It’s one of the hottest topics in the world of personal finance.

Some call it the holy grail.

And people are making hefty sacrifices for it…

Have you guessed it yet?

I’m talking about early retirement…

Most of us will be lucky to retire at 60.

Yet there are software engineers…

Financial analysts…

Who are calling themselves retirees before reaching 30.

Due to a ‘new’ movement called FIRE – Financial Independence and Retiring Early.

It’s all about changing perceptions of work…

Scepticism about traditional finance.

And, what it means to be successful.

The principles of FIRE are quite simple:

- Spend less than you earn

- Grow your income

- Harness the power of compounding

Sounds easy, right?

So why are we not seeing more ‘people of leisure’?

For many early retirees, it took years of diligence, planning and hard work.

With a few lifestyle changes too.

Besides saving a large portion of their incomes…

Some gave up their cars.

Downsized their homes.

And relocated to cheaper areas.

FIRE is a life philosophy.

It begs the question:

“What would I do with my life if I didn’t work for money?”

Travel the world?

Start a hobby or two?

Dedicate your time to charity?

The options are endless.

(As long as your money can support you).

How can you retire early?

The obvious start is saving a large portion of your income.

(Ideally, more than 50%)

This is in stark contrast to the typical household savings rates.

Boosting your savings can happen in two ways.

Either increase your income.

Or, reduce your spending.

For many of us, our largest expense is our home.

According to a report from Deutsche Bank Market Research…

Rent on a two-bedroom property in the world’s largest cities can range from $300 in Bangalore, India to $3,700 in Hong Kong.

A quick look around shows city life certainly doesn’t come cheap:

- Vancouver: $1,609

- Tokyo: $1,740

- Dubai: $1,787

- Amsterdam: $1,876

- Sydney: $2,052

- London: $2,410

- New York: $2,854

Blogger JP Livingstone saved $2.25 million by the time she was 28.

28!

Partly due to a significant downsize in living space – which she shared with her husband and dog.

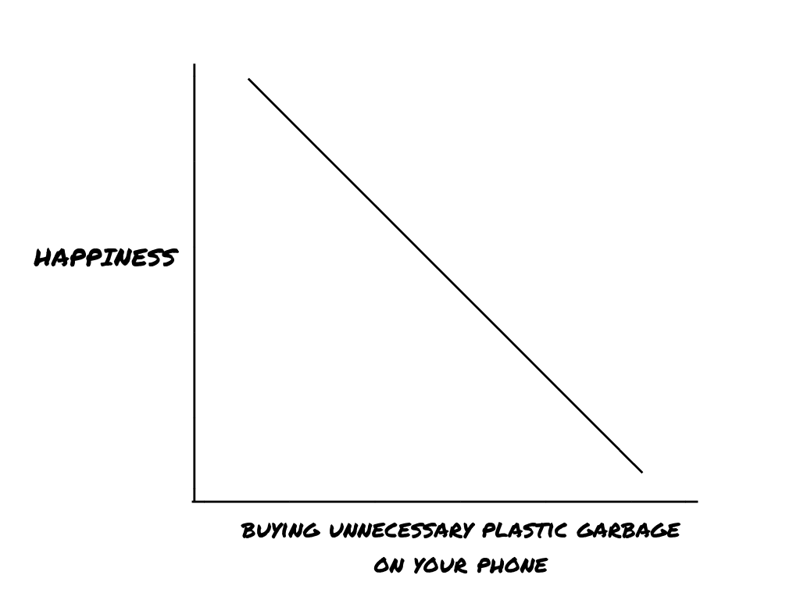

She also thought about the cost of items according to hours worked.

A strategy she picked up from the book, Your Money or Your Life.

So, if your cost per hour is $20 for example.

The latest iPhone XS (costing $1,152) would equal 58 hours of work.

Image: The Behavior Gap

It’s a good way of asking yourself:

There’s also a Google engineer who saves 90% of his income…

By living in a truck in the company’s car park.

(A drastic measure, clearly).

It is worth it?

Those who’ve made sacrifices say they’ve never been happier.

They have more time to do the things they love.

.webp?width=600&height=400&name=More%20time%20to%20do%20the%20things%20you%20want%20(1).webp)

And no longer feel the effects of burn out and stress.

But there are other things to consider.

A longer retirement means more chance of running out of money.

If inflation averages 3% a year for the next 40 years, the million dollars you save today…

Will have the same spending power as $306,000.

There’s also the risk of getting bored and changing your mind.

And incurring large health insurance bills…

Without a company to subsidise a portion of it.

I’m not saying this to scare you.

Or talk you out of an early retirement.

If it’s something you are working towards…

You need to weigh all sides.

It’s not just about financial independence at the end of the day.

But about fulfilment and happiness too.

And whether your decisions will sustain that happiness over the long term.

If you need a second opinion or perhaps a chat on what an early retirement would mean for you, book a Discovery Call with us.

We’ll assess your needs, review your current portfolio and schedule a cash flow plan to make sure you can achieve that goal.

So, at the very least, you’ll know what things may look like.