear that bitcoins offer investors positive expected returns.

Unlike government bonds, they don’t provide clarity about future wealth.

And, unlike holding cash in fiat currencies, they don’t provide the means to plan for a wide range of near-term known expenditures.

Because bitcoin does not help achieve these investment goals, we believe it does not warrant a place in a portfolio designed to meet one or more of such goals.

A globally diversified portfolio invested in the world’s best companies makes better sense for those who prefer to have their investments working in the background for them…

While they spend their time and energy on things they love.