This week’s biggest topic was the 20th anniversary of 9/11.

I was based at RAF Brize Norton at the time, learning how to parachute.

So much has changed since then.

And so many lessons learnt.

Here are a few…

Along with other reads from the week.

Jonathan Clements of Humble Dollar wrote on the 9/11 attacks and the resulting stock market plunge.

The event will always go down as a human tragedy.

The stock market plunge, in contrast, seems of little import.

Still, there was indeed a large market reaction, one that offers three lessons for today’s investor:

1. Extraordinary market declines are anything but.

All feel catastrophic at the time, and yet—in retrospect—they seem almost routine.

2. The talking heads are clueless.

Each stock market’s collapse has been driven by news. The next big decline will be too which no one will be able to forecast.

3. Stock prices go to extremes.

Share prices fall far below their average in declines. But riches await those who keep their heads and seize the opportunity.

Safal Niveshak spoke about the importance of character.

He opens on a diary entry from Anne Frank:

“Human greatness does not lie in wealth or power, but in character and goodness.”

Investors who’ve done well have displayed strong character at various points in their lifetimes.

These five traits are evident in them:

1. Humility

2. Integrity

3. Tenacity

4. Self-awareness

5. Adaptability

Another great one on investor traits is from Compound Advisors.

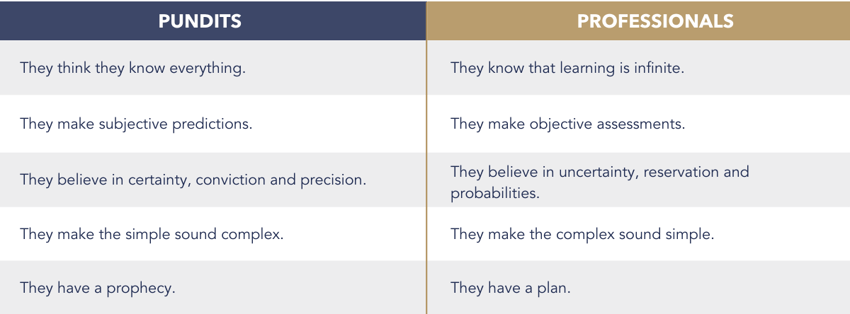

It says there are two types of investors: pundits and professionals.

Their differences include…

More in the article.

One of the longest studies on human happiness tracked everything about 268 Harvard students over decades including their health, careers, relationships, and much more.

The researchers came to a surprising conclusion:

Close relationships, more than money or fame, are what keep people happy throughout their lives.

This sheds light on the importance of relationships for living a happy and healthy life.

It’s why I so often mention investing being about more than just money.

It’s about maximising your social and financial wealth.

Which brings me to my next great read…

Inc.com discussed Daniel Kahneman’s findings on maximising happiness.

Kahneman says there are two types of happiness – chasing pleasant experiences like time with loved ones or aiming for life satisfaction (achieving something worthwhile).

The path you choose depends on your values and preferences.

New research, however, suggests there’s a third option.

Psychological richness.

This is defined as a life full of “interesting experiences in which novelty and/or complexity are accompanied by profound changes in perspective.”

Arming yourself with different conceptions of what it means to live a good life offers you different lenses through which to view your experiences.

Understanding the distinction between happiness and life satisfaction may help you accept the long-term value of short-term sacrifices.

Adding "psychological richness" to your vocabulary could help you reframe difficult times more positively.

A question for you:

What 3 changes could you make in your life to help maximise your happiness?

Meditations:

“Freedom and happiness are found in the flexibility and ease with which we move through change.”

- Buddha

“Our ability to handle life’s challenges is a measure of our strength of character.”

- Les Brown

Humble Dollar's 'Twenty Years Ago'

Safal Niveshak article 'The Most Important Thing That Counts in Investing'

Of Dollars and Data 'What Really Predicts Happiness?'

Daniel Kahneman’s findings 'Psychologists Have Discovered 3 Different Paths to a Good Life'