Meet Joe.

He’s a high-earning international investor, originally from the UK.

Do you know what percentage of his portfolio is held in UK stocks?

It’s around 50%.

But as of January 2022, the UK represented just 3.9% of the global stock market.

That means Joe massively overweighs UK shares.

He invests heavily in UK stocks because he recognises their names.

He can talk about them with friends.

This gives him a nice, comfortable feeling of control.

But Joe isn’t just overly exposed to at-home, economic and political risks.

Even when he invests in UK shares, he’s concentrated in a narrow range of UK stocks, instead of the broadest range of sectors.

It’s true, there’s no place like home.

But if you’re hoping for positive investment returns and a smooth ride towards your goals, it’s best to globally diversify.

Here's why.

Investment opportunities exist all around the globe

But the randomness of global stock returns makes it pretty difficult (or impossible) to figure out which markets are likely to be outperformers.

How should investors deal with this kind of uncertainty?

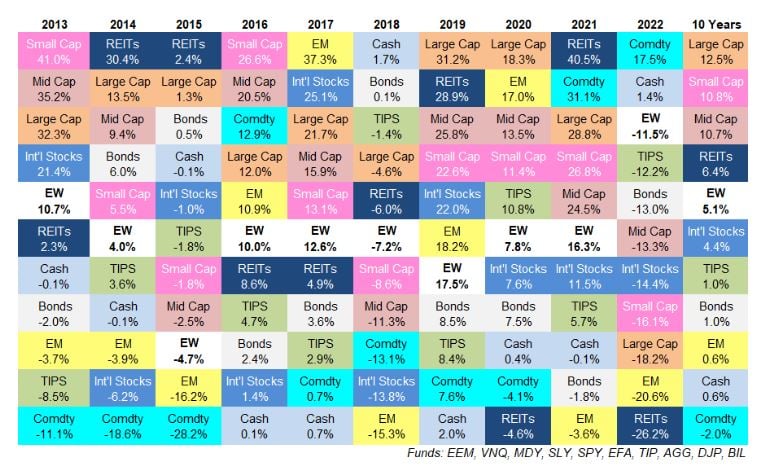

You've likely see the asset allocation quilt.

It's one of my favourite charts which ranks the main asset classes (and sub-asset classes) by annual return over the last decade.

I love it because it shows how humbling the investment business can be.

There’s little consistency from year-to-year.

Here is the latest:

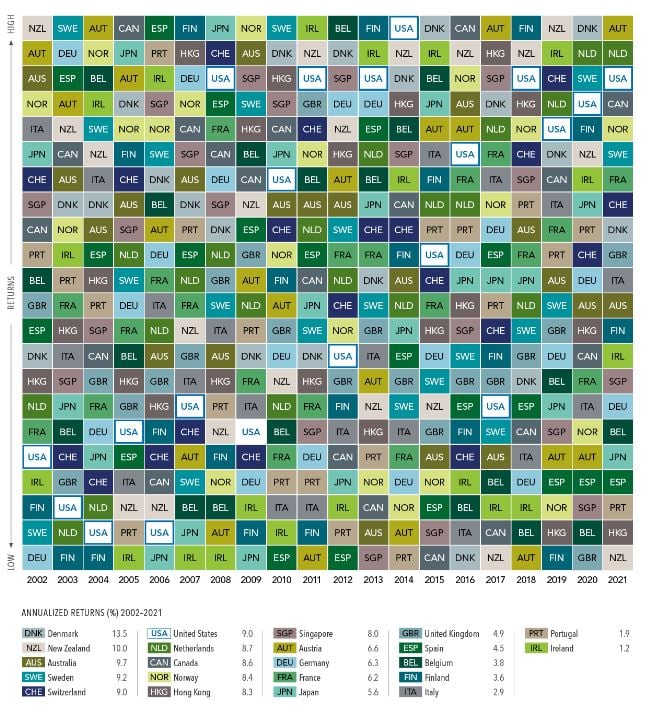

The same goes for a country's returns.

It's challenging, at best, to make any kinds of predictions based on the past.

In the past 20 years, annual returns in 22 developed markets varied widely from year to year (each color represents a different country, and each column is sorted top down, from the highest-performing country to the lowest.):

Two examples help make the point well:

- Austria posted the highest developed markets return in 2017—but the lowest the next year

- The US ranked in the top five for annualised returns over the entire 20 years but finished first in the country rankings just once over that period. In nine calendar years, it was in the lower half of performers.

Practise smart diversification

The cheapest and most efficient way to diversify is to invest in a broad range of low cost index funds covering all the main sectors, geographical regions, and bonds as well as stocks.

This way, when bumps (or opportunities) come along, you can happily absorb them and remain on track.

Put another way, a globally diversified portfolio can help provide more reliable outcomes over time.