Bernie Madoff died this month.

The American fraudster ran the world’s largest Ponzi scheme ($65 billion).

Even some of the brightest investor minds and regulators were completely fooled and lost millions.

No one likes losing money.

In fact, people will do almost anything to avoid it.

So today, here are a few insider secrets to help you increase your chances of investment success.

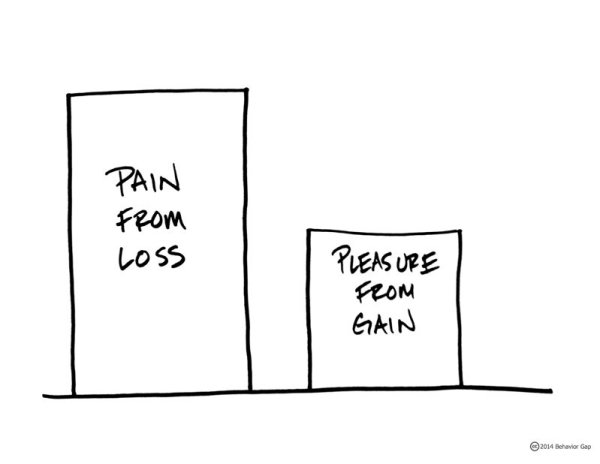

The reason people are so averse to losing is that the pain of loss is more acutely felt than the pleasure of gain.

Academics call it Loss Aversion.

In other words, we might like to win, but we definitely hate to lose.

So how can you avoid risking it all and getting involved with the next Bernie?

To manage your family’s wealth well, you’d need to be an expert in capital markets, portfolio management, tax, estate planning, philanthropy, business management, family dynamics, and all the many other ingredients of successful wealth management.

Following Malcolm Gladwell’s 10,000 hour rule, I define an expert as having a minimum of 5 years (2,000 hours a year) of experience.

As a senior international executive or business owner, that’s time I’m sure you don’t have to spare.

So what’s the solution for those with significant wealth?

Gather and manage a team of experts (with as many years of experience as possible) to address your objectives.

They should bring their own (albeit intangible) expertise to your unique situation.

This may be hard to gauge initially but here’s what to consider:

- You’re looking for a smart, technically astute, ethical and loyal team of people (not a single individual planner).

- You’ll need to conduct your own due diligence and make the best choices you can with the information available to you.

- You’ll need references from others to give you peace of mind that you’ve made the right choices about your team.

This week, Sam touched on Bernie Madoff in his latest Weekend Reading blog.

Bernie Madoff shattered the standards of working with financial services professionals.

He took advantage of his social and professional position (a former Chairman of the NASDAQ) to abuse the trust put in him by thousands of investors.

Billions of dollars were lost as a result but hindsight is a wonderful thing.

It may be easy to sympathise with the family stewards who trusted Madoff as an industry leader.

An expert.

A professional.

Even a friend.

But, as with any failure, important lessons can be learned.

Lesson 1: Taking care of your family’s wealth is a professional endeavour

Friendships, referrals and social interactions (such as being treated to a round of golf) should never replace a fiduciary committed to professionally addressing your finances.

Most individuals are blissfully unaware of the vast amount of due diligence required when choosing a professional planner.

Similarly, many do not understand the research that should go into choosing an investment that’s personally aligned to your goals and individual circumstances.

What are the prudent practices of a professional who acts in your best interest?

You can find a list here.

Lesson 2: Insist on a strategy

Demand a strategic approach to the overall management of your family’s assets, such as an investment policy statement.

It captures the objectives, tolerances, accountabilities, and processes for the management of your investments and can be shared with family members, planners, and other relevant parties to create alignment.

In trying times, such as turbulent markets when emotions run high, this document is invaluable.

It also ensures checks and balances are adhered to (making some of the shortcuts taken by Madoff and his team far less likely).

As an example, you can view our Investment Policy Statement here.

Lesson 3: Trust but verify

Once you’ve found a trusted financial planner, you need regular updates to support your decision.

A simple approach is to compare your results with that of the markets.

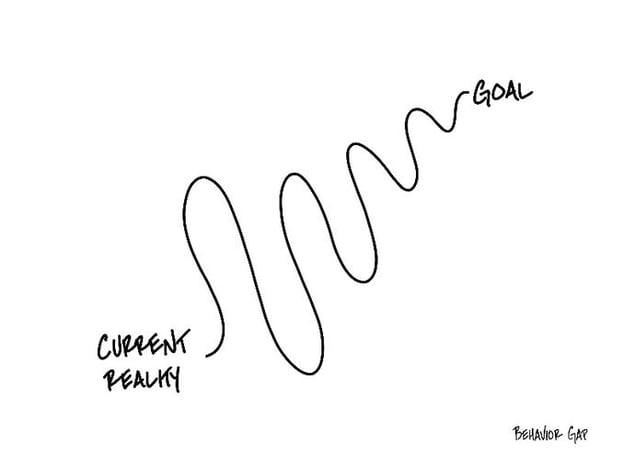

Of course, investment results won’t always be good.

But, with a globally diversified portfolio invested in the world’s greatest companies, you should expect superior performance over the long term.

You should clearly understand your portfolio’s returns and relate that performance to your planner’s strategy.

If you’re having trouble trusting your planner, take note.

Madoff was a crook and the aftermath of his lies was all the more painful for my profession, because many families thought he was credible.

Don’t be too trusting – always verify what you’re told.

Lesson 4: Be a proactive client

We’ve covered the investment policy statement and how this helps create context for your planner.

You should also clearly communicate your expectations of results, as well as be realistic about timeframes, risk and performance.

Don’t be afraid to be vulnerable and tell your planner when you don’t understand them.

Ignore the temptation to feel embarrassed or naïve.

Scrutinising details or asking questions should never offend a competent, fiduciary planner with high standards.

In fact, it’s their job to explain things to you in simple terms and they should appreciate your efforts to engage and understand their work and strategy.

Sometimes, your planner may not be able to answer your question right away.

(Wealth management has such enormous scope and complexity).

Your planner is human and “I don’t know” is a human response.

However, they should endeavour to find the answers to your questions and follow up accordingly.

Your planners have the technical expertise to help you meet your family’s objectives.

But relationships are a two-way street and you need to play an active role on this financial journey as well.

Questions for further reflection

1. Are you confident that your family’s assets are being looked after appropriately and your planners are fulfilling their professional obligations to you?

2. What other systems or documents are in place to guide your planners towards your objectives, constraints, and preferences?

3. When did you last hear something you didn’t understand? How would your planner have reacted if you had responded differently to what you heard?