There has never been a better time to be an individual investor than right now...

And things are only going to get better from here.

You can invest in almost anything these days with the click of a button.

The problem with having so many options available at your fingertips is that it’s never been easier to experience FOMO...

The fear of missing out.

The sheer number of assets we have to invest in these days combined with rising markets and social media means the fear of missing out will always be trading at new all-time highs.

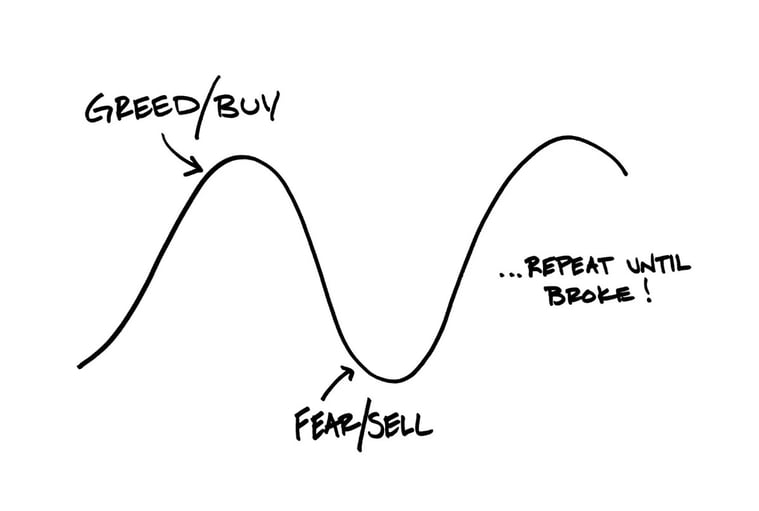

FOMO brings about a lot of emotions — greed, envy, regret — that make it difficult to make level-headed decisions with your money.

You wouldn’t be human if you didn’t have these feelings right now.

I certainly find myself dealing with the prospects of FOMO.

So here are some things I remind myself when markets go crazy to put things into perspective.

(Hat tip to Ben Carlson for this piece):

1. There is no such thing as a normal market.

Uncertainty is the only constant when investing.

Get used to it.

2. The most effective hedge is not necessarily an investment strategy.

The best hedge against wild short-term moves in the markets is a long time horizon.

3. Your gains will be incinerated at some point.

Investing in risk assets means occasionally seeing your gains evaporate before your eyes.

I don’t know why and I don’t know when but at some point a large portion of my portfolio will fall in value.

That’s how this works.

4. You still have a lot of time left.

I’m still young(ish) with (hopefully) a number of decades ahead of me to save and invest.

That means I’m going to experience multiple crashes, recessions, bull markets, manias, panics and everything in-between in the years ahead.

The current cycle won’t last forever just like the last one or the next one.

5. Know yourself.

One of the biggest mistakes you can make as an investor is confusing your risk profile and time horizon with someone else’s.

Understanding how markets generally work is important but understanding yourself is the key to successful investing over the long haul.

6. There’s nothing wrong with using a boring strategy.

Buy and hold is one of the least exciting investment strategies ever…

Which also happens to have the highest probability of success for the vast majority of high-net-worth investors.

There’s no shame in keeping things simple.

Which is what we advocate with our systematic investment approach.

7. Markets don’t end.

For years pundits have been proclaiming...

"I’ve seen this movie before and it ends badly."

Well, guess what? Markets don’t end.

Yes, some companies fail but most of them keep right on chugging along, selling products and services, making profits and paying dividends.

And the stock market isn’t going out of business anytime soon.

No one knows how this movie ends because there will always be another sequel.

8. Anchoring is dangerous.

Whenever there are huge moves in the market it becomes tempting to play the anchoring game.

"What if I would have bought at the lows?"

"What if I would have sold at the highs?"

No one is able to consistently get in at the bottoms and out at the tops.

Hindsight makes it look easy but it never is in the moment.

Buying when something is falling is hard to act on because it always feels like it’s going lower.

On the other hand, selling when something is rising is easy but most of the time you’re wrong.

9. You don’t have to be bullish or bearish.

Focusing on your own goals can release you from the need to always have an opinion on the next move higher or lower.

10. You don’t have to invest in everything out there.

Sometimes what you don’t invest in is even more important than what you do invest in.

It’s never been more important to have filters in place to guide your actions.

For me, low-cost, diversification and risk tolerance are my filters.

11. Don’t worry about what everyone else is doing.

Your goals are personal to you.

Therefore, your financial plan should ultimately be different to everyone else's.

There will always be someone getting richer than you in life and the markets.

Defining what a 'rich' life means to you can help avoid unnecessary envy and regret.

If you need help defining this, perhaps this is a good place to start.

If you took a moment to think about what money means to you and how it will help you reach your goals…

I guarantee you’ll have greater clarity, confidence and control.