“I’m an engineer in Dubai with a UK pension. Should I transfer to a QROPS or a SIPP?”

Your pension is one of your most important financial assets.

Any decision to transfer it should be considered carefully.

Here’s a real-life story of a family steward, who managed to turn his finances around in the nick of time.

Most high-earning executives where I live in Dubai have been called by an army of financial salespeople.

You’ve probably been given unsolicited advice around the “best thing” to do with your pension (or the best products to invest in).

The salespeople sound friendly, well-practised and drop in buzzwords around alleged tax savings.

Our client, John, an engineer based in Dubai, experienced this first hand.

He came to us for a second opinion - he was feeling anxious about remaining on track for a flourishing future.

His main concern was his £800,000 qualifying recognised overseas pensions scheme (QROPS).

You may have friends or colleagues who’ve transferred their pension into a SIPP or a QROPS - and perhaps you’re wondering whether you should do the same.

Before we share John's situation and our recommendations, below is a quick refresher on the differences between QROPS and SIPPs, along with some pros and cons.

Pensions get quite technical, and the personal circumstances around your pension and retirement needs are unique.

So, do seek expert help from a qualified, professional planner before taking any action.

What is a self-invested personal pension (SIPP)?

SIPPs are UK-registered personal pension schemes.

They are defined contribution schemes (meaning only the contribution you make is defined - there is no guaranteed level of income at retirement).

They are generally funded by an individual, and abide by UK legislation with regards to tax, and when and how they can be accessed.

SIPPs have become very popular in recent years, driven by their relatively low cost - and the wide investment choice they offer.

It’s important to remember though, that SIPPs are UK-based, so if you are living abroad the advantages of using them can be limited.

For example, pension contributions in the UK to a UK-registered scheme receive tax relief of at least 20% per year...

However, if you live abroad and are paying into a UK-based scheme, tax relief will only be available for the first five tax years of your non-UK residence…

And you will also be subject to a cap of £3,600 per annum.

Like all UK pensions, SIPPs received a boost a few years back when new rules came into effect providing people with fully flexible access to their defined contribution pensions (including SIPPs).

This flexibility simply means people can decide for themselves when and how they take their pension income, after the age of 55.

What is a qualifying recognised overseas pension scheme (QROPS)?

QROPS are actually very similar to SIPPs, as they are defined contribution schemes, but they are based outside the UK.

They can be based in any country around the world and qualify as a QROPS as long as the scheme meets specific requirements set by HMRC.

As mentioned, HMRC does not vet individual schemes – the scheme trustees notify HMRC of their existence and self-certify that the scheme meets the criteria.

After this, the scheme will normally become “recognised” by HMRC and will often (but not necessarily) be included on a list published on its website.

QROPS are intended for people who are planning to, or have already left, the UK.

The main difference between a SIPPs and a QROPS is the additional tax benefit a QROPS may bring to those living outside the UK.

Make sure you don’t fall foul of UK pension rules

A myth wrongly and often perpetuated by people who promote a QROPS is that a scheme has received approval from HM Revenue & Customs.

They may refer to it as being an “authorised” or “approved” QROPS.

This is untrue.

The reason people choose to refer to them like this is for one of two reasons – ignorance or intentional deception. If someone uses these words to describe a QROPS, while trying to convince you to transfer, be extremely cautious.

QROPS are also sometimes sold to simply empty a UK pension, “tax free”.

If HMRC believes UK tax-relieved pension assets have been accessed improperly or invested in ways it doesn’t permit, you could face a substantial tax charge.

QROPS and the lifetime allowance (LTA)

One of the biggest benefits of QROPS is around something called the lifetime allowance (LTA).

Although the UK Spring Budget 2023 abolished the lifetime allowance tax charge for pensions which are in excess of £1.073m (or higher if you have protection in place) the legislative risk of this being brought back into force remains high, with the Labour party already planning to reverse this and reinstate the tax charge.

