Every year, global events shape our countries.

Our economies.

And our wealth.

But happily ignoring these events,

(in term of our investments, at least),

Is the best course of action.

After all, it’s what the market does.

When huge global events occur, which they inevitably will...

Some high-net-worth investors react.

The most successful ones don’t.

Because despite natural disasters, conflicts, referendums and questionable presidents…

The markets always bounce back.

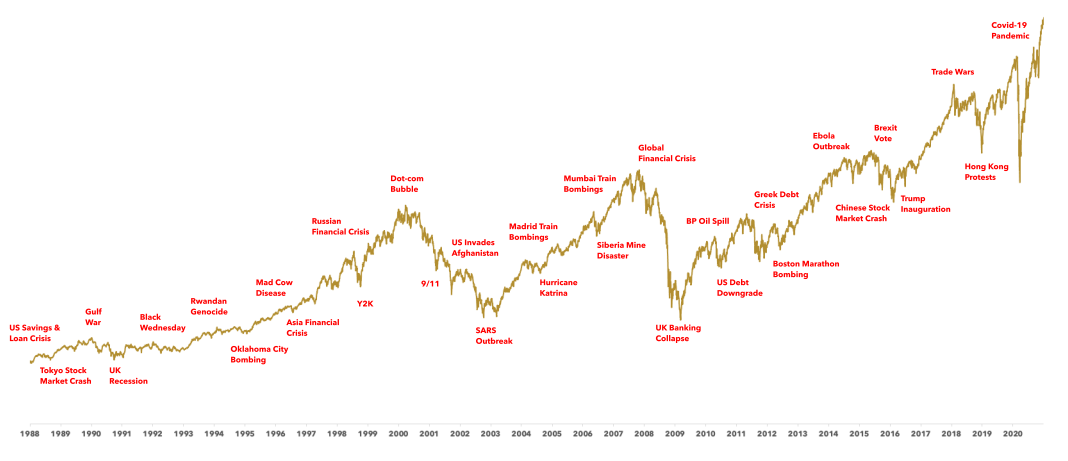

The chart below shows the growth in world equity markets despite a never-ending stream of negative world events.

Despite ongoing uncertainty, $1 invested at the start of 1988 grew to $6.59 by the end of 2020.

This is an average annual return of 5.88%.

I could have chosen to go back 50 years.

Including Black Monday (1987), Falklands war (1982), Watergate scandal (1972), Arab-Israeli war (1967)…

But I think by 30, I had made my point.

The infographic below shows why ‘time in’ is more important than ‘timing’ for your financial plan.

It's never too late to start investing to make sure you reach your desired life goals.

In fact, whenever I'm asked when's the best time to start investing, my answer is always the same.

"Yesterday".

If you would like to begin the journey today, reach out to one of our qualified financial planners.