The father of index investing, and founder of Vanguard, Jack Bogle sadly died of cancer in 2019...

But his legacy lives on.

He revolutionised the way people saved for the future..

And Bloomberg says investors have a trillion reasons to thank him.

Here’s why.

Investors may not realise how returns have improved since Bogle pioneered index funds.

He paved the way for passive investing…

Which Warren Buffett is a huge advocate of.

Jack Bogle created a way for high-net-worth investors, like you…

To bypass expensive fund managers and get better results.

Though notably, Bogle’s innovation wasn’t merely the low-cost index funds that Vanguard created…

It was also structural.

He formed Vanguard as a type of “mutual” investment company…

Which meant it wasn't owned by external shareholders, but literally the shareholders of the company’s own mutual funds (i.e. the investors who used Vanguard products).

Jack Bogle’s fundamental ideas

His insight was mathematically simple.

All market investors can only make the market return.

After all, they are the market.

So, with that in mind…

On average, the investor ends up getting back the return, less their cost of investing.

Unless you’re 100% certain that you can pick a winning active fund manager (which is highly challenging, mathematically)…

You’d be better off aiming for consistent returns and keeping costs low.

It’s the logic behind index-tracking funds.

And it’s proven to work.

While active funds have been known to occasionally beat the market…

It’s rarely substantial enough to make up for the high fees.

Index funds beat stock-picking funds any day…

With relative certainty about the return you’ll get.

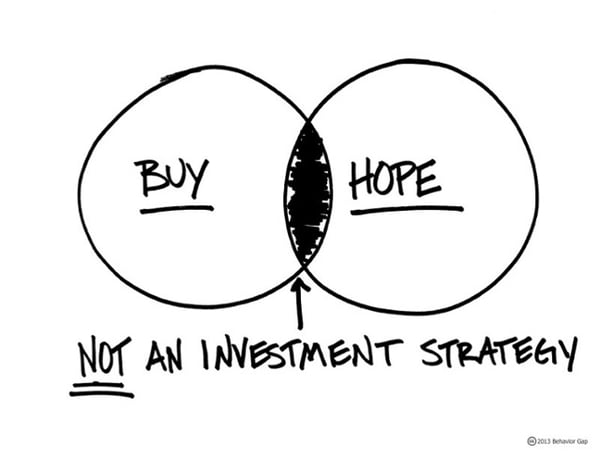

While you can’t predict whether the market will go up or down…

You can be sure you won’t have a fund manager to blame for missing a rally…

Or be tempted to constantly buy and sell on a whim.

Of course, active fund managers will disagree and prove why their approach works.

After all, indexing is taking over their business on a massive scale globally.

But is indexing too good to be true?

There’ll always be critics.

Some ‘experts’ believe that indexing could be dangerous.

They blame it for creating imbalances that will result in the next big financial collapse…

The erosion of shareholder capitalism…

And the rise of monopolies.

But academic analysis shows these theories to be made up largely by those with vested interests (active fund managers, financial press, fund salespeople and the like).

More reasons to thank Bogle

Not only did he understand the huge importance of costs…

He also grasped the many frailties of behaviourial biases that could cost high-net-worth investors their ideal future.

This spawned an entire re-think on the way investors take advice.

In addition to the legacy that Bogle leaves behind in the form of index funds and Vanguard...

Here's a long list of books that Bogle wrote for the benefit of both high-net-worth investors and the advisers who serve them.

I recommend you read them and give indexing a go.

We’ve spoken about the benefits of this investment approach time and time again...

And as strong believers of evidence based investing...

We follow the same approach.

All thanks to Jack.

May his legacy live on…