If you're close to the lifetime allowance, and worried about the possibility of a tax charge being reintroduced in the future, by transferring your pension into a QROPS, it's tested against the LTA at the point of transfer (with the current charge being 0%), and not again thereafter.

This means, if the value of your UK pension fund is close to the LTA, it may be worth considering a transfer into a QROPS to avoid being taxed on your pension savings above the LTA in the future.

Keeping John on track for his retirement

Back to John.

At the time, his previous ‘adviser’ recommended he and his wife transfer into two individual QROPS.

His pensions had been structured as a QROPS, with an underlying bond as the platform.

(A bond is a tax wrapper, so is a QROPS or SIPP).

Having a tax wrapper within a tax wrapper can complicate financial plans.

In this case, it made him liable to unnecessary charges.

These opaque charges funded the commissions of the 'adviser'.

Moreover, the QROPS was expensive and ineffective.

Our recommendation to John

John now lives in the UK, so it would potentially make sense to move his pension back to a UK-based, low-cost SIPP.

However, we recommended a different solution – for him to retain the QROPS wrapper for the following reasons:

- Since John planned to retire abroad, it was more beneficial to retain his QROPS status, as it allowed him to pay out a pension income or capital in different currencies.

- He could draw his pension income free from UK income tax, when he retired outside of the UK.

- If he lived outside the UK long enough, he could draw a higher tax-free initial sum of 30% in retirement, as opposed to 25% (SIPP).

- He had limited capacity to make future contributions to his pension and obtain tax relief, as he was no longer working.

We advised him to retain his QROPS status and transferred him to a lower cost, far higher quality provider.

After which, we introduced a low-cost platform and removed the unnecessary bond tax wrapper.

We rebalanced his portfolio through a low-cost, evidence-based strategy.

Reducing his ongoing charges by 3.48% per annum (or saving £27,840 based on a value of £800,000), while substantially improving his long-term investment performance.

Perhaps far more importantly, our review allowed for the crafting of a tangible financial plan and investment policy to address John's anxiety and focus on his most cherished goals.

