The relationship between security and money is an interesting one.

A paradox, even.

There are those with more money than they will ever need...

Yet are totally insecure.

Then there are those with very little and secure.

Your financial security, therefore, is a feeling.

This comes with good news and bad news...

There are two emails I’ve saved around the idea of money and security.

One is from Carl Richards and the other from Safal Niveshak.

Both renowned experts on how we think and work with money.

Carl’s sketch puts it into perspective.

Wealth means different things to different people.

For some, it’s about being able to live life to the fullest.

Others, it allows them to take care of the people they love.

And then there are those for whom wealth brings peace of mind.

Whatever money means to you – it comes down to a feeling of confidence.

Not the number in your bank account which is an indication of purchasing power.

Confidence comes from having clarity.

Clarity of purpose and clarity about how your future looks.

This confidence enables you to live your best life.

Once you understand your why of wealth – you can begin on your how…

How do you achieve your ideal level of wealth?

Is it by earning or saving a lot?

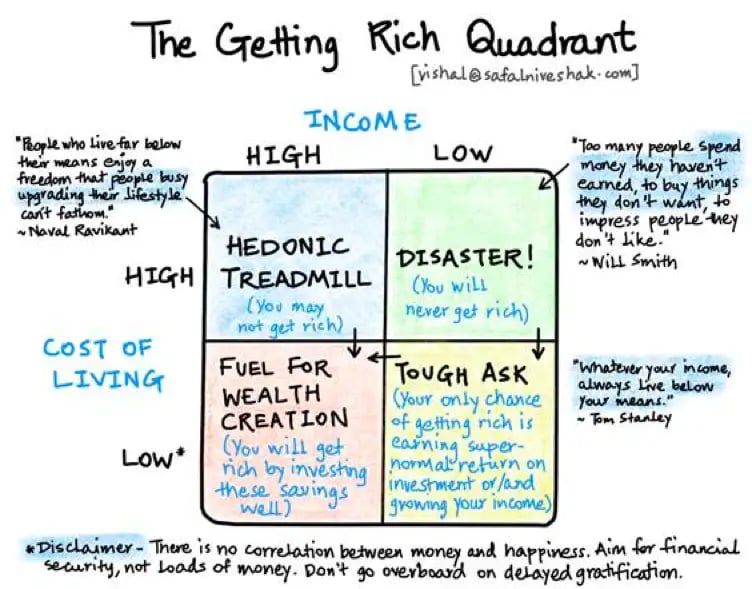

Safal Niveshak references a Bloomberg piece which shares Barry Ritholtz’s view on frugality:

I am not, nor have I ever been, a fan of “sustained and disciplined frugality.” With that said, here’s what to keep in mind:

1. Focus on the big things; the little things will take care of themselves

2. We all only have so much internal discipline, a consequence of limited mental bandwidth. Don’t fritter it away on things that don’t matter very much.

3. Spending should always be a function of what you can afford, not a slavish devotion to some puritan ideal.

4. Money can bring security, comfort and happiness, but beyond a certain point returns on having more of it diminish rapidly.

5. Experiences tend to beat material goods in terms of money well spent.

Basically, avoid the hedonic treadmill and you will be much better off in your financial life.

“Hedonic treadmill” is a theory that people repeatedly return to their baseline level of happiness, regardless of what happens to them.

It is an important concept to grasp when it comes to understanding happiness, which we often lose in forever chasing rainbows.

So how much is enough to help you feel secure?

Happy?

Confident?

An author from Morningstar defines how much is enough for you:

Many of us are operating with an incredibly vague notion of how much we really need to save in order to achieve our financial goals and find security. Hope is not a strategy.

As humans, we often have a natural tendency to reach for more more more, regardless of whether that “more” is actually bringing more happiness and security.

Trying to keep up with the people around us, in terms of possessions and outward signs of success, can get exhausting and may not get us any closer to our life’s goals.

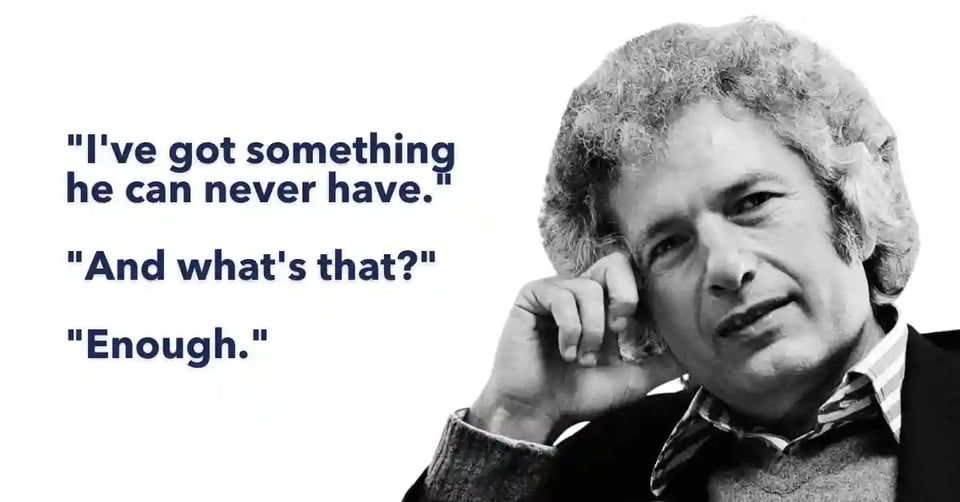

Jack Bogle wrote a wonderful book called Enough that I would recommend; the genesis for the book was a memorable commencement address that he delivered in 2007. (If you haven’t heard the Joseph Heller/Kurt Vonnegut story that serves as the title of the book and speech, I guarantee that you’ll be repeating it to someone soon.)

Joseph Heller, a funny writer now dead, and his friend were at a party given by a billionaire on Shelter Island.

The friend asked,"Joe, how does it make you feel to know that our host only yesterday may have made more money than your novel 'Catch-22' has earned in its entire history?"

And Joe said, "I've got something he can never have."

His friend asked, "What on earth could that be, Joe?"

Joe said, "The knowledge that I've got enough."

What is enough to give you confidence so you can realise your ideal future?

If you need help answering this, perhaps this is a good place to start.

I’m always fascinated by how people view money as the end game.

The result of hard work, sacrifice, discipline and relentless commitment.

Yet rarely dig deeper to understand the purpose that money actually plays in their lives.

If you took a moment to think about what money means to you and your family…

What opportunities it can afford you and how it will help you reach your goals…

I guarantee you’ll have greater clarity, confidence and control.

I hope this blog helps shine a light on where you are now and where you want to be.

And, what’s needed to get you there.