You’ve likely heard the proverb: “rice paddy to rice paddy in three generations.”

The Scottish say: “The father buys, the son builds, the grandchild sells, and his son begs.”

90% of wealth is typically lost beyond the 3rd generation.

Here's why.

There are many ways to fritter away your wealth.

Speculating instead of investing, misplacing trust (in your brother-in-law, golf buddy/'friend') or paying high investment costs.

There are also poorly thought-through leverages, misunderstandings and strong emotions around property.

You could marry a spender, purchase products from Private Banks and salespeople, retire too early or do nothing and let inflation eat away at your future.

Or, you could give into societal pressures and buy expensive “toys” (chalets, boats, planes or in my case bicycles), or mimic the spending of wealthy friends.

The list goes on and on.

While there are many areas of our wealth we can’t control, there is much more that we can.

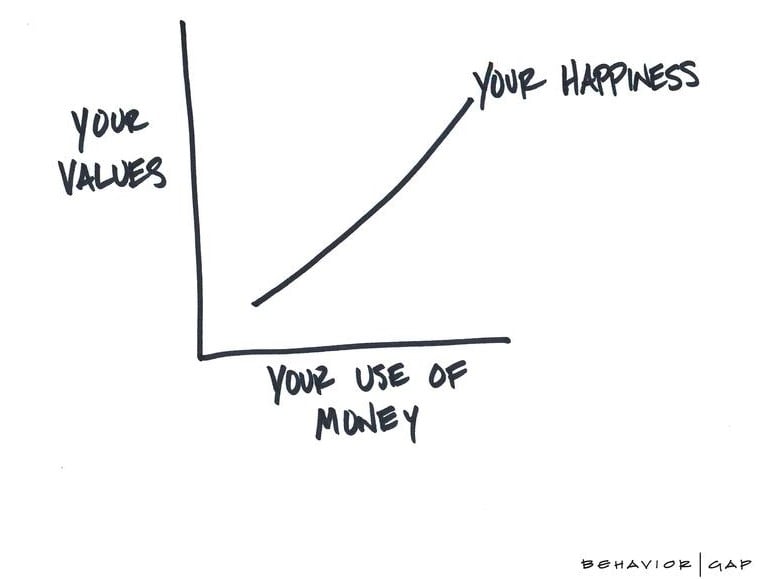

Perhaps, the best place to focus is on behaviour, which is hard to teach, even to really smart people.

Money - investing, personal finance, and business decisions - are thought to be rational.

But in the real world people don’t make financial decisions upon merit.

Most are heavily anchored to our personal experience - especially those in early adult life and made at the dinner table or in a meeting room…

Where personal history, unique perspective, ego, pride, fear/greed, marketing and odd incentives are scrambled together.

Wealthy individuals experience unique challenges and stressors mixed with tight time constraints.

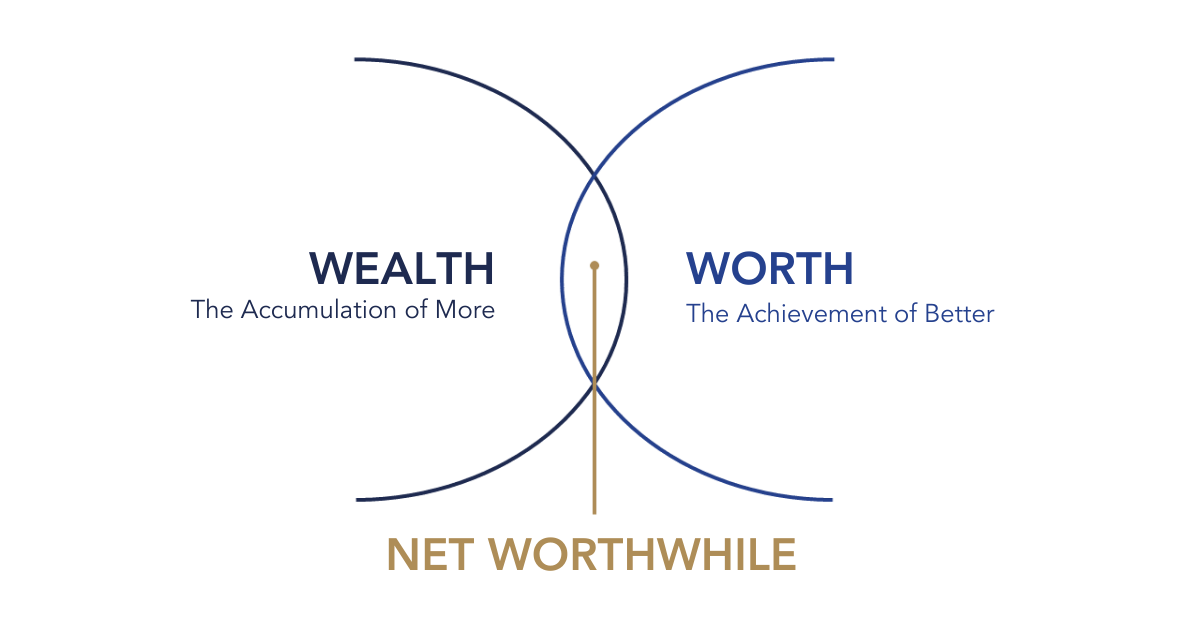

At AES, we define wealth as the accumulation of more, and worth as the achievement of better.