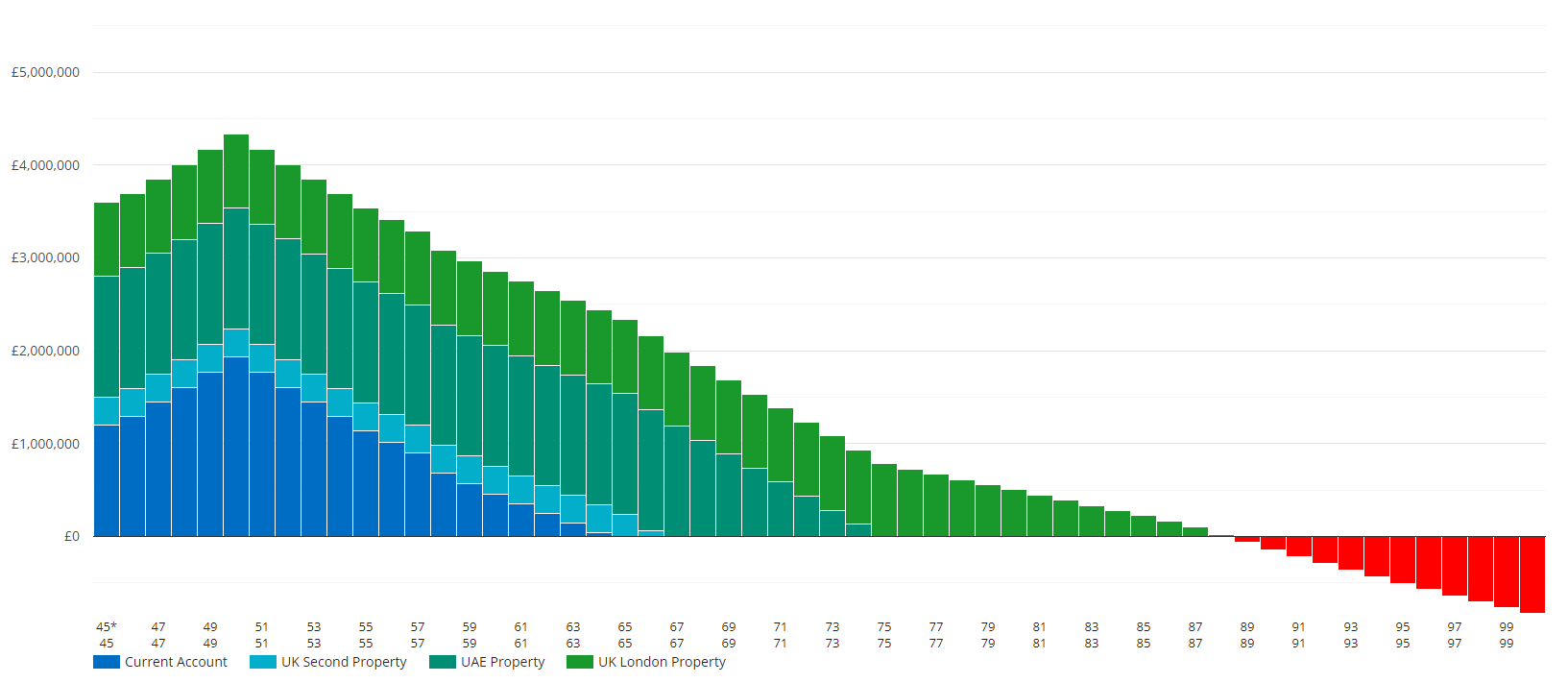

Backing this robust lifetime investment plan with cashflow projections and a highly supportive, professional service. An example cashflow model looks like this:

This was of inestimable value as it prevented the plan from blowing up at some fleeting moment of market or emotional stress.

Remember, there could be many potential solutions for you depending on your circumstances.

Transferring your overseas pension is a huge decision.

So, make sure you understand exactly what pension you have and its unique implications.

It's safe to assume that at least 90% of your personal lifetime investment returns will be driven by (a) the existence of a documented financial plan (b) how much of your investments are sensibly allocated to equities as opposed to bonds and (c) whether or not, in response to an extreme market fad (Bitcoin), or fear (COVID-19 crash), you break faith with your plan.

Salespeople don’t discuss planning because they are paid by focusing your attention on the product.

Should you transfer your UK pension?

As well as understanding what SIPPs and QROPS are, it is vital that you understand the benefits of the type of scheme you currently have.

There are two types of UK pension scheme – defined contribution and defined benefit.

Defined benefit schemes are colloquially known as “gold-plated pensions.”

They provide scheme members with a pension that is intended to be guaranteed.

These schemes are becoming rare due to their cost - and if you have one, you should think very carefully before transferring from it.

It is also now required - by law - that anyone considering a transfer from a defined benefit scheme worth more than £30,000, including into an overseas scheme such as a QROPS, must have taken financial advice from an adviser qualified to provide UK pension advice.

Such an adviser has to be authorised by the Financial Conduct Authority.

6 things to keep in mind if you’re contemplating a pension transfer

#1. Spring Budget 2023 – changes to the lifetime allowance (LTA)

In March 2023, the UK Chancellor made significant changes to the way pensions are taxed, and these changes came into effect on April 6, 2023.

Up until now, high earners faced two key restrictions when it came to contributing to their pensions. The first was the Annual Allowance (AA), which limited the amount individuals could put into their pensions each year. The second was the Lifetime Allowance (LTA), which aimed to limit the total amount of money that could accumulate in a person's pension over their lifetime.

However, these restrictions have been eased, and in some cases, completely removed.

