What we can learn from the best and worst-performing bond funds of 2022 (plus a look at my own investments)

When you were a child, a parent likely told you to brush and floss your teeth.

They said it would reduce the odds of cavities.

But every once in a while, a cavity emerged.

You might have yelled, “But I brush and sometimes floss my teeth!”

Brushing and flossing don’t stop cavities.

But it reduces the odds that they’ll occur.

This is much like owning bond funds in your portfolio.

You were told that they reduce your portfolio’s volatility when stocks crash.

But this year, you might feel like a kid with a cavity.

Bonds fell in 2022.

But how far your bond funds fell depended on the risk you took… whether you realised that or not.

In my books, Millionaire Teacher (2011/2017) and Millionaire Expat (2014, 2018 and 2022) I recommended that investors own short-term or intermediate-term bond funds only.

As I wrote in those books, if inflation rears its head, anyone caught with a long-term bond market fund would get spanked really hard.

I’ll explain how this works with a look at my own investments.

For starters, I’m Canadian.

For the past 20 years, I’ve owned a short-term Canadian government bond market ETF (XSB).

Its returns aren’t sexy.

But over the past 20 years, it helped to stabilise my account when stocks hit the skids.

It comprises bonds that expire within a 1-3 year period.

When a 1-year bond within the index matures, the fund provider replaces it with a new 1-year bond.

When a 2-year bond within my index expires, a new 2-year bond replaces it.

The same goes for the fund’s 3-year bonds.

As a short-term bond market index, none of the bonds within it are held longer than 3 years.

When inflation rises, new bond interest rates rise as well.

As a result, new 1-year bonds launched today pay higher interest than 1-year bonds launched one year ago.

That’s why people don’t recklessly dump short-term bond market funds when interest rates rise.

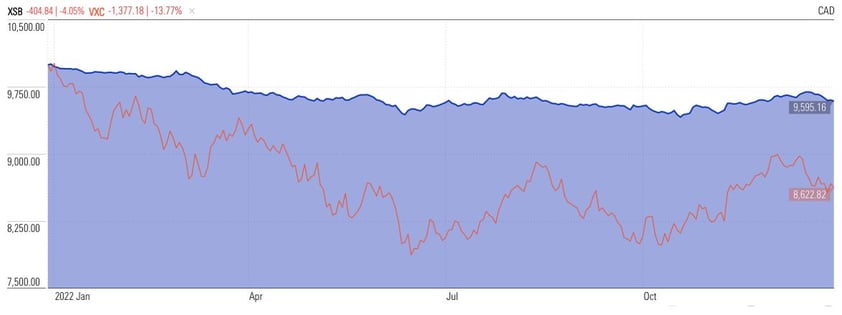

Below, I’ve pasted an image of my bond market ETF compared to the global stock market index, both measured in Canadian dollars.

The global stock market index dropped 13.77 percent in 2022.

Meanwhile, my Canadian short-term bond market ETF dropped just 4.05 percent.

January 1, 2021 – January 1, 2022

Canadian Short-Term Bond Market ETF

vs.

Global Stock Index ETF

Source: Morningstar.ca; measured in Canadian dollars

Source: Morningstar.ca; measured in Canadian dollars

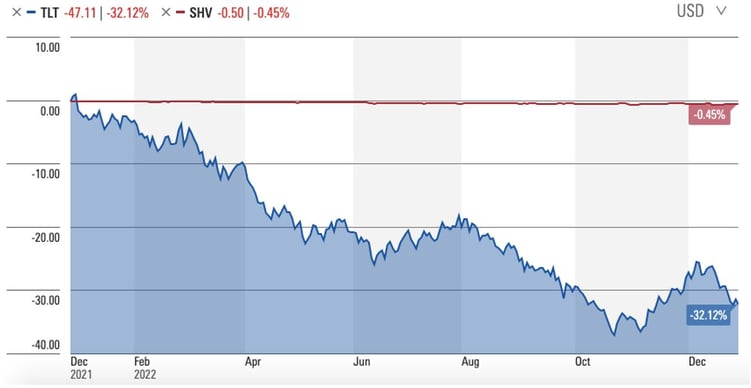

In sharp contrast, anyone who owned a long-term bond market fund paid a hefty price.

Instead of containing bonds with maturities lasting 1-3 years (like a short-term bond fund) a long-term bond fund comprises bonds with maturities of 20 years or longer.

That almost never makes sense.

But plenty of people own them.

Such investors would be stuck with past interest rates... for at least 20 years.

Because inflation and global interest rates have risen, people dumped those bonds.

That’s why the iShares Long-Term Government Bond ETF dropped 32.12 percent in 2022.

Every long-term bond fund performed as bad… or worse.

Below, you can see how it performed compared to its US government short-term counterpart, which dropped just 0.45 percent last year.

January 1, 2021 – January 1, 2022

US Government Short-Term Bond Market ETF (SHV)

US Long-Term Government Bond ETF (TLT)

Source: Morningstar.com

Regardless of the currency, short-term bond funds trounce long-term bond funds when inflation swings fast.

This is why I’ve always only recommended short-term and intermediate (broad) bond market funds.

If you own an intermediate bond index fund, make sure you keep it.

Yes, they fell a bit further than short-term bond funds in 2022.

But within such a fund, you’ll have bonds that expired and were replaced this year already.

Next year, another batch will be replaced, all at a higher interest rate.

What’s more, humans often respond to market news in extreme ways.

That means the bond sell-off was likely overdone, much as the euphoric buy-in for high growth stocks like Tesla and Cathie Wood’s ARK Innovation funds was overdone when they soared.

Bond funds will recover, and perhaps sooner than you think.

Be patient.

And continue to add money to your overall portfolio.

Everything is on sale.

And that’s the best news of all.

Author’s Note: AES International’s portfolios of Dimensional Funds do not include long-term bond market funds.

Andrew Hallam is the best-selling author of Millionaire Expat (3rd edition), Balance, and Millionaire Teacher.