Successful investing, as with most things in life, comes down to mastering the basics.

Here are 3 investment tips that nobody wants to believe…

…but everyone should follow.

Yes, they’re basic.

But they’re also essential.

Take these ideas to heart and you'll reap major benefits.

While most people waste time debating the endless stream of investment noise…

…“hot” funds and star managers…

…all you really have to do is focus on these simple concepts.

And you'll see results.

Hat tip to James Clear, who wrote this blog originally about exercise.

Funny how the same rules apply to investing…

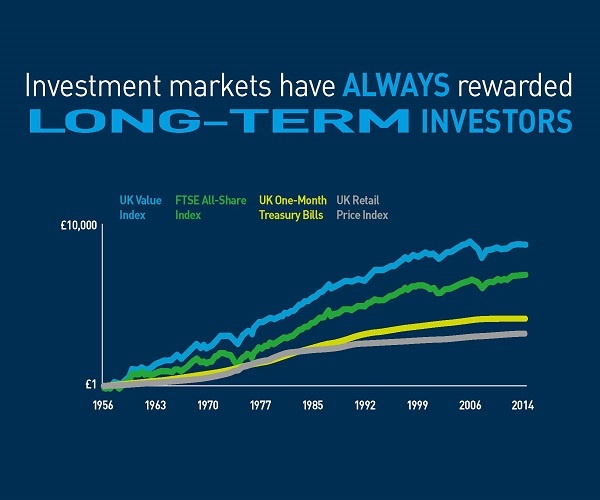

1. Commit for the long-term

Most people invest with a short-term goal in mind.

I like looking at investing in a different way…

- The goal is not to grow your portfolio in the next 12 weeks. The goal is to have a comfortable retirement.

- The goal is not to panic when markets drop. The goal is to be the steady one who remains invested.

- The goal is not to add 10% to your portfolio in 12 months. The goal is to be wealthier next year than you are today. And wealthier two years from now than you will be next year.

Ignore the short-term results.

What's funny is that when you commit to being consistent over the long-term, you end up seeing remarkable results in the short-term.

That's the power of average speed.

2. Set a schedule for rebalancing

Most people never rebalance consistently.

This is because the financial press and financial salespeople make money by getting them to wonder about the “next big thing”.

Rather than focussing on building their portfolio on the right foundations…

…and generally leaving it alone.

Here's a better idea.

Avoid investment fads…

Keep away from crypto, FANGs and ‘structured guarantees’.

Make rebalancing a risk management process – not an opportunity for short-term gain.

Set a reminder to do this at least once per year.

Good risk management is what makes the difference between success and failure.

It’s also a way of pulling yourself back on track as quickly as possible.

Top performers make mistakes just like everyone else.

The difference is that they get back on track quicker than most.

3. Know your goal

Great results come from great focus.

Not great variety.

Too many people waste time investing because they bounce around without any real goal.

Trying a little bit of this.

A little of that.

