A ritual is a consistent behaviour, intentionally practised and precisely scheduled.

They are the foundation upon which high performance is built.

Take Rafael Nadal, for example.

His pre-game rituals may seem a little OCD, but they help his focus.

More below along with my other reads of the week.

Before every match, Nadal arranges his energy drink so that it is slightly in front of his water bottle.

When he moves to another end, he sips his energy drink before his water, then makes sure they're perfectly placed to line up with the end of the court he will play.

That's not all.

He always carries one racket to the court, always steps over the side line with his right foot, always jumps at the net during the coin toss, always takes off his jacket while facing the crowd and always runs to the baseline to warm up.

He says,"When I do these things it means I am focused, I am competing -- it's something I don't need to do but when I do it, it means I'm focused."

When things go out of focus, performance drops or there's an air of discombobulation; my friend and own coach, Mick Todd of 2BLimitless always begins by examining in detail the underlying rituals within the lives of those he coaches.

What are your rituals as a high-performance individual?

I was inspired by an article on the joy of work.

It offers four suggestions on how to help you rethink the relationship between work and money.

- First, take the idea that work is what we need to do to live, and turn it on its head. The goal is to live to work, not work to live.

- Second, in retirement, work is no longer something we want to get done as quickly as possible. By contrast, in retirement, our leisure is often found in work.

- Third, in retirement, there’s no longer any need to strive for applause or monetary reward. Instead, we can focus on the satisfaction that comes from looking at the results of our labour. This is a reason many retirees find volunteering so fulfilling.

- Fourth, once retired, we’re able to devote ourselves to work that fits our nature. Retirement provides the time to eliminate the work for which we have no particular skill, and instead devote ourselves to work that matches our personality and gifts.

This reminds me of Brian Dyson's (CEO of Coca-Cola) speech on the five balls of life:

"Imagine life as a game in which you are juggling some five balls in the air. You name them work, family, health, friends and spirit. And you’re keeping all of these in the air. You will soon understand that work is a rubber ball. If you drop it, it will bounce back. But the other four balls – family, health, friends and spirit – are made of glass. If you drop one of these, they will be irrevocably scuffed, marked, nicked, damaged or even shattered. They will never be the same. You must understand that and strive for balance in your life."

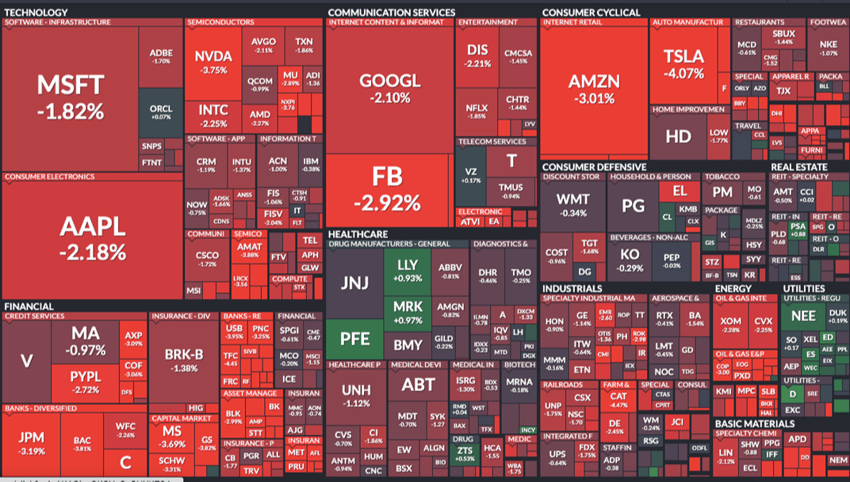

Looking at the markets, Jason Zweig from The Wall Street Journal wrote about Monday’s 2-3% dip in the stock market.

“A sea of red”, he called it.

Everyone says"seeing is believing" but, in fact, believing is seeing: Our perceptions are shaped by our preconceptions. How you see the world is determined not just by what’s there but by what you expect to be there.

So what does the dip mean?

If you're bearish, it's proof the market meltdown you've long anticipated has begun.

If you're bullish, it's the latest sign that stocks can still rise further.

For those who prefer a more evidence-based approach, let’s compare this to the returns of the past year…

A field of green.

If ever there was visual proof to stay the course, this would be it.

Short-term volatility is a blip on the radar.

If your eyes are firmly set on long-term gains, bullish or bearish sentiments have little to no impact on your strategy.

To explore the map further, go here.

On a similar topic, you might feel compelled to invest in the next hot stock.

Or “freak out” about the lagging performance of others.

This is marketing timing and often leads to investors buying and selling at the wrong times.

Jonathan Clements of Humble Dollar says you should rather be concerned with subtraction.

This will help you keep more of what the markets deliver.

Minimise the high costs associated with active management strategies and popular products.

Avoid unnecessarily large tax bills.

Stop trying to make changes to your portfolio.

In the Middle East, there are luxury homes and cars abound.

How often have you judged their owners?

Or thought about how much they’re earning to afford them?

Why do we do that?

And why do we allow someone else’s spending habits to influence our own?

Food for thought in this latest blog by Carl Richards.

Another piece to ponder is on financial freedom and happiness.

This time in The Journal of Investing Wisdom.

It starts off with a few questions from Matt Haig’s book Reasons to Stay Alive.

If we were happy with what we had, why would we need more?

How do you sell an anti-ageing moisturiser?

You make someone worry about ageing.

How do you get them to buy insurance?

By making them worry about everything.

How do you get them to buy a new smartphone?

By making them feel like they are being left behind.

Investing is the same.

The things we hear or read in the media are designed to depress us.

Happiness isn’t very good for those peddling their toxic financial products.

To practice peace, you need to remove the noise.

Try it today and you’ll start feeling grateful for what you have.

And what you’re working for in the future.

A question for you:

What can you remove from your life to increase your happiness?

Meditations:

“Enjoy the satisfaction that comes from doing little things well.”

– H. Jackson brown, Jr.

“Until you remove the noise, you’re to miss a lot of signals.”

– Seth Godin

“The art of knowing is knowing what to ignore.”

– Rumi

Inc.com 'Want to Improve Your Performance? Science Says Harness the Power of Rituals'

Coach 'Mick Todd' of 2bLimitless

Humble Dollar's 'The Joy of Work'

The Wall Street Journal's 'Believing Is Seeing'

Finviz 'S&P 500 map'

Jonathan Clements of Humble Dollar 'Behaving Badly'

Behavior Gap 'Wondering how much so-and-so makes? Don’t.'

The Journal of Investing Wisdom's 'What Nobody Told You About Financial Freedom'