The secret to spending more in retirement, without ever running out of money

What if I told you there's a way to enjoy a more comfortable retirement without worrying about running out of money?

Sounds good, right?

It's totally possible.

For those who dream of retiring early (or even those you don't), this blog offers a brilliant perspective on using spending flexibility to accelerate your retirement plans.

The widely accepted rule for retirement spending is known as the 4% rule, which suggests that you withdraw 4% of your portfolio annually and account for inflation going forward.

For instance, imagine you've retired with £1 million in assets, and let's say inflation remains steady at 5% each year. Following the 4% rule, you'd allocate £40,000 in year 1 [4% * £1 million], £42,000 in year 2, £44,100 in year 3, and so on. This approach gained immense popularity due to its simplicity and the assurance it provides that your funds won't dwindle over time.

But what if you could be more flexible?

Introducing guardrails

By following a simple strategy of cutting your spending when in a bear market, you can increase the amount you spend to as much as 5.5%, instead of 4%.

On 31 December each year, you check to see how far the MSCI World Index is away from its all-time highs. Based on that number, you would fall into one of three possible spending conditions, or 'guardrails':

- Normal market: If the MSCI World Index is less than 10% away from its highs, you spend all of your discretionary spending in the next year.

- Correction: If the MSCI World Index is more than 10% away from its highs but less than 20% away from its highs, you spend half of your discretionary spending in the next year.

- Bear market: If the MSCI World Index is more than 20% away from its highs, you spend of your discretionary spending in the next year.

Discretionary spending is anything 'nice-to-have' - but not necessary - in your retirement. Perhaps a holiday, eating out, or theatre tickets. Everything else is required spending.

An example using a £1m portfolio

If you had a £1 million portfolio and your expected required spending was 100%, then you'd use the 4% rule and spend £40,000 per year (adjusted for inflation). This is the default advice.

But what if 50% of your spending was on 'nice-to-haves'?

You could spend up to 2.75% of your portfolio every year (adjusted for inflation) as required spending and spend the other half based on the 'guardrails' above (note that we never adjust our discretionary spending for inflation).

So, you'd spend $27,500 every year and adjust it for inflation for the rest of your retirement. This is your required spending and it doesn't change based on what's happening in the stock market.

However, your discretionary spending would change based on the markets. For example:

- Normal market: If the MSCI World Index is less than 10% away from its highs, you could spend an additional £27,500 in the next year.

- Correction: If the MSCI World Index is more than 10% away from its highs but less than 20% away from its highs, you could spend an additional £13,750 in the next year.

- Bear market: If the MSCI World Index is more than 20% away from its highs, you could spend an additional £0 in the next year.

These discretionary numbers never change with inflation throughout your retirement. Whether you check the MSCI World Index on 31 December in year 1 or year 30 of your retirement, you would use the numbers above and add them to your required spending (which has moved with inflation).

In summary, your total spending in your first year of retirement, based on the three market conditions above, would be:

- Normal market: £55,000 [£27,500 required + £27,500 discretionary]

- Correction: £41,250 [£27,500 required + £13,750 discretionary]

- Bear market: £27,500 [£27,500 required + £0 discretionary]

As you can see, during a normal market and a correction, you get to spend more money than you would under the 4% rule (£40,000) because of 'guardrails'.

The probability of you not running out of money

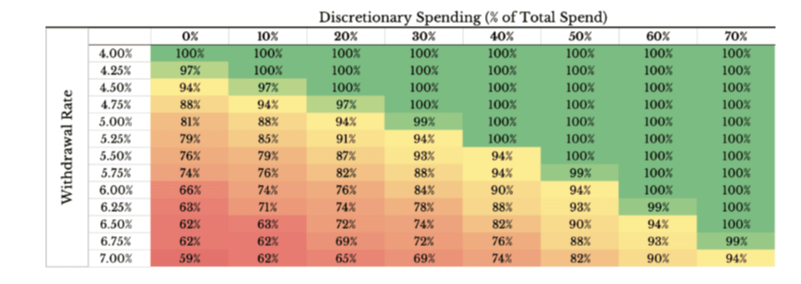

Of course, not all retirees will be comfortable with a 50% level of discretionary spending. The table below, adapted from a similar one used in this blog post, shows what happens when you alter your discretionary spending levels and withdrawal rates over a 30-year retirement. It uses a global stock/bond portfolio.

Probability of not running out of money over 30 years

First, guess what percentage of your spending will be on nice-to-haves in retirement. Go to that column and then look down for the percentage change of not running out of money, you feel happy with. This gives you your withdrawal rate.

For example, if you had 10% discretionary spending and wanted an 88% chance of not running our of money over 30 years, you would choose a withdrawal rate of 5%. However, if 40% of your spending was discretionary, you could increase your withdrawal rate to 5.25% and still have a 100% chance of making it through 30 years of retirement. Of course, this is based on historical simulations since 1926 where you follow the guardrails detailed above.

Why do guardrails work?

In simple terms, every extra pound you withdraw during a major decline doesn't have the chance of recovering.

When asked the worst time in modern history to retire, most people think of the Great Depression. As bad as things were then, the worst time to retire in modern history was actually 1972. Not only did you have the bear market of ‘73-’74, when the markets fell 50%, but it was followed by more than a decade of extreme inflation. Guardrails worked in this period and every other period we’ve seen. While there’s certainly no guarantee it’ll work in every future scenario, based on everything we know and can control, guardrails are our best strategy.

Imagine this:

- It's the morning of 31 December, 2023.

- You have £1,000,000 in your retirement portfolio.

- You plan to withdraw £100,000 from this on 1 Jan 2024, to take the whole family on a once-in-a-lifetime world cruise to celebrate your 60th birthday. This would leave you with £900,000 for 2024.

- However, your portfolio declines by 20% when the market opens and you end 2023 with £800,000, not £1,000,000.

- On the first day of trading in 2024, you take your £100,000 as planned, leaving £700,000.

- Over 2024, your portfolio recovers and increases by 25%. This offsets the 20% loss experienced at the end of the previous year. The total 1-year return is 0%.

- What will you have at the end of 2024?

The answer is £875,000 (£700,000 + 25%). Of course, this is £25,000 less than the £900,000 you expected to have after taking out your holiday money at the start of the year.

That £25,000 disappeared due to something called 'sequence of return risk'. You withdrew the £100,000 after a 20% decline, so that £100,000 (and you) never got to experience the recovery of 25%, in 2024.

This is where guardrails come in. If the market ends the year being at least 10% off its highs (and you end up following your guardrails) you won’t withdraw as much in the following year. Guardrails work because you get to withdraw more when times are good, because you were more frugal with your spending when times weren't do good.

Tradeoffs are everywhere

There are two ways guardrails can benefit you (and they're pretty much the same thing, said differently):

- You can spend more in retirement

- You can save less for retirement

Whichever feels right for you, guardrails can be beneficial if you're willing to make the necessary tradeoffs. If you want to spend more in retirement you have to either: (a) take on more risk or (b) spend less money at least some of the time.

So whether you have a 30-year retirement or a 60-year retirement ahead of you, if you want to spend more, you just have to be flexible.

Interested to read more about how AES uses guardrails? Click here to view our short guide, or get in touch using the button below.