11 rules high-net-worth investors swear by (plus 3 questions they ask themselves)

It’s time to decide what you want from life.

What motivated you to click on this?

Do you want the ideal life you’ve always dreamed of or to avoid costly errors?

Without understanding your motivations, you won’t be able to set clear goals.

To get started, we have 3 questions for you to think about.

These will help you on your way to gain clarity, confidence and control over your ideal future.

1. Why is money important to you?

In my 15 years of experience in financial services, I’ve found senior international professionals generally invest for one of three reasons:

- They have anxiety about the future.

- They want to be able to afford more enriching experiences.

- They want to provide a better life for their loved ones.

And the questions they have are often:

- Am I going to be okay?

- Do I have enough?

- What happens if I make an expensive mistake?

- Will my loved ones be taken care of when I’m no longer around?

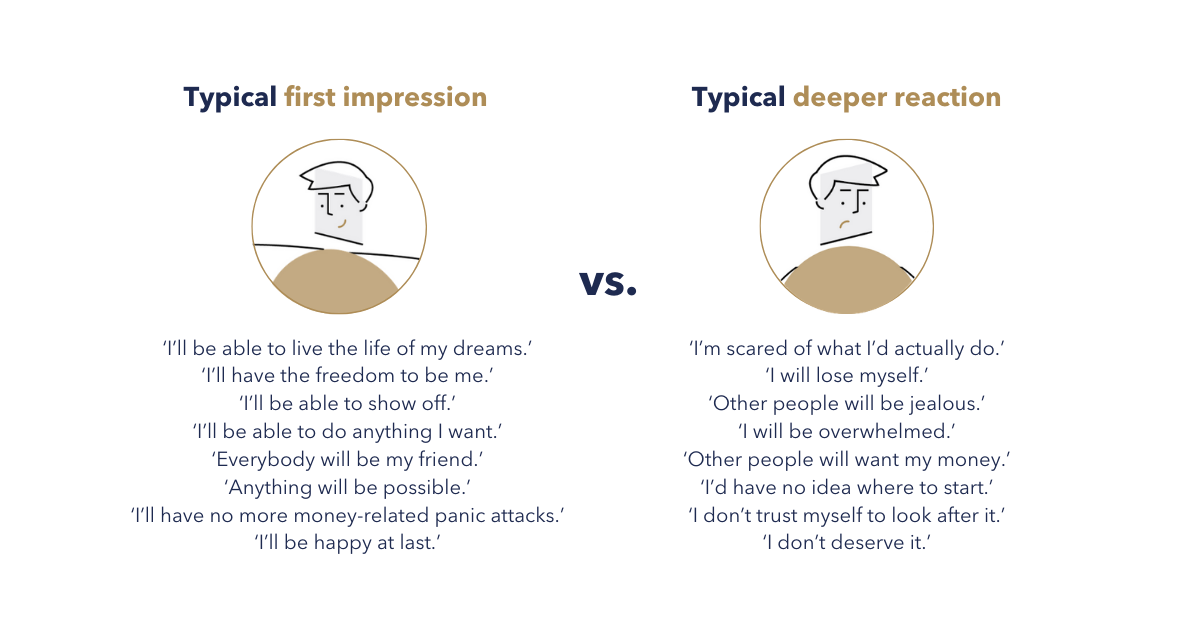

However, these questions tend to be surface level.

You need to understand what’s truly driving your financial goals.

Now, try to dig deeper and think about the following:

- What unfulfilled dreams and desires do you have?

- What kind of life would you like to have in ten, twenty or thirty years’ time?

- In what way is your life today comfortable? And in what ways is it a financial struggle?

- Are you comparing yourself to others? Do you want to emulate somebody else?

- Are you trying to avoid something, for example financial distress that you have seen your parents or friends face?

The answers to these will determine whether you’re driven by a sense of fear, happiness or commitment.

2. What does wealth mean to you?

Wealth enables you to get and keep the life you want.

Achieving that wealth, however, requires focus and commitment.

At times, even sacrifice.

It’s not always going to be comfortable nor exciting.

In fact, investing can test even the most resilient investors, causing emotions to bubble to the surface.

It’s perfectly natural for something as life-changing as becoming wealthy to be an emotional experience.

What’s important is to work through your responses to ensure there’s nothing holding you back.

3. How wealthy do you want to be?

In 2017, financial services firm Charles Schwab interviewed 1,000 investors aged 21 to 75 and discovered that on average, respondents wanted £1.1 million to feel financially comfortable and £1.9 million to consider themselves wealthy.

In another 2017 survey by the salary benchmarking website emolument.com, the average twenty-something British professional said they would feel wealthy if they were earning £93,000 per year. For more senior international professionals, this figure rose to £370,000 per year.

These numbers vary by country, reflecting different costs of living.

There is no single answer to what being wealthy means.

It’s about what wealth means to you, where you decide to set your financial target and how much you want to leave for future generations.

Begin with the end in mind

If you don’t know where you’re going, how will you get there?

As a senior international professional, your overseas income combined with hard work and perseverance will help you become wealthier than you are today.

Will you retire comfortably, travel the world, donate to your favourite charities and give your children a head start in life?

Most importantly, how much will you need to make your goals happen?

Don’t worry if you can’t calculate a precise figure. Having a rough estimate is a good start.

The next step is to ensure you have the information you need to help you along the way.

Download the 11 rules high-net-worth investors swear by, using the form below.

Like you, I'm an international executive who requires an inordinate amount of time and energy to balance my business, family, finances and life in general.

I understand the importance of having the right knowledge and the right people in your corner to help manage various areas of life.

These 11 rules are designed to give you clarity, confidence and control over your ideal future so you can get and keep the life you want.

What's more, they're taken directly from Nobel-prize winning research and evidence.

Are you ready to be better, do better and achieve better results?