Technology and investing have many parallels.

Both constantly improve.

Both evolve over time.

Newer versions constantly replace what was once seen as the best.

And both are passions of mine.

Some have even described one particular type of fund as having a ‘cult-like status’.

Fans of Apple can certainly relate to this.

The type of fund I refer to is called an evidence-based, systematic fund.

In particular, Dimensional Fund Advisors.

I’m currently investing that way.

I read Robert B. Cialdini's bestselling book, Influence: The Psychology of Persuasion recently.

It said that when we can’t have something (or it’s tough to get) we often want it badly.

Cialdini calls this the scarcity effect.

Dimensional Fund Advisors’ mutual funds are a lot like that.

They can't be purchased directly by retail investors.

Instead, they are only attainable through a DFA approved financial adviser.

DFA’s funds have performed well.

But their scarcity might have given them cult-like status.

Between 2008 and 2012, investors pulled $535.7 billion from U.S. mutual funds.

The average returns for mutual funds over the past 15 years is roughly 10%.

But Dimensional was different.

During that same time period, investors added $34.4 billion to DFA’s funds.

During the ten-year period ending December 31, 2015, the typical index fund investor beat the average investor in actively managed funds by 2.39 percent per year.

Actively managed funds charge higher fees than low-cost index funds.

That’s one reason investors in index funds did better.

But there’s another.

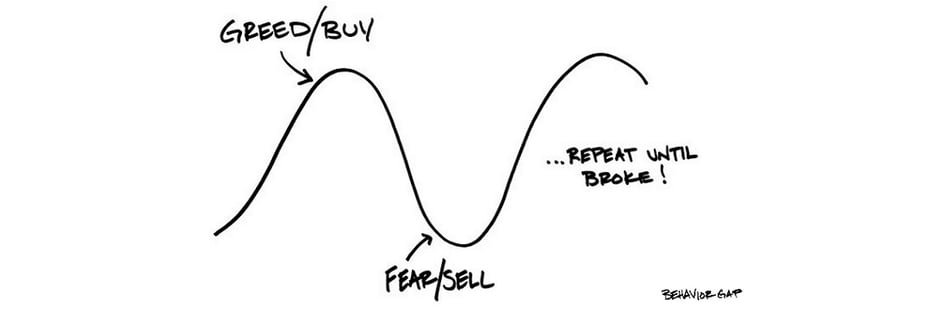

Investors in actively managed funds buy and sell a lot.

Their aim?

To beat the market.

Unfortunately, this causes many people to buy high and sell low.

They buy funds after a strong winning streak.

They sell funds that lag.

Most index fund investors don’t jump from fund to fund.

They can’t forecast winning funds or predict where stocks are headed.

They do far less trading and market timing.

In some cases, they even beat the posted performances of their index funds.

This is probably down to dollar-cost averaging, or in other words, investing the same amount every month, allowing them to add fewer units when the fund price rose and more units when it fell.

Factor-based funds, such as those offered by Dimensional Fund Advisors, aren’t like broad market index funds.

Its index is made up of specific types of stocks.

For example, a small-cap index contains only smaller stocks.

How do these investors perform?

Morningstar doesn’t provide performance data for many of DFA’s funds.

But Vanguard does for factor-based indexes.

Retail investors can buy these funds directly.

Vanguard’s U.S. Value Index (VIVAX) earned a compound annual return of 5.81% during the ten-year period that ended January 31, 2017.

The typical investor in this fund averaged a compound annual return of just 1.81% during the same time period.

Investors in Vanguard’s Growth Stock Index (VIGRX) averaged a compound annual return over ten years of just 5.22%.

The fund itself? 8.09%.

So what about Dimensional Fund Advisors?

These funds are also factor-based.

Most of DFA’s investors probably hope to beat the market.

But they won’t win every year.

It's clear that investors in actively managed funds jump around a lot.

Investors in Vanguard’s factor-based funds appear to do the same.

But DFA promote a buy-and-hold approach instead of speculation.