After two decades in financial life management, I’ve realised almost everyone gets the same thing wrong

One day in 1995, a man robbed two American banks in broad daylight.

He didn’t wear any sort of disguise and smiled at surveillance cameras before walking out.

The police arrested him later that night.

Interestingly enough, when the robber was handcuffed, he was puzzled and mumbled:

"But I wore the juice".

A completely bizarre response, but bear with me.

Apparently, the robber thought smearing lemon juice on his face would make him invisible to security cameras.

And he didn't just think that…

He was pretty confident about it.

His rationale?

Since the chemical properties of lemon juice are used in invisible ink, it should render him invisible too.

(This is obviously not a normal way of thinking).

But what's interesting is that, even after the police showed him footage of his robbery, he was genuinely surprised it didn't work.

He thought the footage was fake.

The police concluded this man was not crazy or on drugs, just incredibly misinformed and mistaken.

The funny robbery led two social psychologists, Dunning and Kruger, to study this phenomenon more deeply.

Specifically what interested them the most, was the confidence he exerted.

What made him believe he’d be able to obstruct the security cameras with just lemon juice?

To investigate this, they examined a group of undergraduate students according to their grammatical writing, logical reasoning and sense of humour.

They asked each student to estimate his or her overall score, as well as their relative rank compared to other students.

After knowing the actual test scores, Dunning and Kruger found something fascinating.

Students who scored the lowest in these cognitive tasks, always overestimated how well they did.

And not just by a little. By a lot. They thought they'd scored well above average, while their scores were actually the lowest. Not only were those students incompetent or less skilled in those areas, but they lacked awareness of just how bad they were.

Students who scored the highest, had more accurate perceptions of their abilities.

But, they made a different mistake. Paradoxically, the highest-scoring students underestimated their performance. They knew they were better than average at the test. However, because it was easy for them, they assumed it was easy for everyone.

They didn't know their ability was at the top percentile.

A paradox is born

Today this phenomenon is known as the Dunning-Kruger effect.

Essentially, low-ability people don't possess the skills needed to recognise their own incompetence or lack of knowledge. Their poor self-awareness leads them to overestimate their own capabilities.

You can clearly see what I mean in this graph below, by Safal Niveshak.

Having barely any skill or knowledge, leads to massive confidence.

In fact, the top point of the chart is often called 'Mount Stupid'. This is simply because confidence tends to outpace competence early on, as we transition from novice to amateur. It happens to all of us. Once we reach the summit, we think we know everything.

However, when you become more knowledgeable about a certain topic, that confidence falls (also known as 'The Valley of Despair'). And only when you start to become above average in a skill, does your confidence about a certain topic start to pick up again ('The Slope of Enlightenment').

.png?width=800&height=533&name=Dunning%20Kruger%20effect%20(1).png)

Contrary to popular belief, this isn't just limited to cognitive tasks. It doesn't seem to matter what specific skill we pick. The less a person knows about any given activity, the more likely they are to overestimate their skill or knowledge.

The Dunning-Kruger effect can be observed during talent shows like American Idol.

The auditions are usually filled with a variety of good and bad singers. The ones who are bad at it, almost never realise how bad they really are. That's why they're genuinely disappointed when they get rejected.

The truth is, we're not very good at evaluating ourselves accurately.

We’re all cognitively biased. It's part of being human.

The majority of people believe they're better than average.

For example, someone might read a newspaper article or book about the economy and believe they understand how macroeconomics (a complex system) works.

And 88% of investors assume they're better in comparison to their peers.

After 20 years of full-time, professional investing myself, the uncomfortable truth is that many of the retail investors I meet are somewhere in-between 'Of course I know everything!' and 'Oh, is there more to it than I thought?' on the above graph.

For successful families looking to protect their future purchasing power, this may mean your perception of ‘what's good’ and ‘what's bad’, or ‘what's safe’ and ‘what's risky’ when it comes to investing, is slightly off.

I recently covered this in my YouTube channel:

The simple truth is we judge ourselves to be better than others, to a degree that violates the laws of mathematics. But why? Why does being less skilled make you more confident in your abilities?

Let's visualise how this happens.

Alex is a DIY investor.

He’s read a few books and subscribed to a few blogs, and is now confident he knows a lot about investing. He’s bought a basket full of index funds. With this reasoning, he's easily at the top percentile of all investors.

