Wealthy expats face large UK tax bills if they are not aware of UK tax residency rules

Wealthy foreign expats can expect to come under increasing scrutiny from HMRC's 'Expat Team', who brought in an extra £154m in tax in 2012/13, according to a new report from law firm Pinsent Masons. Whilst the team is currently focusing its work on highly paid workers in the City of London, success could well mean their focus will widen to include expats 'visiting' the UK to work, as well as expats who have taken extended periods of leave back in their home country.

This news comes only days after the UK Government announced the removal of the personal allowance for UK expats. Here is a reminder for how an individual’s UK tax residency status is now determined by the Statutory Residence Test (SRT) which came into effect on 6 April 2013 and applies to UK residents from the tax year 2013/2014 onwards. For earlier years, different rules apply.

An individual’s UK statutory residence test can be determined very broadly as follows:

-

You work full time in the UK;

-

You spend 183 days or more in the UK in a tax year;

-

Your only home, or homes, are in the UK and you visit that home, or homes, for 30 days or more in the UK tax year.

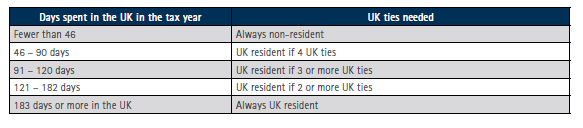

If you are coming to the UK for the first time, or you have not been resident in any of the previous 3 tax years, the following table will help you determine your UK tax residency status:

The HMRC website “Guidance Note: Statutory Residence Test (SRT)", published December 2013, provides the detailed tests that HMRC set.

UK ties which count towards your residency status include:

-

Family - if your spouse (or civil partner) and / or children are resident in the UK;

-

Accommodation - if you have accommodation available to you in the UK, even if it does not belong to you;

-

Substantiative work in the UK - if you work for 40 or more days in the UK during a UK tax year. More than 3 hours work per day counts as a working day;

-

Presence in UK previously - if you spent more than 90 days in the UK in either of the two previous tax years.

If you would like to speak to someone from our award-winning team about your liablity to UK tax and your UK tax residency and how to plan for it, as always, do get in touch.