[Estimated reading time: 3 minutes, 52 seconds]

Would you be tempted to stake a small sum of money – say £300 – on something that had climbed 14,000% already?

That kind of vertical move, if it continued, could turn your £300 stake into £42k!

The question is…

Would you risk your money?

When presented with all the facts, all the arguments, all the proof you needed to see to convince yourself it was worth a punt…

Would it really be sensible to stake your £300?

…I’m talking about Bitcoin…

Will this bubble burst?

Whilst some suggest Bitcoin is in a bubble of its own, head of technical strategy at Goldman Sachs, Sheba Jafari, thinks bitcoin will head much higher.

In a note she sent to clients at the beginning of this month, Jafari wrote:

“There’s potential to extend as far as 3,915."

If you had invested in Bitcoin at the beginning of this year, you’d be delighted today…

If you’d invested in Bitcoin’s rival Ethereum, you’d be even happier…

In just the six-months to June the 13th 2017, it gained more than 3,000 percent!

What is Bitcoin anyway?

Both Bitcoin and Ethereum are cryptocurrencies – with Bitcoin first out of the stalls.

Created in 2008 by unknown persons who hide behind the moniker Satoshi Nakamoto, Bitcoin is a peer-to-peer electronic cash system…

…and, according to many (including most recently a Forbes columnist), a criminal’s best friend!

Indeed, drug dealers were among the first to use Bitcoin because it’s extremely tough for authorities to track transactions.

In other words, Bitcoin is a very effective money laundering tool, and that fact alone could see Bitcoin’s value continue its high…right?

Hmmmm, no!

Since its creation, Bitcoin’s price hasn’t only hit hallucinogenically enhanced highs – like a junkie going cold turkey, it’s also bombed badly.

The Bitcoin bounce

In late 2013 $1,000 worth of Bitcoins plummeted in value to just $150 in two short months.

How would a drop of 85% impact your portfolio?

Business Insider interviewed a drug dealer affected by a similar Bitcoin crash in 2015…

“I am losing 10-20% on all orders in escrow now! Make that 30%!!! There goes all profit!”

Funnily enough, I don’t feel any sympathy for his plight…

However, his plight is worth highlighting to protect you…

Here’s the problem with Bitcoin

It seems to me that each new generation must learn the following lesson itself...but I truly hope you’ll heed this warning and not need to learn by doing…

Cryptocurrencies aren’t tangible – and they aren’t businesses, bonds or property.

They don’t create cash.

They’re only worth as much as the market will pay…and that’s dangerous.

Of course, short-term that’s also the case with equities - but if stocks produce cash from reinvested earnings or dividends, their prices can keep rising.

How our forefathers were burned by the Bitcoins of the past…

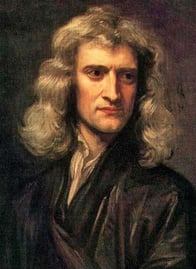

In the early 1700s, Sir Isaac Newton fell for South Sea Company stock – and lost a fortune worth about £2.4million in today’s money.

The South Sea Company was meant to facilitate trade with the Americas – its stock price rose on hope and anticipation…

When the business failed to earn any tangible profits, its price collapsed.

Following the crash, Newton said:

“I can calculate the movement of stars, but not the madness of men.”

Author of Millionaire Teacher and expat financial educator Andrew Hallam writes:

“The four most dangerous words for investors are: “This Time It’s Different.” They were whispered during The South Sea Bubble. They were uttered during The Dutch Tulip Craze. They were shouted from the rooftops during the 1990s Dot-com charade...”

I’d wager that many of those invested in Bitcoin and its contemporaries are chanting the same mantra today…

“This time it’s different, this time it’s different.”

No, it’s not!

Cryptocurrencies don’t make profits – heed the lessons of your investing forefathers!

Alternatively, heed the words of the world’s greatest investor, Warren Buffett.

In an interview with CNBC he said,:

"Stay away. Bitcoin is a mirage. It's a method of transmitting money… The idea that it has some huge intrinsic value is just a joke in my view."

Buffett also said:

“Gambling is a tax on ignorance…”

If you have £300 and fancy a flutter, then Bitcoin may be an interesting gamble..

But I’d wager that that horse has probably already bolted.

And good investment is starkly different to speculation and gambling anyway.

Good investment is like watching paint dry or grass grow- i.e., it’s inherently boring!

Perhaps why so many people fly by the seat of their pants, making ‘bets’ that fly in the face of the evidence – like Bitcoin, tulips, South Sea Company stock…

If you want to be a prosperous investor however, just remember the 6 simple steps that will secure your success : -

2. Beware of market gurus

3. Control your costs

4. Spread your risk

5. Be disciplined

6. Stay balanced