You’re probably not a good investor…

These aren’t my words.

They’re the statistical reality.

As described by Dan Solin, the New York Times bestselling author of ‘The Smartest’ series of investing books and The Smartest Sales Book You’ll Ever Read.

According to Dan, the “average investor” tends to panic when markets drop.

This causes them to miss out on the relatively few days when the market posts stellar returns.

Buying high and selling low.

Because of this, they enjoy annualised returns of just 2%.

Barely keeping up with inflation.

Dan didn’t make this figure up.

An analysis of returns for the 20-year period from December 31, 1993-December 31, 2013 found the annualised returns of the “average investor” hovered around 2% for that period, which didn’t even keep up with the pace of inflation.

Part of the problem is the kind of investment products purchased.

This stems from a lack of unbiased data and available information for the average investor.

As such, here’s my personal view of 5 types investments.

Where are you on this hierarchy?

5. Hedge funds (in tech terms, think back to ‘the brick’ car phones of the late 80s)

Someone once told me hedge funds are for “stupid, rich people.”

Image credit: The Behavior Gap

I agree. But without data, my opinion doesn’t matter.

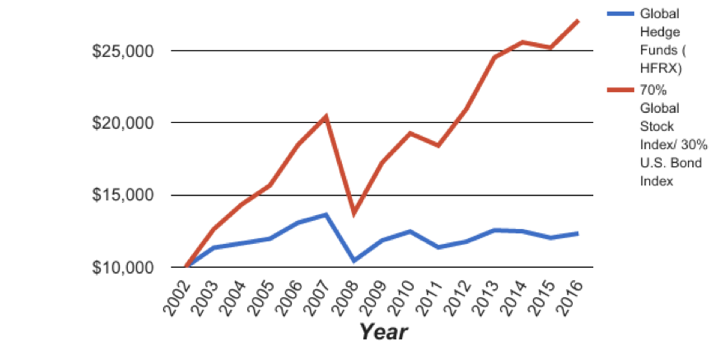

While some 75% of hedge funds go out of business within their first 8 years, this chart shows how badly the average surviving fund does against a global stock and bond index…

Source: Hedge Fund Research ; portfoliovisualizer

High fees combined with low returns give this investment its top position on the list, but private equity, structured products and unregulated collective investment schemes (UCIS funds) likely belong here too.

4. Individual stocks (in tech terms, think Nokia 3310)

Ask a man in the street his thoughts about investing and he probably likens it to gambling.

Stock picking is pure speculation.

It’s not impossible to pick a stock “winner”, but your chances of doing so are statistically exceedingly low.

As Dan stated in this blog post:

Owning individual stocks, rather than diversifying through ownership of an index fund made up of similar stocks, significantly increases your risk without increasing your expected return. Think about well-known companies that once were "sure things," but are no longer around, such as Lehman Brothers, Enron and Bear Stearns.

But we know from survivorship bias, we rarely learn from failures.

3. Actively managed mutual funds (in tech terms, think Blackberry)

If you want to pay high fees, with the statistical likelihood of underperforming a comparable, low-management fee index fund, buy an actively managed mutual fund.

Most investors do, and their returns suffer as a consequence.

%203.jpg?width=740&name=The%20best%20investment%20funds%20today%20(backed%20up%20by%20data)%203.jpg)

The average investor (red dotted line) in a mutual fund enjoys a return far lower than the market average return (gold line) which is attributable to their high costs and the bias of the fund manager.

A few do outperform, but statistically speaking, the minority that outperform one year don’t keep this up over time, which is why most investors end up with some real dogs…

There’s a mountain of data indicating the folly of buying these funds, nevertheless they’re aggressively sold to unaware investors.

2. Index funds (in tech terms, think about the basic smartphone)

Lower cost index funds, in a suitable asset allocation are an excellent choice for investors.

Blackrock’s iShares, Vanguard and SPDR are the gold standard for low cost index funds, but there are a number of low-cost exchange-traded funds and index funds available from other providers.

%202.jpg?width=727&name=The%20best%20investment%20funds%20today%20(backed%20up%20by%20data)%202.jpg)

Represented by the blue dotted line, these funds prioritise tracking the relevant market, keeping costs and tracking errors low.

The data shows investors in these funds can do substantially better over time than active investors.

1. Passively managed funds (in tech terms, think iPhone)

Dan sets forth the differences between passively managed funds and index funds in this blog.

These differences potentially yield significantly higher returns to passive fund investors.

%201.jpg?width=729&name=The%20best%20investment%20funds%20today%20(backed%20up%20by%20data)%201.jpg)

A leader in passively managed funds is Dimensional Fund Advisors (DFA).

I like to think of it as the best fund manager in the world that you have never heard of.

That’s because big institutions, college endowments and professional advisers who understand the data are busy loading up.

Things change and evolve.

Good investment evolves like good technology.

The Nokia was great in its day, but those days are over.

My own money is in firms such as DFA moving forwards.

Get in touch if you want to learn more about better investing.