But let's say he meets a professional financial life manager, someone who's been immersed in the world of finance and investing all day, every day, for 10 years.

This professional knows the field is much larger, and there's vast amounts still to learn about it. Because he's more knowledgeable about the subject, he knows a grey area exists.

Alex however, doesn't.

Now you can see why Alex is so confident in his ability. He has no idea just how much he doesn't know.

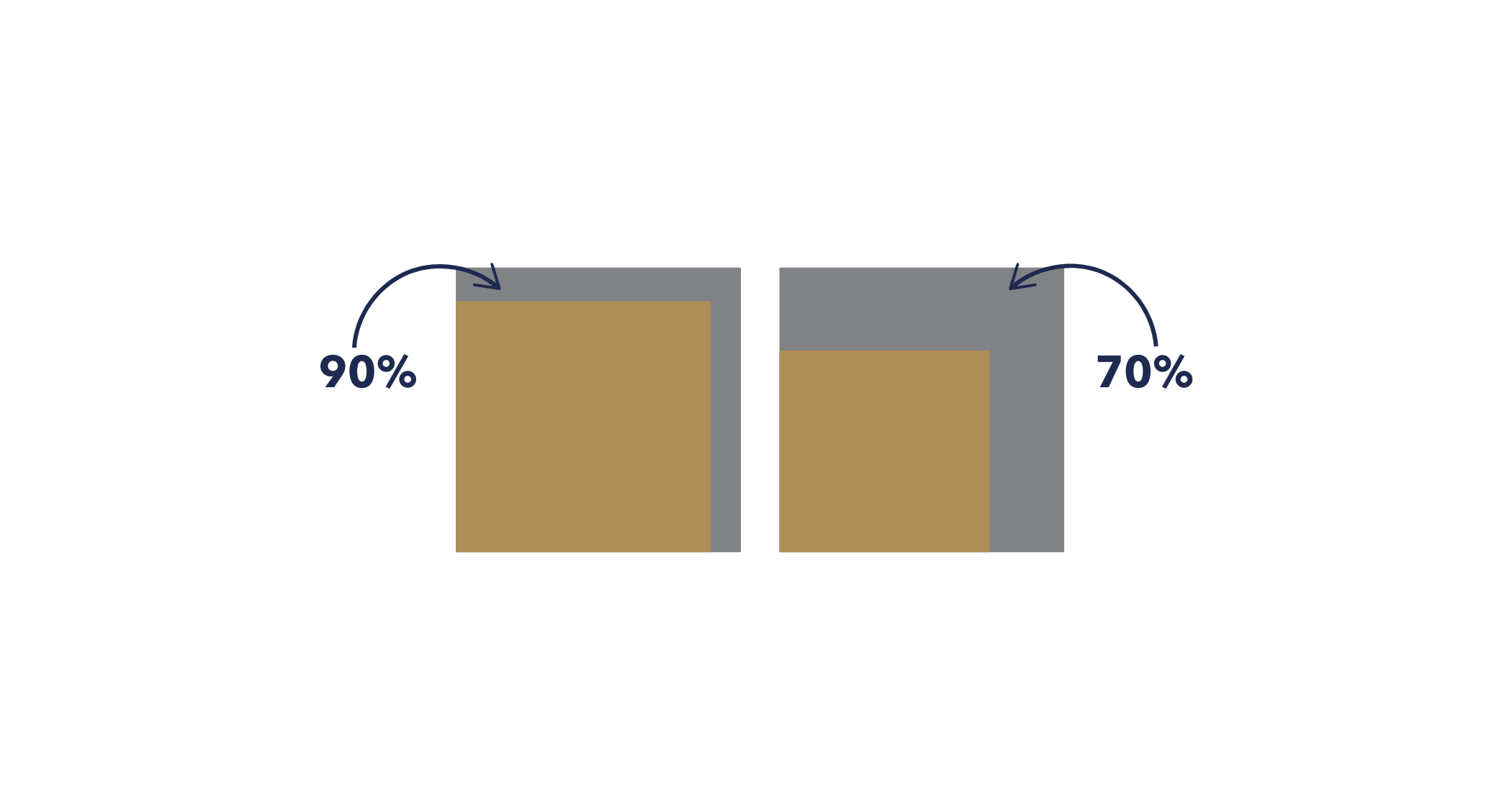

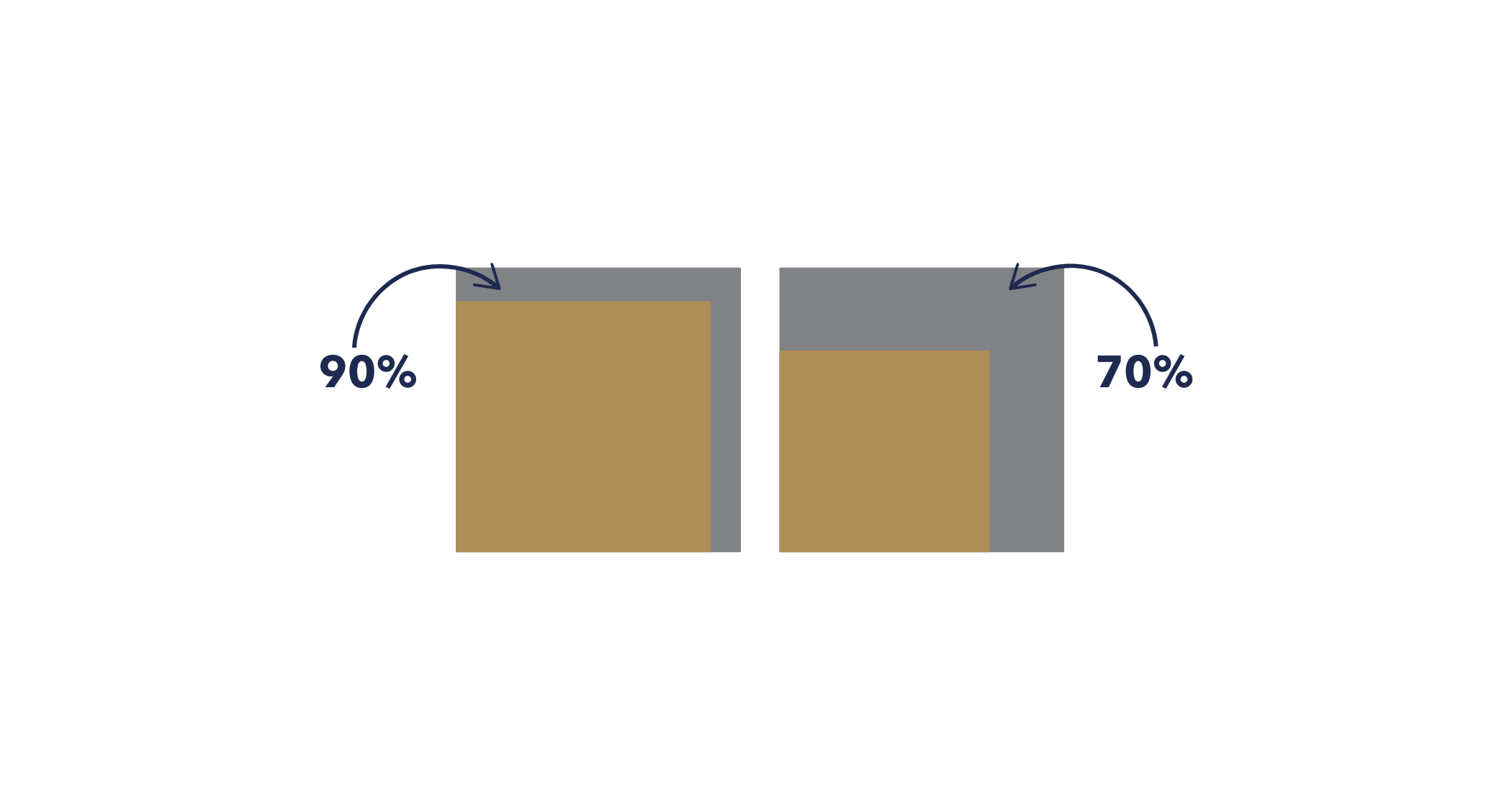

Because he only has a little knowledge of the field, he doesn't how much more extensive it is. And because he doesn't know what he doesn't know, he thinks he knows around 90% of what there is to know about investing!

Meanwhile, experts tend to be more aware of how knowledgeable they are.

But, remember the mistake they make. They assume everyone else is knowledgeable as well, mostly because others exert so much confidence.

