Are you concerned by recent market performance and thinking about making a change?

Investors with bond-centric portfolios are likely feeling fragile after unusually poor first-quarter returns.

Negative returns for equity and fixed-income asset classes alike is a less common market event that likely affected all investors…

But its impact may have been especially felt by conservative, bond-centric investors because they also have the highest loss aversion.

For those conservatively invested, you may be less accustomed to simultaneous stock and bond drawdowns, like the ones we have seen in Q1.

Now, one bad quarter should not trigger a change to your financial plan – assuming it was fit for purpose to begin with.

It should however serve as a reminder to understand the frequency and scale of these types of events—and keep your long-term objectives in focus.

Bonds have experienced a 40-year bull market—there’s seldom been bad news to communicate.

Typically, the greatest pain in a portfolio comes to those investors more heavily weighted towards equities and other risky assets.

However, in the first quarter of 2022, both stocks and bonds had negative returns—so, conservative investors have experienced a drawdown that is much less common for them.

In fact, bond returns for the quarter were worse than stocks.

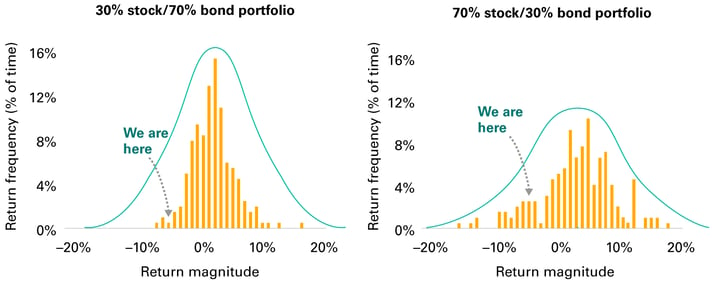

In the past 50 years, an investor with a conservative 30/70 stock/bond mix, has only experienced three worse quarters.

As a result, as a more loss-averse investor, you may be feeling anxious and uneasy.

This differs from the experience of a more aggressive 70/30 investor.

They’ve experienced similar or worse quarterly performance 26 times, or on average, every two to three years.

It’s a matter of putting things into perspective.

Historically speaking it’s true, bonds saw one of their worst quarters.

But comparatively speaking, equities tend to fare much worse, and far more often.

Sources: Vanguard analysis of Morningstar Direct data, as of March 28, 2022

As we know, when the financial markets are volatile, investors can feel strongly compelled to change their financial plan and their stated portfolio asset allocations to halt any perceived continued losses.

Yet, most of history has shown that remaining committed to your plan is a much better alternative to additional de-risking (such as moving further into bonds or money markets).

Changes to your plan should come because of changes to your goals, objectives, risk appetite and other aspects of your life.

Not because of changes in the markets.

My thoughts are to put this event into perspective - before reading any news headlines prompts you to question your long-term investing plan.

Be realistic about the future – none of us know what it holds.

Finally, remember it’s a marathon, not a sprint.

Portfolio asset allocation balances principal risk, as well as purchasing power risk (the risk your portfolio loses value to inflation).

Remain diversified and look for credible long-term investment themes, avoiding emotional behaviour dictated by fear.

We talk a lot about the importance of managing different risks through highly diversified portfolios and whenever we look back at a crisis, we always take comfort in the level of diversification in our strategies.

As ever, we're convinced that those who remain disciplined and systematic in their investment approach, will ultimately be rewarded in the long term.