The best email I've received so far this year - and it's from a 14-year-old!

This week I was blown away by an email I received from a young girl who wanted to start investing.

Not your typical 14 year old!

By accident, she came across one of my tweets, clicked through to our blog and subscribed.

But she grew concerned about this term 'volatility'.

Can I explain it to her, she asked.

Will she lose money if she invested it now?

Here's my response.

Dear Amy,

I think you may be the youngest person to ever email me about investing.

You've made my day.

In fact, your timing is perfect as a new book arrived this week.

It’s called “Simple Wealth, Inevitable Wealth” by Nick Murray.

In Simple Wealth, you will learn what most people consider to be risky - buying stocks - is, in fact, the opposite.

Buying stocks with the intention of holding them forever is the most conservative thing any young person like yourself could possibly do.

I'll prove it to you.

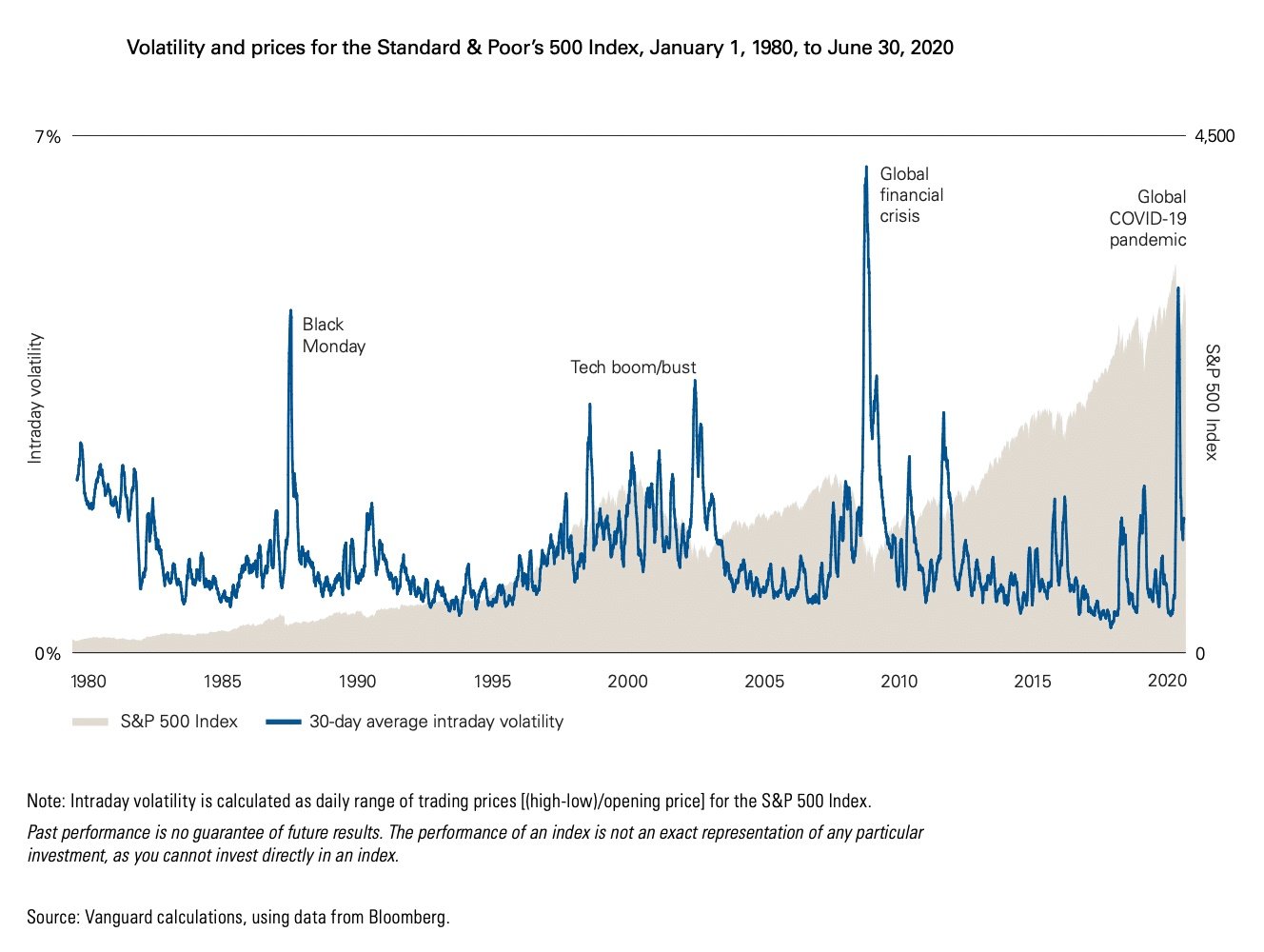

Consider this chart below, published by Vanguard.

It depicts the biggest risks over the course of my lifetime...

Along with the associated volatility (another word for price fluctuation) that hit the stock market every time people were frightened:

As you can see from the blue line, volatility comes and goes.

It is never permanent.

But as the grey area shows, the gains are permanent if you remain invested long enough.

Since 1 January 1980, the S&P 500 is up over 9,000% including reinvested dividends, which is an average annual return of over 11.5% per year.

You cannot earn anywhere near that amount by not accepting volatility (or risk) in the short-term.

There is no way around this basic fact.

By accepting the potential for losses today, we earn the potential returns of tomorrow.

Once you have accepted this fact, you are ahead of most investors, both individuals and professionals, who spend their entire lives searching for an escape or a clever way around this reality.

Nick Murray will convince you that this search, given your time horizon of decades, is completely unnecessary.

This is not the way finance has traditionally been taught, but it is the plain, undeniable truth:

Anything we try to do in order to avoid risk today means less reward in the future, which is in actuality equivalent to taking more risk, not less.

I really hope this helps and I'm here if you have any other questions on investing.

All the best,

Sam