Fight or flight: How should investors react to the panic surrounding coronavirus?

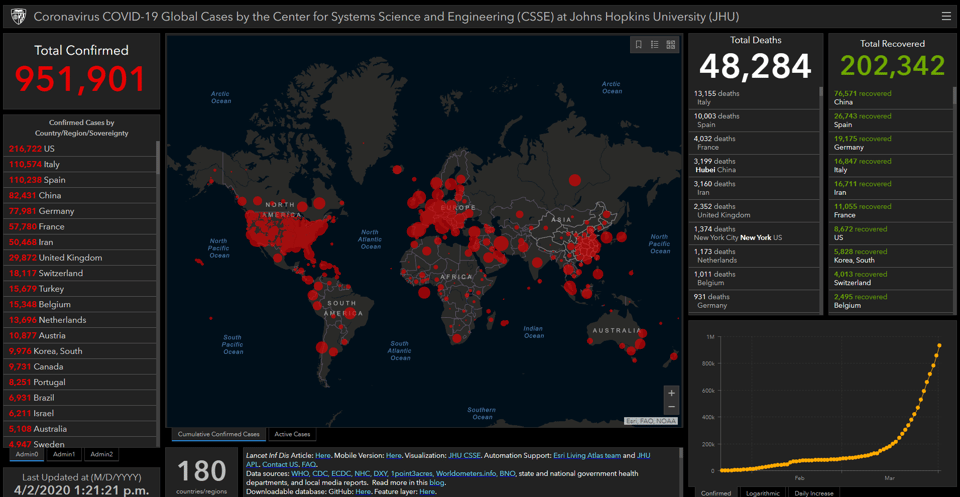

There are over 951,000 confirmed coronavirus cases worldwide.

(As of 2 April 2020).

To put that into perspective...

There were 81,000 cases when we first published this blog on 26 February.

The pandemic doesn’t seem to be slowing down.

It's causing markets to rattle and investors are feeling uneasy.

Here’s what you should do…

When this blog first went out...

Italy was just about entering the arena with 322 cases.

Now, it's an epicentre with 110,574.

Other continents and countries previously uncontaminated have now confirmed the virus too.

Countries in Africa are seeing rapid spread.

And the USA has the highest number of confirmed cases...

216,722!

These numbers simply boggle the mind.

Travel bans, border closures, social distancing, army deployment...

Have become buzzwords synonymous with panic.

Mass hysteria has lead to bulk buying.

Supermarkets are reporting empty shelves.

Fights are breaking out over the last pack of toilet rolls.

Trollies are being filled with tinned goods.

A third of the world is in lockdown.

Are we headed for an apocalypse?

I know that's what many are thinking.

In times like these...

Perspective is an important commodity.

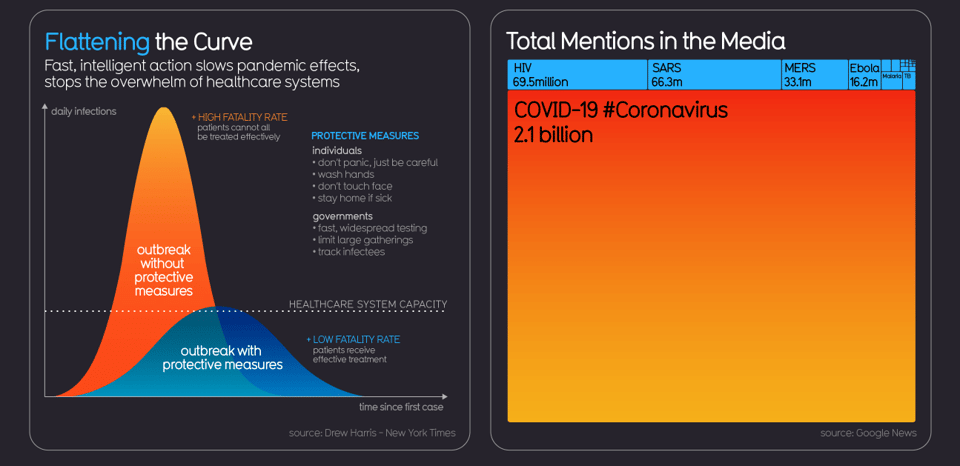

Let evidence and data drive your reactions and decisions.

Not the media and their sensationalism.

Looking at the data from the above graph...

The numbers look ominous.

But looking at the number of deaths vs total recoveries...

You'll see most people recover.

(Just like the markets do).

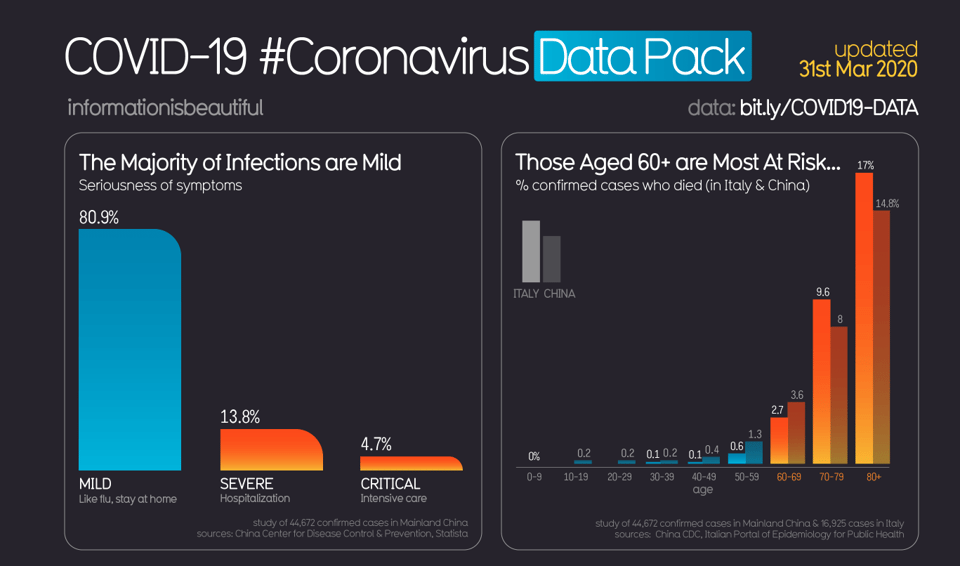

I posted a few graphs to LinkedIn the other day.

