Guest post from Robin Powell of The Evidence-Based Investor blog...

One of the biggest attractions of having a broadly passive investment strategy is the simplicity of it.

You don’t have to speculate on particular sectors or regions or constantly monitor how your portfolio is performing.

The long-term market return is more than adequate to meet the need of most high-net-worth investors.

Here's why.

By simply aiming to capture that return at very low cost...

You’re giving yourself every chance of a successful outcome.

Index funds themselves are beautifully simple.

So too are passively managed exchange-traded funds or ETFs.

You know exactly what you’re getting with them.

But when you buy an actively managed fund you’re not quite sure.

Many active equity funds, for example, include an element of bonds, cash or both.

Because active managers typically turn over their entire portfolio every couple of years or so, it’s very difficult to keep tabs on everything you own at any given time.

A more worrying development is that, with active managers finding it increasingly hard to beat their benchmarks…

They are resorting more and more to complex strategies.

Principally, these strategies come in three different forms:

Leverage — the fund manager borrows money to increase the potential return of an investment.

Short selling — the manager sells a security they don’t own, or they have borrowed, in the hope the security’s price will decline. This allows them to buy it back at a lower price to make a profit.

Options —the fund manager pays for the right to buy or sell a security at an agreed price at a later date.

They’re often called hedging strategies.

They’re ostensibly designed to protect investors from risk.

In practice, though, they often have the opposite effect.

All three strategies carry a degree of risk high-net-worth investors particularly may not want.

Worryingly, research from Canada has confirmed that active managers are making increasing use of these complex strategies…

Resulting in higher fees, lower returns and greater risk.

The paper, titled Use of Leverage, Short Sales and Options by Mutual Funds, was produced at the Smith School of Business at Queen’s University in Ontario.

According to the authors — Paul Calluzzo, Fabio Moneta and Selim Topaloglu — in 2002, 42.5% of US domestic stock funds used leverage, short sales or options at least once.

Between 1999 and 2015, the percentage of funds allowed to use all three rose from 25.7% to 62.6%.

But, this additional complexity came at a cost for investors.

Funds that used complex investments had a 0.59% decrease in excess return.

And a 0.072% increase in expenses.

So, what did the researchers find specifically on risk?

To quote the paper:

"Although (managers) use the instruments in a manner that decreases the fund's systematic risk, they hold portfolios of riskier stocks that offset the insurance capabilities of the complex instruments."

“We find not only that funds that use complex instruments take more risk, both systematic and idiosyncratic, in their equity positions, but also that bylaws that authorise complex instrument use are associated with greater fund risk.”

In the paper’s conclusion the authors say:

“Our results suggest that the use of complex instruments is associated with outcomes that harm shareholders: lower returns, higher unsystematic risk, more negative skewness, greater kurtosis (essentially volatility) and higher fees. Overall, it appears that mutual fund investors are better off choosing simplicity.”

So, why is it that active managers are using these complex strategies more and more?

The bottom line is…

Regulators have allowed them to.

But you could also argue that active managers are resorting to using them because they’re increasingly under pressure to prove they can beat the index.

To quote the investment author Larry Swedroe:

“The active world has to fight back to keep their share, and one way to do that is to add complexity. They need to say, ‘We have a story to tell, and you need to be a member of our secret club, which has all these superior instruments.’”

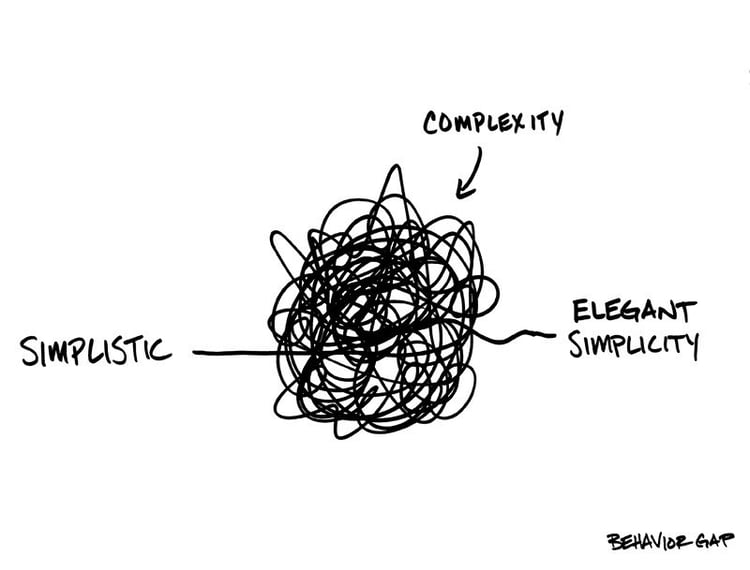

In investing, simplicity is the ultimate sophistication.

Ideally that means avoiding actively managed funds altogether.