I held a webinar on Dimensional vs. Vanguard the other day.

After, one attendee emailed asking my advice on the best countries to invest in.

With a cash lump sum being eroded by inflation, he wanted to know how and where to invest it.

He’s not alone.

Many international investors are looking for the best ways to grow and protect their wealth.

Financial markets can be unpredictable.

Yet, fund managers often promise the equivalent of endless sun which rarely ends well.

Luckily there’s an answer to this cycle of unrealistic hope…

Diversification.

Described by Nobel laureate Harry Markowitz as the only free lunch in investing, diversification is the equivalent of a safety cushion.

It increases the reliability and predictability of investment returns.

It works because different parts of financial markets aren’t perfectly correlated.

As one asset class goes down, another may go up.

Shares (a growth asset) and bonds (usually a defensive one) are the classic example.

But diversification also applies within asset classes.

In your stock portfolio, you can spread your risk across sectors.

Instead of putting everything in technology, materials or financials, you can have a bit of everything.

And instead of sticking to one country, you can diversify internationally across developed and emerging markets.

Which brings me to that investor’s question…

Which countries are best to invest in?

Investment opportunities exist all around the globe, but the randomness of global stock returns makes it difficult to figure out which markets are likely to be outperformers.

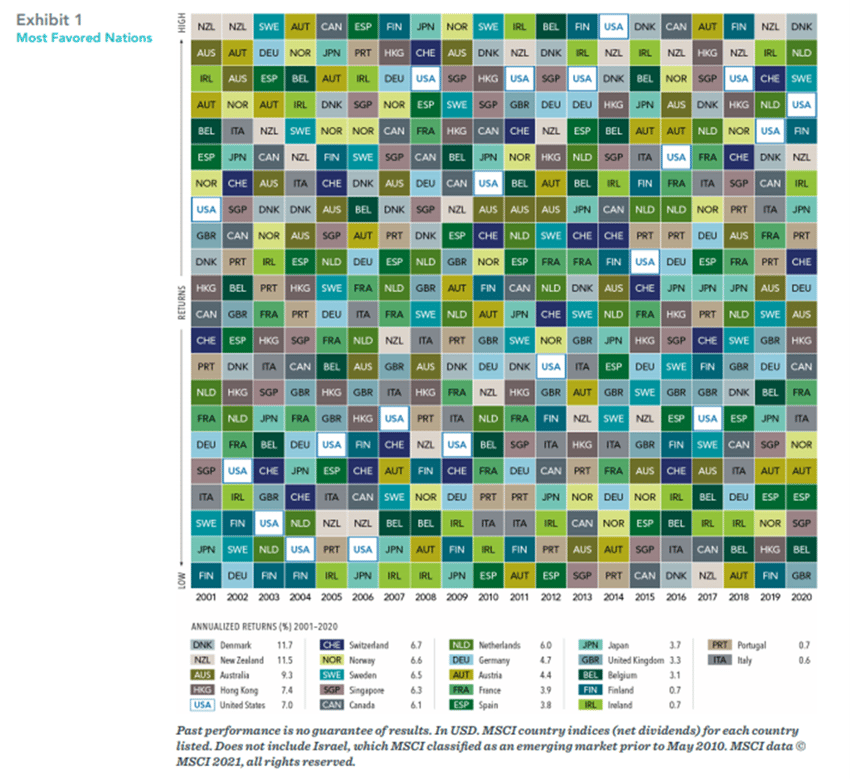

To deal with this, investors should remember it’s challenging, at best, to predict a country’s returns by looking at the past, as shown by the performance of global markets since 2001 (see Exhibit 1).

In the past 20 years, annual returns in 22 developed markets varied widely from year to year.

(Each colour represents a different country, and each column is sorted top down, from the highest-performing country to the lowest.)

The key takeaways?

- Austria posted the highest developed markets return in 2017 - but the lowest the next year.

- The US ranked in the top five for annualised returns over the entire 20 years but finished first in the country rankings just once over that period. In nine calendar years, it was in the lower half of performers.

You never need to predict which countries will deliver the best returns during the next quarter, next year, or next five years.

In the same way you don’t need to predict which asset classes or sectors will outperform.

A globally diversified portfolio invested in the world’s best companies can help provide more reliable outcomes over time.

You’ll experience a sense of calm and confidence if you create a plan infused with decades of evidence-based research rather than speculating on any single area or asset type.

Here’s to your future success.