Yesterday was our monthly Team Leaders’ Day.

A day to reflect on our goals.

Track their progress and plan ahead.

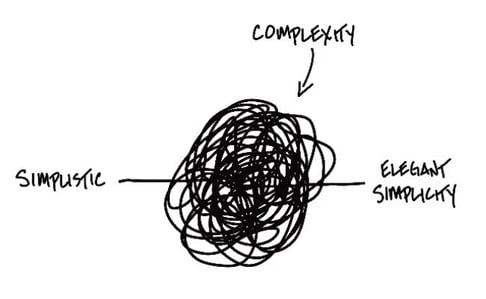

We also chatted about one of my favourite topics - “simplification”.

And how it can do wonders in life and wealth.

If 2020/21 has taught us anything, it’s change happens.

Events outside of our control happen, and they don’t have the courtesy of waiting until there’s a lull in our own lives.

Here are some examples; purchasing a house, marriage, children, divorce, inheritance, retirement, sale of a business, widowhood, a windfall, a global pandemic!

While we’re taught how to do countless things through the course of our lives, adapting to life’s many changes is not usually among them.

However, we all experience them and they often involve complexity.

I am a big believer the value of a planner is in the ability to simplify the complex. To save time, anxiety and enable those they serve to get on with living their best life with clarity, confidence and control around their ideal future.

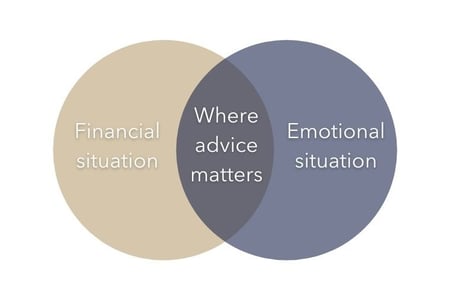

We believe investors have a number of moments throughout their lives when the financial situations they are experiencing overlap with the emotional elements of being human.

We believe investors have a number of moments throughout their lives when the financial situations they are experiencing overlap with the emotional elements of being human.

Some of these items may be small and some can be life-changing events. When the financial and the emotional collide, as depicted below, there tends to be an overlap or intersection where advice is needed.

This intersection is where an independent planner is needed more than ever. After all, personal finance is more personal than finance.

The planner has the ability, through a deep understanding of the client, to understand how wide or narrow this intersection is and how the investor or his or her family can get to a resolution everyone feels good about.

One simple example is the financial and emotional overlap of an investor having to make the decision of whether to keep the mortgage on his house or to pay it off when he and his wife retires.

This takes me to Carl Richards’ latest piece which talks about money and feelings.

He says money is not in the math department but the psychology department.

It’s not about spreadsheets and calculators or 2+2=4.

When it comes to money, 2+2 equals feelings.

A hot topic lately is inflation.

A hot topic lately is inflation.

It’s a complicated one too.

In fact, Ben Carlson says it might just be the hardest economic variable to forecast in his latest piece.

The main argument at the moment about inflation is whether it’s finally here to stay from all of the government spending or simply transitory from a quirky pandemic economy.

There are solid cases for both sides of this argument.

My colleagues Stuart Ritchie and Adam Dalby wrote their own piece on inflation as well. Give it a read.

As you’re reading this, take a look around.

Is your workspace a magnet for mess?

My Co-CEO, Pippa Miller, is currently reading the book 'Joy at Work'.

Creating a clutter-free environment can help you feel less stressed and more efficient.

It could make your work life simpler.

Life can be overwhelming at times.

It seems like there’s a new technology, a new hack, a new way of doing things, or a new way we need to be every five minutes.

Figuring out what to pay attention to is hard.

In this Farnam Street article, you’ll learn lessons from Shakespeare around better thinking and applying incentives:

- Better thinking and education

Doing and thinking reinforce and augment each other. It’s a subtle but powerful feedback loop. You learn something. Armed with that new information, you do something. Informed by the results of your doing, you learn something new. - Applying incentives

The wrong incentives do far more damage than diminishing your motivation to attain a goal. Applying bad incentives can diminish the effectiveness of an entire system. You get what you measure, because measuring something incentivises you to do it.

As a husband, father and business owner; I understand how important it is to simplify one’s life.

To remove clutter and complexity, and create more space.

Space to live richly, lead by example and have memorable moments.

A question for you:

How can you create an environment that will naturally bring about your ideal future?

This week’s mediations:

"Any intelligent fool can make things bigger, more complex . . . it takes a touch of genius - and a lot of courage - to move in the opposite direction."

– Albert Einstein

"Know what you own, and why you own it."

– Peter Lynch

If you liked this post, please share it using the social buttons at the top, or just forward them this blog.

Have a great weekend and enjoy the ‘light’ reading!

Carl Richards' 'Money = Feelings'

Ben Carlson's 'Predicting Inflation is Hard'

Stuart Ritchie and Adam Dalby on 'Why inflation is such a hot topic lately'

Marie Kondo's 'Joy at Work: Organizing Your Professional Life'

Farnham Street's blog 'Better Thinking & Incentives: Lessons From Shakespeare'