Investors' needs have changed.

Financial planners have had to adapt and evolve as traditional money management is no longer enough.

Now, investors want a lifetime financial planner who understands the deeper role money plays in their lives.

Here's why.The best of new breed planners play multiple and nuanced roles regardless of what's going on in the world.

I’ve said this many times –

A true financial planner focuses on your personal goals…

Beginning with your individual needs, risk appetite and circumstances.

They combine technical expertise with the knowledge and understanding of how money intersects with your life to provide tailored advice.

So here are 7 of the many ways a financial planner adds value to your life.

1. They focus on what makes a difference

Before digging into your numbers, a planner should begin to understand what drives you.

Is it fear?

Greed?

They should clarify your values and priorities.

The best financial outcomes are not about how much you know about the markets necessarily, it's about how you behave.

What your relationship is with money currently and your emotional reactions to what's happening in the world around you.

Morgan Housel wrote an article about a humble secretary who left $7 million to charity in 2010.

That same year, Merrill Lynch's Vice Chairman, filed for bankruptcy.

Despite the vice chairman's Harvard education, the secretary had a far better grasp of her values and purpose, which underpinned everything - including the way she worked with her money.

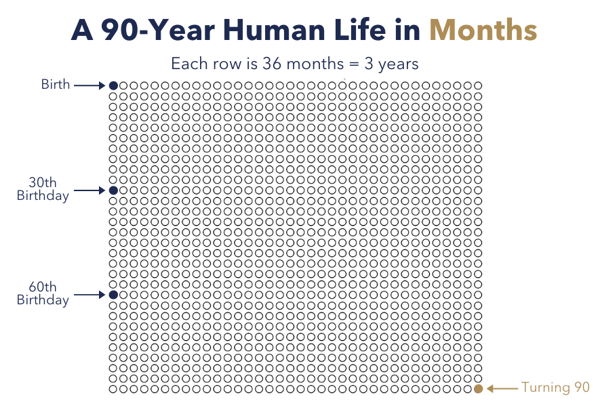

2. They value your time

As a senior international executive, you have a high-pressure career and loved ones you want to look after.

You also have hobbies and things you enjoy outside of the office.

You often feel pushed for time, wishing there were more hours in the day.

Your planner should understand this.

They'll know that time is arguably as important to you as your health.

Time helps you create better relationships, have greater success and more memorable moments.

Research suggests that those who value time more than money are happier and more productive.

And if you want to become a happier person - and you already make enough money to provide the essentials - you should start placing more value on time.

More than likely, you have a good grasp of how the world of finance works.

But managing your money would require too much of your time...

Time you would rather spend with your loved ones.

3. They know you and your family

Your planner knows the value of family.

That it is common for one spouse in a couple or family to “look after the finances”.

They also understand the sacrifices you make to not only enjoy today and plan for tomorrow but also to ensure your family will be taken care of should anything happen to you.

You don't want the financial complexity to weigh heavy on your family's shoulders so your planner will give you the peace of mind that everything will be taken care of, even when you're gone.

Removing the fears, anxieties and 'what ifs' from the equation.

4. They help you avoid mistakes

A recent US report tried to quantify the value of working with a planner.

The report calculated they can add at least 5.3% per annum in monetary value to clients even (or perhaps especially) in difficult investing climates.

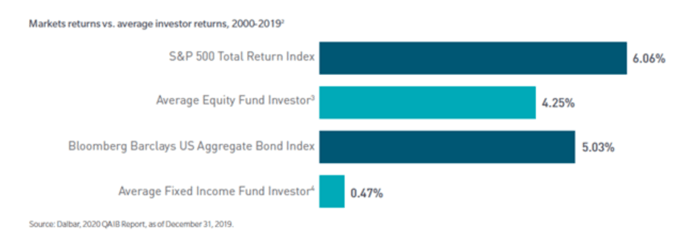

US research firm Dalbar produces an annual report quantifying the cost of behavioural mistakes.

It shows a difference between the average return an investment generates, and what the average investor in that investment receives.

The results of their December 2019 US focused report showing 20-year market returns compared to the return of the average investor are shown below:

The Behaviour Gap for equities was 1.81% pa and for bonds was 4.56% pa – this gap occurred each year for 20 years.

For a $1 million portfolio invested in a 60% growth portfolio in 2000, the cost to the average investor was almost $60,000 per year – or $1.2M over 20 years.

6. They help you manage risks and costs

There'll always be an element of uncertainty when it comes to the markets.

If there was no uncertainty, expected returns would be much lower.

Your planner should help you deal with this by ensuring you're prepared for any and all eventualities.

So, when the unexpected happens, like a pandemic, you can remain calm and confident.

On the other hand, your planner can help you manage the one thing you can control - costs.

If your planner's not completely transparent about how they're paid and how you're being charged, costs can significantly reduce your returns.

7. Everything is centred around you

If you have no written plan for your future, you have no framework for what you are doing, thinking and why.

Instead, you often bounce from one short term, ad hoc matter to the next, and are a slave to random commentary either on the TV or at dinner parties.

The best predicator of financial well-being is financial security – knowing you have enough to pay for your desired lifestyle now and in the future.

When you are in control of your finances, you feel less stressed and anxious.

You have more peace of mind and happiness.

With this comes a greater sense of well-being, quality of life and general health.

Your planner should have a vested interest in who you are, what's important to you, what drives you and what makes you fearful.

Reassuring you of your goals and purpose, and communicating with you regularly.

Many people don’t hire a financial planner because they don’t know what to do.

They hire one to be their independent voice, expert, listener, teacher and coach.

The same way you hire a personal trainer to help you reach your fitness goals, a financial planner provides the motivation and encouragement you need to keep going.

The evidence from thousands of people, who have been properly advised, is that the real value of having a financial planner is the peace of mind it gives you, the sense of security and confidence about the future.