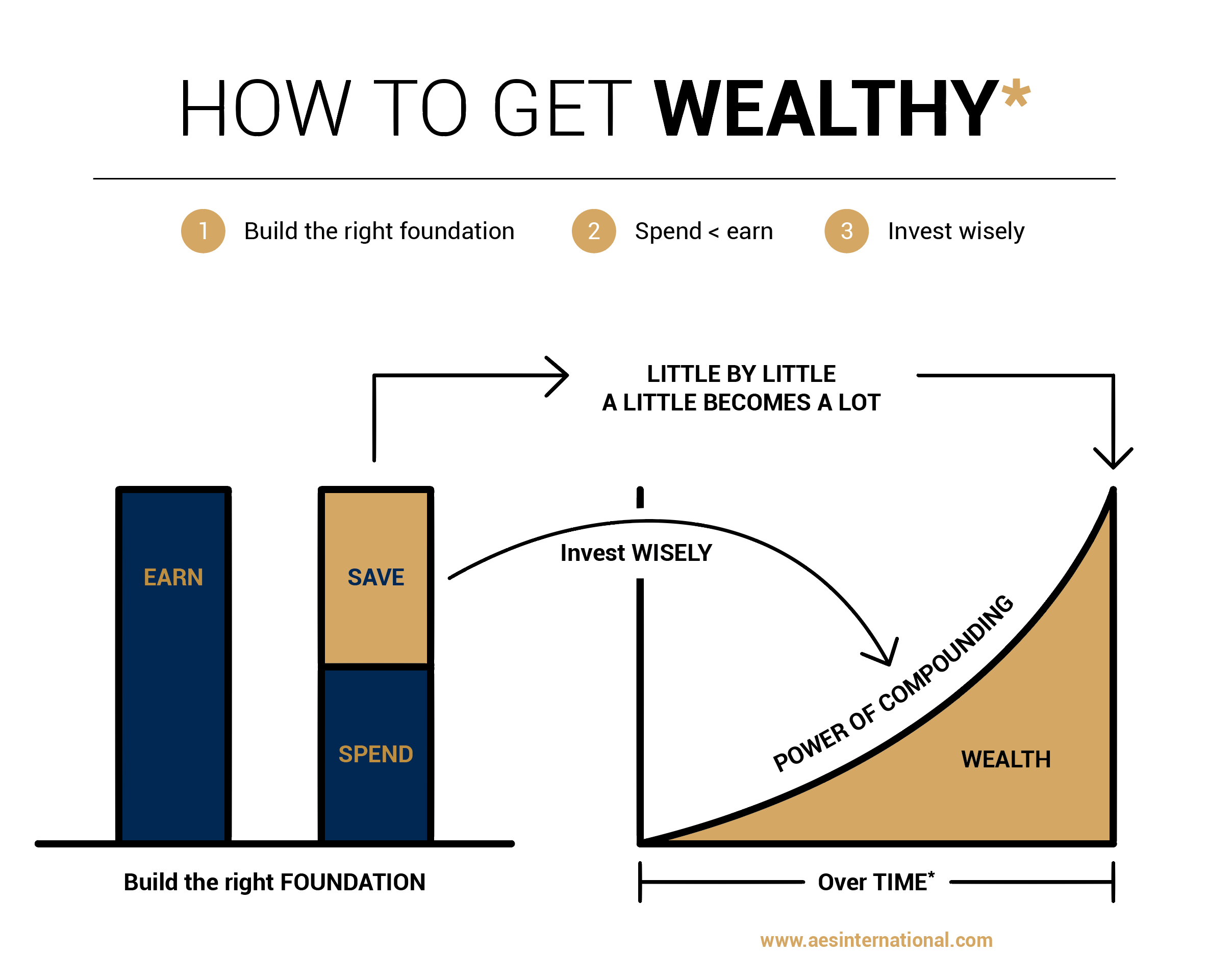

Thankfully, there are 3 simple rules that will always guide you toward success.

1. Start with the right foundations

2. Spend less than you earn

3. Invest wisely

What to do now

You could spend your entire life mastering these 3 points…

…but these are the basics that will make a real difference to your results.

Here are your action steps:

- Review your income and outgoings

- Start spending less than you earn

- Stop checking your portfolio every day

- Set a reminder to rebalance annually

- Clarify your goal

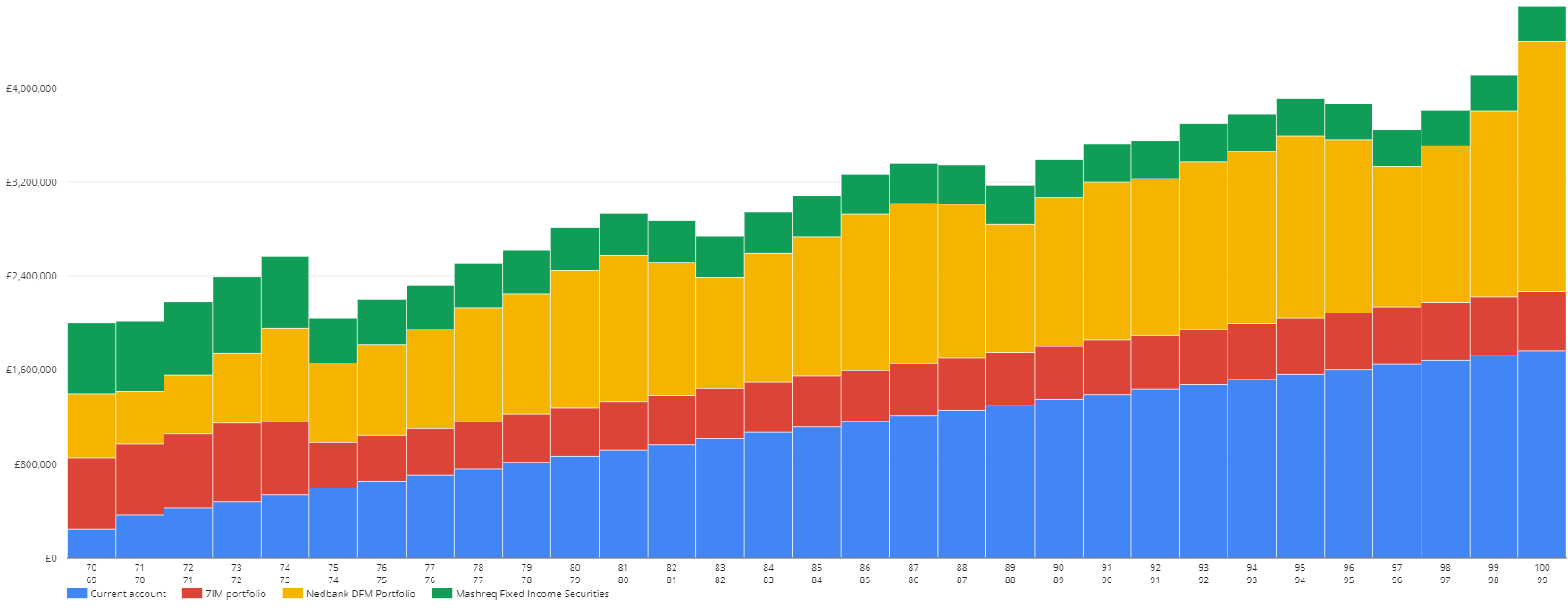

Like management accounts for a company - a cashflow plan can really help you know where you are and where you are going.

They look like this:

Happy investing.