In this instance, the professional financial life manager is aware he only knows about 70%.

But if he met someone like Alex, he'd underestimate himself.

90% is better than 70%, after all.

We're all susceptible to the Dunning-Kruger effect

But how can we prevent ourselves from falling prey to it?

Well, you should strive to educate yourself as much as possible. You're not expected to know everything, but thinking you're always right is foolish.

It seems the more knowledge people have, the more they realise how little they know in reality. In other words, the more people know about a certain issue, the more they realise how complicated, unexplored and extensive it is.

And, how many things they don't understand or know yet.

It’s a beautiful paradox in which the more we study something, the less we know about it.

On the other hand, people who dabble on the surface of anything they pursue, will never know how much they still have to learn.

In the Dunning-Kruger experiment, unskilled or incompetent students improved their ability to correctly estimate the test results after receiving minimal tutoring on the skills they lacked.

It’s helpful to have someone who's ahead of you, show you what you have yet to learn.

So next time you feel confident you know a lot about something, take a closer look at the topic.

It could be you're a victim of the Dunning-Kruger effect. You just might not know what you don't know.

The best advice I have found for DIY investors

There are many simple things we can do ourselves. Paint a ceiling, mow the lawn or assemble some flat-pack furniture.

But, we’d never attempt to take our own appendix out or perform our own dentistry.

There’s just too much at stake. That’s when we seek expert help.

This, however, doesn’t stop some people thinking financial planning (or what we call, financial life management) is somewhat tricky yet something they’ll still attempt to do on their own.

They see it as a challenge.

For those who have the time, inclination, and knowledge to be fully responsible for their own financial affairs, they can and SHOULD take the DIY approach.

If investing and personal finance is a hobby of yours and you derive energy from managing this aspect of your life – then you should certainly do it yourself.

Below you'll find a checklist to help you decide whether to embark on this journey alone.

It’s clearly biased, but I hope you get the gist!

‘Be your own financial planner’ checklist

- Think about what you wish to achieve now, and also in the medium and long term. Build a financial plan using sophisticated financial forecasting software which lists and prices all of your goals and expected transitions. It's challenging to think about our own futures because we are hard-wired by evolution to think about today.

- Be a critical thinking partner to yourself and ask yourself the hard questions (know what the hard questions are). This is what Daniel Kahneman calls 'System 2' thinking.

- Understand how investment management works, knowing where the returns come from, the factors involved, anticipate the changes/developments that happen and know the companies to use.

- Know how to insure yourself and your family against bad health surprises, know what your human capital is.

- Know what asset classes and financial instruments provide the returns and know which ones to avoid. Only focus on what’s always worked and avoid what’s working now.

- Understand the flavours of risk, which financial dragons you need to fight and which you need to ignore. The three flavours of risk are loss of capital, inflation and volatility.

- Realise you're the biggest wealth destroyer of all and as a result of this, control your behaviour through all market cycles, fads, fears, euphoria and Armageddon.

- As an absolute minimum, complete the Diploma in Regulated Financial Planning. This is the entry level planning qualification and should take you approximately 5 years to complete. If you wish to excel – you may want to extend this to Chartered.

- Join a few online communities and face-to-face masterminds where you’ll benefit from the support and intellectual capital of your peers. But be extremely careful in the counsel you take.

- Keep up to date with the changes in financial rules, tax and legislation. Subscribe to established professional magazines and blogs to keep you regularly informed.

- Have a finely tuned scam avoidance antenna.

- Schedule regular progress meetings to ensure your plan is on track and that it’s fit for purpose in the current climate.

Attempting to DIY is the no-help option.

We offer the ‘help’ option.

In return for a very small fee relative to its value – you'll receive an extremely high-quality insurance policy (financial life management service) against the risk that one day you’ll experience a deeply human impulse to cast the plan aside because of current events.

You may think this doesn’t apply to you, because everyone does: that’s the Dunning-Kruger effect, or human nature.

But let’s be clear, unlike general insurance that pays you when your house burns down...

A sage financial guide will actually prevent the fire or train wreck. This is their main job as CFO for your life.

They act as an insurance policy against the most fundamental, destructive human instincts (which everyone has) by offering a longer than lifelong, problem-solving, possibility-capturing partnership.

If you wish to compare your options or seek our expertise, please get in touch and start to work towards your financial goals with a caring, considerate financial guide.