There's a fascinating show on Netflix right now.

How To Get Rich, hosted by Ramit Sethi, is based on his best-selling book.

He looks at the emotional side of financial planning - encouraging couples to communicate openly about money, think about what they value, and what a rich life means to them.

He recently tweeted something controversial...

To his 250,000 followers, he said:

Is he right?

You may have heard this idea before.

Another popular thought is that working a few extra months can have the same significant impact on your retirement savings as decades of disciplined saving.

So, let's work this out, using 10 years as a time frame.

Picture yourself a decade away from your retirement. You've been diligent with savings throughout your career and are confident that you'll be able to retire without any financial worries. But, a part of you yearns to retire earlier.

However, you're aware that retiring earlier means you'll have to tighten your purse strings today and save more. Before taking the plunge, you're keen to determine if the trade-off is worth it.

If saving an extra 1% only shaved a month off your retirement timeline, is that enough to make the sacrifice worthwhile? What if that 1% could potentially allow you to retire a whole year earlier? Is that a decision worth pondering?

Fortunately, we have the ability to calculate the potential impact of increasing your savings rate by 1% on your retirement timeline. However, it's important to note that the outcome is influenced by your existing savings rate. This rate is crucial because high savers see less benefit (in terms of retiring earlier) compared to lower savers when they boost their savings rate.

Here's an example.

Low-saver Liam earns $100,000 a year after tax and needs to save 5% per year in order to retire in 10 years.

Over this time, he'll save $50,000 in total (5% * $100,000 * 10 years).

If he increased his savings rate by 1% (to 6% in total), he'll get to his $50,000 savings goal a little over one year earlier [6% * $100,000 * 9 years > $50,000].

High-saver Harry also earns $100,000, and saves 50% per year in order to retire in 10 years.

Over this time, he'll save $500,000 (50% * $100,000 * 10 years).

If he increased his savings rate by 1% (to 51% in total), he'll be able to retire about 1 month earlier.

In summary it's true, saving 1% more per year for 10 years can move your retirement date up 1 month, when you have a 50% savings rate. But if your current savings rate is more like the rest of us (i.e. 5%-20%), boosting your savings rate by 1% per year for 10 years will have a bigger impact.

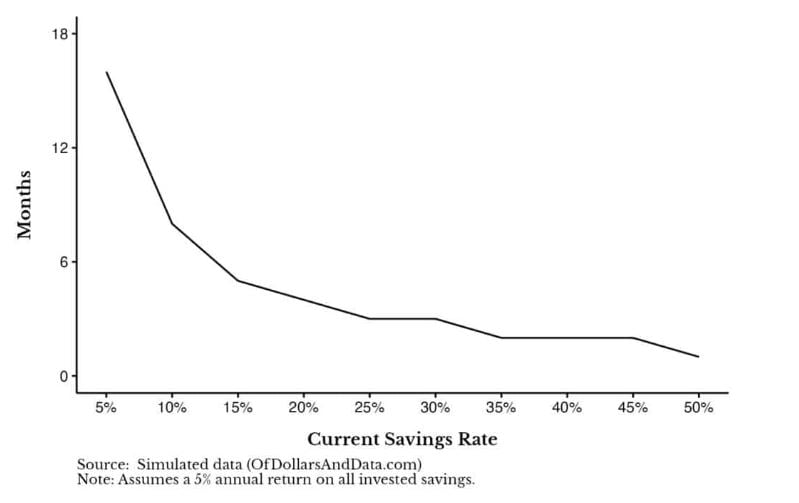

This great chart shows how much earlier you would retire (in months) by saving 1% more, for different savings rates:

It's clear to see - if your current savings rate is 5%, increasing it to 6% would allow you to retire almost 18 months sooner.

But this diminishes as your current savings rate increases (if your current savings rate is 15%, increasing it to 16% would only allow you to retire 6 months sooner).

Let's not forget, you could also increase your savings rate by 5% or even 10%, which can of course have a much larger impact on how much earlier you can retire.

In particular, if your current savings rate were 5% and you increased it by 10% (to 15% in total), you could retire 6 years earlier.

So, what about saving for longer periods?

Most of the successful families we help have a family steward who is around 10 years from retirement. But, if you're 20 or 30 years away, you can retire much earlier by saving more.

This table shows how many years you would save if you increased your savings rate (while 20 years away from retirement):

| Current savings rate | Save 1% more (years) | Save 5% more (years) |

Save 10% more |

| 5% | 2.20 | 7.60 | 10.90 |

| 10% | 1.20 | 4.70 | 7.60 |

| 15% | 0.80 | 3.40 | 5.80 |

| 20% | 0.60 | 2.70 | 4.70 |

| 25% | 0.40 | 2.20 | 3.90 |

| 30% | 0.30 | 1.80 | 3.40 |

| 35% | 0.30 | 1.60 | 3.00 |

| 40% | 0.20 | 1.40 | 2.70 |

| 45% | 0.20 | 1.20 | 2.40 |

| 50% | 0.20 | 1.20 | 2.20 |

Source: OfDollarsAndData.com

So, if you currently save 5%, and increased this by 10% over 20 years, you'd be able to retire almost 11 years earlier.

Small changes can really add up.

Increasing your savings to retire earlier depends on many factors, including your present savings rate, the amount you want to save, and the number of years left until retirement.

Saving more can make a considerable difference in retiring earlier, especially if your current savings rate is lower. Though, once you're saving a lot, saving more doesn't move the needle as much.

Of course, you must strike a balance between saving for the future and enjoying your life now.

Is retiring four years earlier worth saving 10% more for 20 years?

It's a personal decision. But having the data can certainly help.

If you'd like to run the numbers with us, we'll focus on the $30,000 questions and equip you with a Life Strategy to help ensure you're on the way to a flourishing retirement... not drifting into the unknown.