Do you remember what it felt like when you first earned money?

I’m not talking about money your parents might have given you.

I’m talking about the first dollar, euro or pound that you truly earned.

At 12 years old, I babysat the neighbour’s kids. Later that year, I started my first paper route. That money was freedom. I could buy as much candy as I wanted, or (with a bit of coaching) save for a fishing rod.

If we tell our children to invest, it tosses a chain around that freedom. It’s like telling a newly freed prisoner to spend their weekends in jail.

As adults, we know the importance of investing. We’re especially aware of the power of starting early. Whether your own children are 12, 18 or 25+, you might feel the need to tell them what to do. “Invest your money for the future, blah, blah, blah. You’ll be old one day, blah, blah, blah.”

Telling your children what to do might work. But let me suggest something better.

I taught personal finance at a high school. In the beginning, I told students to invest. I even showed them how, while explaining the miracle of compound interest.

Excited by the subject, I jumped on desks like a monkey. The students liked that. But the topic?

Yawn.

The second year, however, I found a better strategy. And almost 40 percent of my high school students (with help from their parents) opened investment accounts.

Here’s what you could try at home.

First, tell your child that it pays to be lazy.

This should put their head on a swivel, working as a hook.

Next, ask them to respond to the simple maths questions in red. Don’t do it for them.

How laziness pays

|

Justin saves $3,650 /year from age 19-65 |

Emma saves $20,000 /year from age 40-65 |

|

$3,650 x 46 years |

$20,000 x 25 years |

|

How much does Justin save? |

How much does Emma save? |

How laziness pays

|

Justin saves $3,650 /year from age 19-65 |

Emma saves $20,000 /year from age 40-65 |

|

How much does Justin save? |

How much does Emma save? |

|

$3,650 x 46 years = $167,900 |

$20,000 x 25 years = $500,000 |

Justin saves $167,900.

Emma saves $500,000.

Now ask, “If Justin and Emma had the same jobs over their lifetimes, and they earned the same incomes, which one of them could spend more of their income on cool things?”

Once again, make sure your child answers this.

The correct answer is Justin. He saves less, overall. That means, over his lifetime, he can spend more of his income.

Now ask them to focus on how this money would grow, given the scenarios in red.

How laziness pays

|

Justin saves $3,650 /year from age 19-65 |

Emma saves $20,000 /year from age 40-65 |

|

How much does Justin save? $167,900 |

How much does Emma save? $500,000 |

|

And if it were invested? |

|

|

|

|

What would it be worth at age 65? |

|

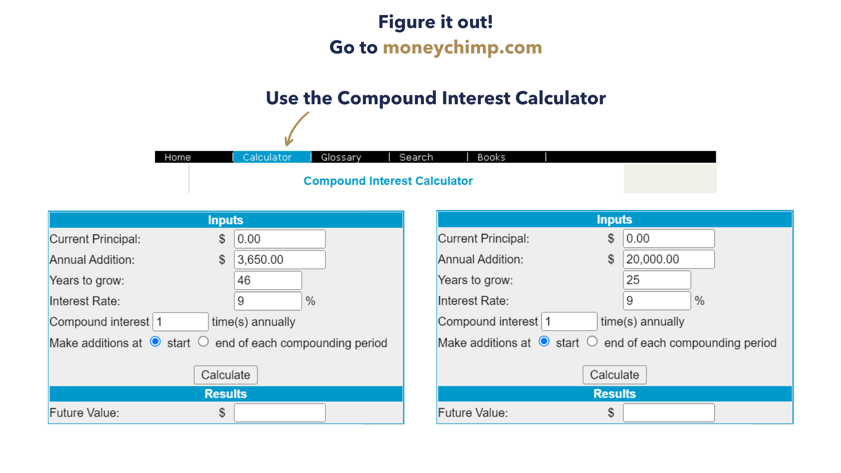

To help your child figure this out, introduce them to an online compound interest calculator, such as the one at moneychimp.com

Below, you can see what they would discover.

Lazy people start investing as soon as they can.

They save less than normal people.

Normal people wait.

But lazy people end up with a lot more money.

Ask your child to summarise the lesson with these simple questions.

Q: Who saved less?

A: Justin, the lazy guy.

Q: Who was able to spend more on fun things while they were working?

A: Justin, the lazy guy.

Q: Who would have ended up with more money in the end?

A: Justin, the lazy guy.

Q: Who could spend more on fun things during retirement?

A: Justin, the lazy guy.

Q: Who would you rather be?

No doubt, they’ll say Justin.

This should work better than telling them to invest.

That’s when you say, “Let me know when you’re ready and I’ll show you how to do it.”

They might be ready now.

Andrew Hallam is the best-selling author of Millionaire Expat (3rd edition), Balance, and Millionaire Teacher.