At the intersection of these two concepts is where we can help define what 'having it all' means to you.

At the intersection of these two concepts is where we can help define what 'having it all' means to you.

Be that happiness, contentment, philanthropy, more time for family/leisure or indeed a mountain of money.

And perhaps, the quickest and most effective way to begin ‘living richly’ and protecting and growing your wealth is by asking questions to raise self-awareness.

For example:

If you’re told this is your last day on earth, what is that immediate feeling of regret that comes to mind about who you didn’t get to be and what did you not get to do?

How can you live your best life without feeling that sense of regret?

What does a 'wealthy' life look like to you?

Will giving money to your child make it easier or harder for them to be successful on their own?

What priorities, actions and accountability will help things become better?

Is your family receiving genuinely objective, planning-led advice?

This week, I'd like to remind you that none of us will live forever and that we all need a succession plan for our family and its finances. Being proactive and having these talks with your family can be a way to bring you all closer together and offers your loved ones the opportunity to demonstrate responsibility and good stewardship.

After all, your wealth is about so much more than what you own. Don’t you want to pass on that wealth as well?

It then leads on to an important topic of leaving money to our children as a formal part of our financial strategy.

I’ve made it clear in the past that I’m big on spending less than you earn, living within your means, personal accountability and so on. And yet I very much want to - and I'm planning to - leave a legacy to my children. As a family steward, I see this as an obligation that is as much about education, and values as money. I can’t think of many better ways to use our money.

One of the most riveting reads over the last few weeks was the story of a 93-year-old who waged war on JP Morgan and her two grandsons. Her grandsons managed her money at JPMorgan, forged documents, ran up commissions with inappropriate trading and made her miss tens of millions of dollars in gains.

She finally decided to teach them all a lesson.

And it’s a lesson many affluent investors need to learn as well. Private Banks may appeal to the elite – but they harbor a litany of conflicts, misaligned incentives and hidden dangers.

We’ve seen multiple Ponzi schemes and frauds over the past few years. Another gripping piece I read recently (albeit slightly morbid) is the Australian case of Melissa Caddick – a con artist who made millions off the back of her hard-working clients. Her fraud came to light after her left grey Asics Gel Nimbus sneaker washed up on the south coast of Australia. I’ll leave the rest for you to read.

Fraudsters focus on the market instead of the client. Outperforming the market is something that can’t be assured or guaranteed, but it’s presented as a service to people who don’t know any better.

On the topic of performance, Cliff Asness takes a deep-dive into how value strategy has performed in 'The Long Run Is Lying to You', and why the realised average return is not necessarily the best estimate of its true long-term return.

And to round up this week, I wanted to share a great TED Talk by behavioural economist Dan Ariely - 'Are we in control of our own decisions?' This entertaining video essentially talks about our own limitations and how we tend to ‘forget’ these when it comes to things like healthcare and the markets. Perhaps if we understood our cognitive limitations better, we could create a better sense of self and maybe even contribute to a better world. An interesting idea, isn’t it?

A question for you:

What are my actions moving me closer to?

This week's meditations

"People generally have more control over their actions than their feelings. But we can influence our feelings by taking action. Take one small step. Move the body first and the mind will follow."

– James Clear

"There is a wonderful, almost mystical, law of nature that says three of the things we want most - happiness, freedom, and peace of mind - are always attained when we give them to others. Give it away to get it back."

– John Wooden, Basketball coach and winner of 10 championships

If you liked this post, please share it using the social buttons at the top, or just forward them this blog.

Have a great weekend and enjoy the ‘light’ reading!

Linda Davis Taylor on 'Designing Your Family’s Future: Lessons from 2020'

Richard Quinn's article 'About the Kids'

Tom Schoenberg's 'At 93, She Waged War on JPMorgan - and Her Own Grandsons'

Mancell Financial Group's blog 'The Lies of Melissa Caddick'

Cliff Asness' essay 'The Long Run Is Lying to You'

Dan Ariely's TED Talk 'Are we in control of our own decisions?'