3 bits of international financial advice we would give Greece...

...if we were asked.

On the day the Greek stock markets open after five weeks, we look at the Greek debt crisis in a different light. But first, how did it come to this?

It’s really a combination of different factors (read our earlier post: An Idiot’s Guide to the Greek Debt Crisis), but it all comes down to one thing: terrible financial planning.

![]() In this article, we outline three pieces of financial advice we would give if we were Greece’s financial planner.

In this article, we outline three pieces of financial advice we would give if we were Greece’s financial planner.

1. Be financially disciplined

Greece’s financial misery partly boils down to inefficiency and a lack of discipline. Corruption and tax evasion have always been a problem for the Greek government. Add to this the bickering politicians left, right and centre and you’ve got yourself a recipe for a political and economic disaster.

Greece – money is emotive, and perhaps never more so than when combined with politics. This emotional turmoil is compounded by the dire straits in which you find yourself. As hard as it may be, you need to wrench your emotions away from the decision making process when it comes to money. You must now base your decisions on the cold, hard facts, not on whichever emotions are running highest at the time.

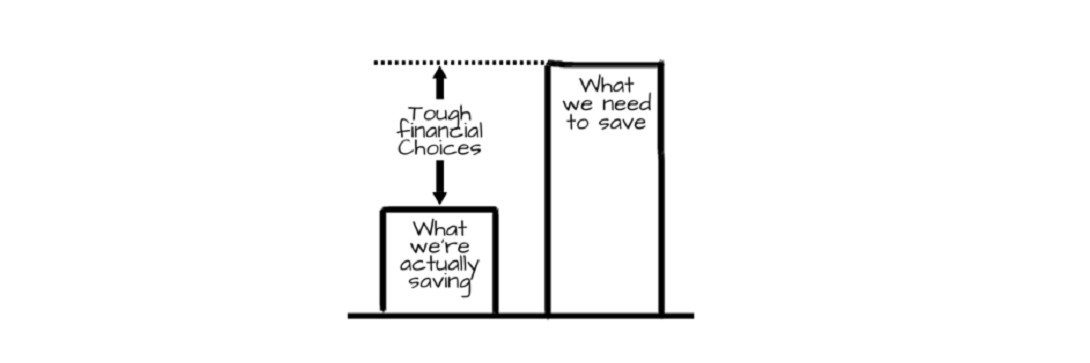

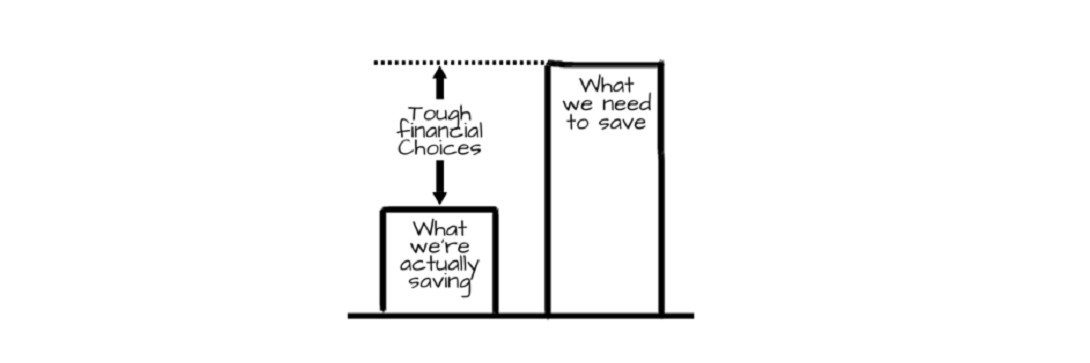

2. Sacrifices have to be made, no matter how difficult they are

One of the major difficulties facing Greece, as with any country which finds itself struggling financially, is that decisions need to be taken by “the few” at the top which can have serious and often negative consequences for “the many” at the bottom. However, in order for progress to happen, sacrifices have to be made.

Greece – there is no way around the fact that the austerity measures being placed on your people are painful. But, in order to secure a prosperous future for the generations which follow, some pain must be borne now. Making the right cuts now to spending and paying off debts, will allow growth in the future – controlling spending and paying back debt are the foundations of all successful financial plans.

3. Beware of financial predators

As we mentioned in our Idiot's Guide, there is speculation that high profile Wall Street bankers helped falsify Greece’s finances in order for it to enter the European Union and take the euro as its currency (while making a tidy sum for themselves in the process).

Greece – you will meet such characters again, all smiles and friendly, making promises of ‘guaranteed returns’. These people do not have your best interests at heart and unfortunately appeal to your darker tendencies too – they told you the many benefits of entering the euro, but I’m betting they never warned you this could happen?

They have sharp claws and are ready to pounce on any opportunity to make money – then abandon you when you’re up to your eyeballs in debt.

Beware of these financial predators. Choose a trusted financial planner. It can be as easy as looking up their credentials and checking if they're regulated and qualified to give advice. Just think of it this way: You wouldn’t trust just anyone to restore the Colossus of Rhodes, would you?

Giving financial advice to a nation like Greece (with billions of euros in debt) is very different from giving financial advice to an ordinary person, but that does not mean they don’t have any common ground. There are lessons to be learned from what has happened in Greece for everyone. If nothing else, it teaches us that in order to succeed financially, we need to build on solid foundations and to take advice from someone who has our interests at heart.