The response was overwhelming.

People were relieved to see the data...

It gave them peace of mind and made them feel a lot less anxious.

My advice is always the same, whether it's a good or bad day in the markets...

Avoid listening to the media.

Let the evidence speak for itself.

Coronavirus and the markets - an unparalleled opportunity

Over the last few weeks, equity markets tumbled and bonds outperformed.

More funds were flowing into perceived ‘safe haven’ assets.

During the outbreak we saw the S&P 500 fall by 9%.

The next day it was up 9%.

The market is having difficulty pricing in COVID-19.

With all the uncertainty regarding the spread...

We're seeing this reflected in the markets as corporate results are falling.

The travel, tourism and hospitality industries have taken a particularly big hit.

Yet despite the market's movements, now is the best possible time to invest.

With equities "on sale", you have the opportunity to buy in at huge discounts.

Doing this will not only boost your investment returns...

But also keep you invested so that when the markets improve (which they always do)...

You'll be ready to maximise your growth.

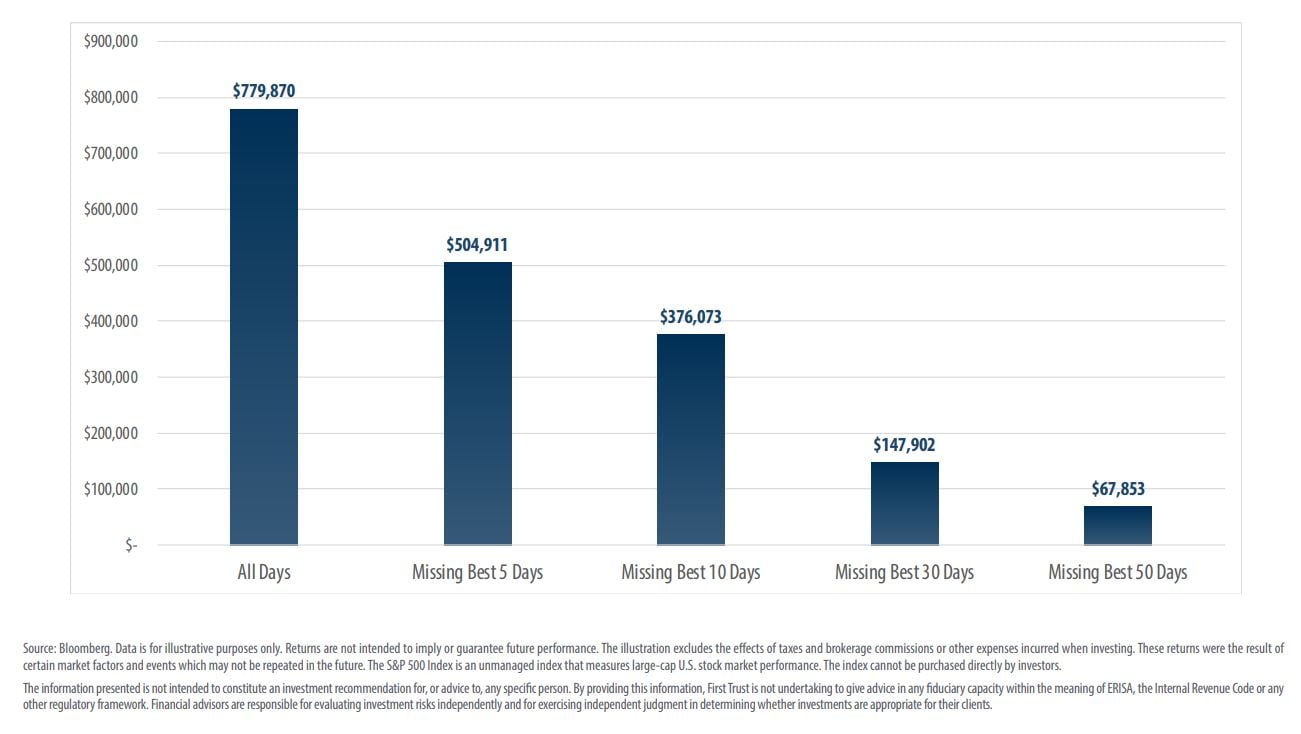

Staying invested is the single most important thing you can do right now.

And here's the proof.

Over the last 40 years, $10,000 invested in the S&P 500 would have returned $779,870.

However, coming out of the market and missing just the best 5 days would have reduced those returns to $504,911.

Missing the best 50 days would have returned $67,853.

The best days are often seen in the short-term recovery.

You are bound to miss these days if you react by selling when the markets are down.

And buying back in when they are high.

I know sitting tight and not reacting to the current situation is easier said than done.

However, looking back at similar cases...

The evidence proves that, as usual, the markets always recover.

Ensuring your portfolio is globally diversified across asset classes is the best possible thing you can do right now.

It will minimise your risk exposure.

You shouldn't have to worry about your money.

This is advice I reiterate to my clients during turbulent times.

One client sent me this response on 17 March 2020...

"Many thanks for the advice. As you say, it's turbulent times. I'm in for the long term, so while these market swings are concerning, I understand not to panic and stay invested."

This is the mindset I wish for everyone.

Focus your energy towards your health and the things you can control.