Revisions to the Lifetime Allowance (LTA)

The Lifetime Allowance (LTA) is the prescribed threshold for accumulating funds within your pension during your lifetime without incurring additional tax liabilities. Prior to April 6, 2023, if your pension savings exceeded a specific threshold (set at £1.073 million for the 2022/23 tax year), you would be subject to supplementary tax charges. As of April 6, 2023, the government eliminated these extra tax charges on pension savings exceeding the LTA. Consequently, if your pension savings surpass the LTA after this date, you will no longer be exposed to the extra tax burden. Instead, these excess savings will be treated as regular income and taxed at your standard income tax rate.

The Chancellor has expressed the intention to completely do away with the LTA framework in the 2024/25 tax year, although this decision remains unconfirmed. Importantly, the maximum tax-free cash withdrawal from your pension remains unchanged at £268,275 for the 2023-24 tax year, or 25% of the protected amount for those with pension protection in place.

Increase in the Annual Allowance (AA)

The Annual Allowance (AA) designates the permissible growth of your pension savings within a single year without triggering supplementary tax obligations. In the March Budget, the Chancellor raised the standard AA from £40,000 to £60,000 for the 2023/24 tax year. However, high earners with a taxable income exceeding £200,000 may experience a lower personal AA due to the so-called "taper" mechanism. The minimum level of this tapered Annual Allowance (TAA) has increased to £10,000 starting from April 6, 2023, up from the previous £4,000 for the 2022/23 tax year. This lower threshold applies to individuals with taxable incomes, including employer-sponsored pension savings, surpassing £260,000.

These changes provide individuals with greater flexibility to save for their retirement without incurring extra tax obligations. If you had previously refrained from pension savings due to TAA constraints or because your savings neared the LTA limit, you may now be inclined to reconsider increased savings. Furthermore, you have the option to carry forward any unused allowance from the preceding three tax years to optimise the benefits of these alterations.

#2. What will my spouse and children get when I die?

With a defined benefit scheme, the death benefits provided to your spouse and children can be relatively poor.

In some cases, especially if your children are older, you may find they receive nothing.

By transferring into a defined contribution scheme – either a SIPP or a QROPS, you may be able to leave much more to your family when you die.

In addition, it may be possible for the fund to “cascade” from one generation to the next.

#3. How much tax will I pay on my income?

UK pensions are taxed, and in some cases, it may make sense to move your pension to a QROPS in the country you are living in, or to a “third party” QROPS jurisdiction.

This depends on the terms of any double taxation agreement (DTA) between the country where your pension income comes from, and the country in which you are living.

Claiming double taxation relief can be complicated, and if your pension income is paid from the UK, it may result in a procedure to reclaim tax deducted at source.

The purpose of a DTA is to prevent pension (and other) income being taxed twice.

But if there is no DTA in place, you could end up being taxed twice – in the country in which you are living, and where your pension is based.

It is therefore of paramount importance that you take specialist tax advice on this point.

#4. How will currency impact my pension income?

Currency is something that must be carefully considered.

You may be able to exchange pension income into another currency, but the timing of an exchange could have a material impact on the size of your pension.

Also remember that if your pension is paid from the UK, and you are living abroad, you will need to factor in an exchange to a local currency when working out your income.

#5. I have a defined benefit scheme and would like to begin drawing my pension early, is this possible?

It’s generally possible to move the retirement date if you have a defined benefit scheme – this is set by the rules of the scheme, but subject to the minimum pension age set by the UK government, now 55…

But, taking your pension earlier than the scheme pension age will normally bring with it quite a substantial reduction in pension.

However, if you transfer the pension into a defined contribution scheme, such as a SIPP or a QROPS, you will be able to begin withdrawing income from age 55.

#6. Will my pension savings perform better if I consolidate into a QROPS or SIPP?

It’s very common for people to have multiple pensions from time spent working at different companies, all with different schemes.

It may make sense for you to consolidate your pensions to reduce costs and make your pension portfolio work more efficiently.

Knowing whether to transfer your pension is arguably one of the biggest financial decisions of your life, and so it must only be done after taking advice from a fully qualified planner.

Or, if you would like to chat about your options or concerns, get in touch.