Many senior international professionals like yourself create their wealth working offshore.

Simply put, the opportunity to grow capital is bigger.

But what happens to your pension while overseas?

I am often asked this question, even when retirement is imminent.

Throw into the mix the country you want to retire to and of course tax…

And the drudgery can be unbearable.

Let’s break it down…

Many of our readers are based in the UAE, so we’ll use UAE residents with UK pensions as an example.

A double taxation agreement exists between the two countries which means UK pension holders residing in the UAE are broadly not liable to income or capital gains tax on assets outside of the UK.

Usually, UK pension holders would pay UK income tax on any withdrawals taken from their pensions.

When you draw from a UK pension, 25% of the fund is tax-free while the remaining 75% is taxable at your highest marginal rate (which could be up to 45% tax paid).

However, as a UK pension holder in the UAE, your effective rate of tax is 0%.

By applying for a tax residency certificate, you can withdraw part or all of your pension free from UK income tax.

So what happens when it’s time to retire?

Retiring to the UK

Income tax rates are currently some of the highest rates of tax in the UK at 20%, 40% or 45%.

In comparison, Capital Gains Tax on general investment accounts is 10% or 20%.

Where you withdraw capital from your pension whilst living in the UAE using the DTA, you can withdraw 100% of your pension tax-free (as long as you’re 55 or older).

You can then reinvest your funds in general investment accounts and benefit from the lower tax rates.

It’s important you do not hold large amounts of cash as the capital value will be eroded over time by inflation.

You want your capital working for you within a well-diversified, low-cost portfolio, which will help you reach your retirement goals.

Let’s illustrate this with a simple comparison…

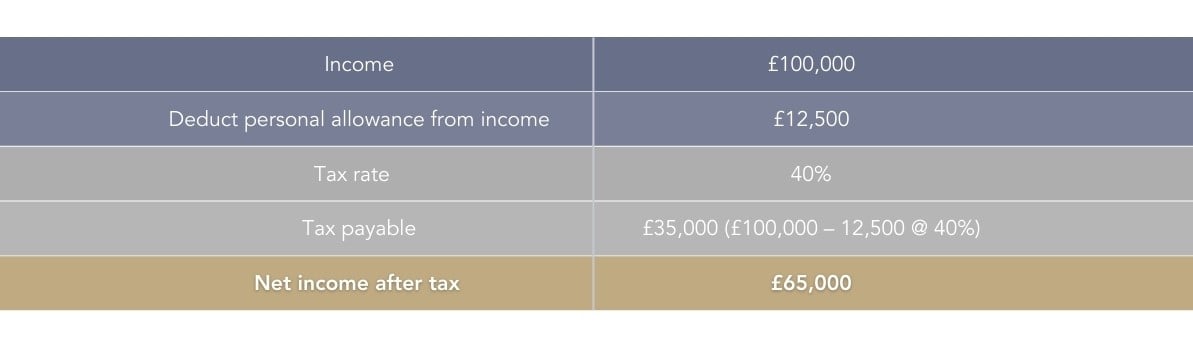

Ben lives in the UK and only has a pension and withdraws £100,000 for his retirement income from it every year.

Ben has exhausted his 25% tax-free cash and is a higher rate taxpayer therefore subject to 40% income tax on his pension.

Now, if Ben lives in the UK and has a general investment account from which he withdraws £100,000 each year…

As a higher rate taxpayer and subject to 20% capital gains tax upon his investment portfolio, this would be his net income.

Ben can reduce his tax bill considerably by drawing his funds from his pension wrapper, while living and working in the UAE.

It’s important to note, however, this will have a material impact on your inheritance tax position which is why seeking financial advice on the matter is so important.

Retiring outside the UK

For those with UK pensions who do not retire to the UK, you can draw your funds outside of the pension wrapper, tax-free, using the DTA.

You can then reinvest your capital in a tax-efficient solution wherever you plan to retire.

This will mitigate the need to reclaim UK income tax from the HMRC and also enable you to invest in the currency of your retirement destination, or closest denomination.

For example, if Ben were to retire and remain in the UAE, he would not pay any tax across his pension provisions.

With the introduction of the various retirement visas in the UAE, this is a highly viable option.

What about the Lifetime Allowance?

For successful senior professionals, this could also help you avoid breaching the Lifetime Allowance which is £1.073 million.

Amounts in excess of the LTA are taxed at 25% or 55%.

Unfortunately, you cannot avoid paying the Lifetime Allowance charge.

However, income tax saved via the DTA withdrawal could help preserve your pension wealth and prevent you from paying high levels of tax.

Alternatively, if you’ve not yet breached the Lifetime Allowance, drawing your pension capital via the DTA and reinvesting in a suitable General Investment Account could prevent you from ever suffering the Lifetime Allowance charge in the future.

Inheritance Tax

Removing capital from your pensions brings it into your estate for inheritance tax purposes.

Your financial plan and retirement tax management strategies should be tailored to you and your family’s unique needs and long-term retirement objectives.

This is best achieved with the help of a qualified financial planner.

Your planner will help you strike a balance between the tax you pay in retirement and the tax your family will pay upon your death.

I hope this blog helped shed a little more light on the double taxation agreement and what it means for you as a UK pension holder living overseas.

As always, the world of finance can be complex and murky.

Find a financial planner who can simplify things for you while also putting your needs first.