Think about the state of your life, your career, your business, your major relationships - anything consequential to you.

How many important decisions have you already had to make?

And, how well did you make them?

Sometimes it can feel like there are not enough hours in the day.

The bulk of our days are spent at work - after which, each of us has a few remaining hours to prioritise hobbies, sports, relaxation and relationships.

It’s why many of us tend to make rash decisions as a result of always feeling rushed or pressed for time.

While we all like to think we have complete control over our days, truth is, we often waste time on meaningless and pointless activities.

At the core of effective time management is a continual focus on the right priorities. It sounds easy, but many of us face competing demands that take our attention away from what is truly important.

US President Dwight D. Eisenhower is alleged to have said, “What is important is seldom urgent and what is urgent is seldom important.” The tool bearing his name, the Eisenhower Box, offers a useful framework to help you prioritise tasks, avoid distraction and ultimately make better decisions.

.png?width=800&name=Exhibit_1_Thinking%20Inside%20the%20Box%20(1).png)

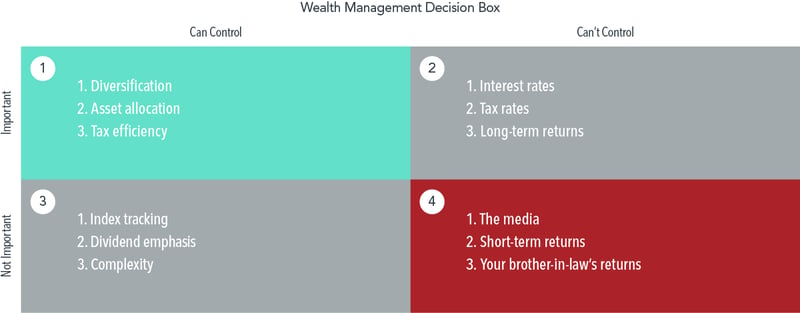

Quadrant one is what is urgent and important. That’s what you focus on doing now. Quadrant two is what is not urgent but still important. You should decide when to do those things and plan accordingly. Delegate what’s in the third quadrant whenever possible because these items aren’t important yet are nonetheless urgent. And, lastly, delete anything in quadrant four because these items are neither important nor urgent.

Importance vs Control

Similar to time management, sound financial decisions require focusing on the right priorities while resisting distractions. Perhaps the following modified version of Eisenhower’s Box, framed upon the dimensions of importance vs. control, will help you maintain the appropriate focus.

People tend to think about success in terms of wealth and accomplishments yet overlook the sacrifices it takes to get there. In order to pursue hobbies with high returns when you only have 24 hours in a day, you need to forgo activities with low returns. Bill Gates and Warren Buffett are prime examples of how strategically giving up some activities to focus on more rewarding ones can help you reach your goals.

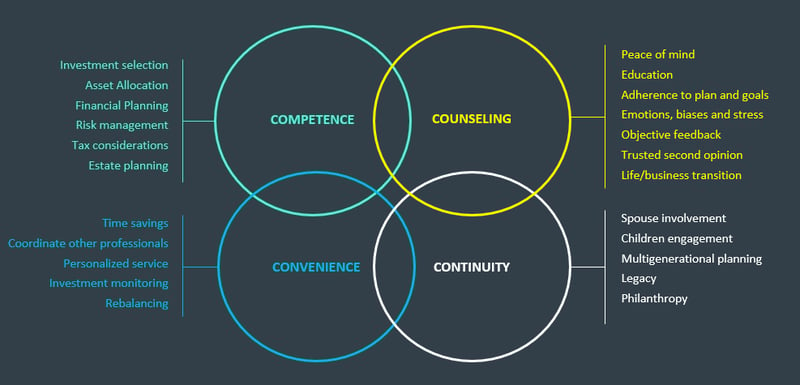

Similarly, Malcolm Gladwell explains in his book “Outliers: the Story of Success” how part of Gates’ success was built on the foundation of the “10,000 hour rule”. The rule states that world-class mastery of a skill requires 10,000 hours (5 years) of practice. In Gates’ case, it was programming practice. In your financial planner’s case, for example, it should be about rigorously studying the world of finance in order to deliver as much value as possible to those they serve (perhaps unsurprisingly Chartered Status requires 10,000 hours of experience). This is how they deliver it:

Few things will change your trajectory in life or business as much as learning to make effective decisions. You probably already think in mental models. Mental models are mental chunks of knowledge that represent a concept and shape how you think, how you approach problems, and how you identify the information that matters and ignore what doesn’t. What I particularly enjoyed about this article is that it’s not only riveting, but light-hearted too.

I listened to a brilliant podcast this week around the psychology of long-term decision-making. Psychologist and UCLA Associate Professor Hal Hershfield explores the concept of well-being and the factors that impact it. He also unpacks the balancing act that’s required to live in the present while safeguarding your wealth to support your future self. There’s more to discover in this episode along with self-compassion, dealing with life changes and how achieving personal milestones often requires financial re-evaluation.

Another podcast I’d like to share is between Adam Grant, organisational psychologist, and Daniel Kahneman, author of Thinking Fast and Slow. They explore when to trust your intuition and when to second-guess it. Daniel explains how he finds joy in being wrong, spells out steps to smarter interviewing, and reveals how he - the master decoder of decision-making - makes decisions.

Last night, I had the pleasure of introducing a talk by Brian Portnoy to the Global Association of Independent Advisors (GAIA). Brian is passionate about simplifying the complex world of money and helping investors learn how to make better financial decisions so they can lead meaningful lives. His latest book with Carl Richards and Josh Brown is a rare and honest look at how leading financial experts invest their own money. Add it to your next book purchase here. His thinking is quite simply brilliant.

Lastly, and in keeping with my own military roots, I’d like to share this mental model with you: the OODA Loop, a decision making cycle developed by U.S. Air Force Colonel John Boyd. This practical concept is designed to function as the foundation of rational thinking in confusing or chaotic situations. “OODA” stands for “Observe, Orient, Decide, and Act.” If you want to make good decisions, you need to master the art of observing your environment. Before jumping to your first conclusion, pause to consider your biases, take in additional information, and be more thoughtful of consequences.

A question for you:

What can you learn from your last poor decision? And how can that help you to make better decisions in the future?

This week's meditations

"Get action; do things; be sane; don't fritter away your time; create; act; take a place wherever you are and be somebody; get action."

- Theodore Roosevelt

"New goals don't deliver new results. New lifestyles do.

And a lifestyle is a process, not an outcome.

For this reason, your energy should go into building better habits, not chasing better results."

- James Clear

If you liked this post, please share it using the social buttons at the top, or just forward them this blog.

Have a great weekend and enjoy the ‘light’ reading!

Tom Popomaronis for CNBC 'Warren Buffett and Bill Gates prove that quitting this 1 bad habit will help make you more successful in life'

Malcolm Gladwell's 'Outliers: The Story of Success'

Farnham Street's 'How to Make Smart Decisions Without Getting Lucky' and 'The OODA Loop: How Fighter Pilots Make Fast and Accurate Decisions'

The Rational Reminder Podcast episode 'Hal Hershfield: The Psychology of Long-term Decision Making'

WorkLife with Adam Grant podcast episode 'Taken for Granted: Daniel Kahneman Doesn't Trust Your Intuition'