Picture Marilyn Monroe.

Old Hollywood mid-century glamour.

Now picture The Queen of England.

Because of conceptions of time, we often place each in a different era.

So it might come as a surprise they were both actually born in the same year!

Anne Frank and Martin Luther King Jr. were also born in the same year and if they were alive today, would both be younger than The Queen.

Similarly, the release of Forest Gump, Jurassic Park and The Lion King were also closer to the 1969 moon landing than they are to today.

Chronostatic illusions (essentially how our minds alter our perceptions of time) certainly work backwards.

However, we are equally bad at imagining our future selves and working forwards.

Who do you think you'll be in a year? Five years? Twenty years?

One of the big problems with setting goals, especially financial ones, is that evolution wired our brains to focus on surviving today.

Remember what you thought you'd be as an adult when you were a kid?

Are there any gaps between that dream and your life currently?

The reality is that when we talk about financial goals, we're often talking about long time frames.

When it comes to retirement, for example, that could be upwards of 20 to 30 years from now.

You can't even imagine yourself at that age, let alone plan for it or the 40 years of life you may spend in retirement, or at least 'slow-down' mode!

When my first daughter was born, university was the last thing on my mind. But by the time we had our third child, I had a good idea of how fast 18 years would pass.

When we talk about our distant future selves, it's easy to rationalise the decision to not do anything.

In fact, our future selves can often feel like some other annoying person constantly stealing heaps of fun from our current selves.

"Don't eat that now, you'll regret it later."

"Don't spend your money now, save it for your future self."

"Don't take that vacation now, work overtime so you can have an even bigger holiday later."

So what's the solution?

To start, get really clear on your goals.

You may feel like you're still 30, but if you just celebrated (or mourned) turning 40 or 50 - it's time to get real.

Our future selves will be here faster than we think.

Don't be the 65-year-old that wants to hit your 40-something self over the head for not getting clear on your financial goals.

I recently finished a book called 'The Art of Resilience' by Ross Edgley - in it he has a diagram around creating unbreakable resilience.

This requires a strong body, a stoic mind and a strategic plan (healthy, wealthy and wise). He should know, he became the first person to swim the entire coastline of Great Britain, among other records!

Everyone's future looks different. It's why I so often talk about your financial plan being tailored to you.

Your goals.

Your family's needs.

Your dream retirement.

There's a great piece by Morgan Housel which talks about 'doing things differently to everyone else'. Going against the grain.

To put this into context in recent times, when everyone else was losing their minds over GameStop, be the one who preferred the boring route. The person who, even when others ran amok, enjoyed the peace and quiet of a long-term, personalised investment strategy that's silently working towards their goals in the background.

Morgan Housel also looked into the 'power of feedback loops', where one event fuels another. Social momentum is impossible to predict, which is why it seems hard to believe that things can explode into the mainstream when they were recently so irrelevant.

My friend and best-selling author, Andrew Hallam, wrote about a similar concept of how 'successful investments can become a curse'. He likened chasing the latest or hottest ETF to running a marathon. When the starting gun fires, it's best not to chase a fellow runner who's sprinting. Instead, follow the fast and steady older runners. Halfway through the race, you'll pass the bruised and ego-whipped. Nobody earns a prize for getting to the 5km flag first in a 42km marathon...

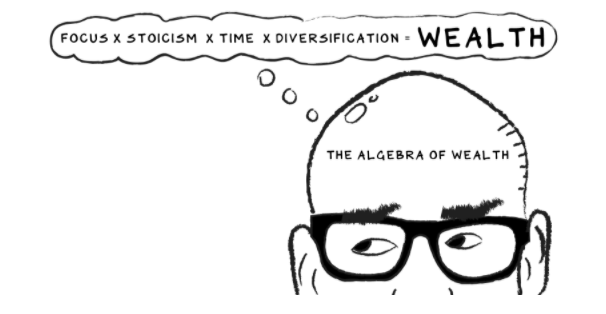

While on the topic of wealth, Professor Scott Galloway shared his 'Algebra of Wealth' this week.

Focus on what matters. Be a Stoic in the face of temptation. Use Time to your advantage. Diversify your investments.

In any economic climate, how do we build economic security, foster love, and find joy? How do we get rich? Slowly. (I spoke more about this idea of 'slow investing' in yesterday's blog.)

If you're living in Dubai, you would have woken up to stunning fog every morning for the last 2 or 3 weeks. You'll know how difficult it is to see ahead in this weather. How clouded your view is.

Harvard Business Review talks about 'planning your life when the future is foggy'. Having a plan is one of the best stress-reduction strategies out there. But of course 2020 may have veered us off track. In this piece you'll learn about adaptability and micro-planning, and how it can help you thrive despite what happens around you.

To end off, here's a question for you

Ask yourself - what would it take for you to have complete clarity on your goals and purpose?

Is this something you can do alone?

Or do you need to find someone who can help and hold you accountable?

This week's meditations

"A nobel purpose inspires sacrifice, stimulates innovation and encourages perserverance."

- Gary Hamel"People are frugal in guarding their personal property; but as soon as it comes to squandering time they are most wasteful of the one thing in which it is right to be stingy."

- Seneca

If you liked this post, please share it using the social buttons at the top, or just forward them this blog.

Have a great weekend and enjoy the ‘light’ reading!

Ross Edgley's book 'The Art of Resilience' and his account of 'swimming the coastline of Great Britain'

Morgan Housel on 'Unfortunate Investing Traits' and 'Why It's Usually Crazier Than You Expect'

Andrew Hallam's article 'How wildly successful investments can also become a curse'

Professor Scott Galloway's 'The Algebra of Wealth'

My blog post 'If investing excites you, you're doing it wrong'

Kate Northrup for the Harvard Business Review on 'How to Plan Your Life When the Future Is Foggy at Best'