The US economy, the world’s biggest, is in a ‘technical’ recession.

Data released in July confirmed two consecutive quarters of negative GDP growth.

But if the indicators of a possible recession feel very different from the last major one (2008-09 global financial crisis), that’s because they are.

Here are three reasons this time is different:

1. Inflation

At 8.5%, the US inflation rate is close to a four-decade high.

It’s also more than double what it averaged in 2008 (3.8%).

Surprisingly, the inflation rate was negative for most of 2009, meaning consumer prices were actually decreasing.

High inflation is a problem that seems like it can only be corrected by a recession.

2. Employment

The other side of inflation is employment rates.

The US job market is performing strongly, with the unemployment rate at just 3.5%, nearly a five-decade low.

During the global financial crash, unemployment more than doubled, eventually hitting 10% in 2009 and staying as high as 8% even as late as January 2013.

3. Shortages

Both recessions experienced shortages, but of very different things.

During 2008-2009, the world was troubled by a shortage of money – customers were struggling, banks were under significant pressure, and some governments couldn’t meet their financial obligations.

Today, there’s a shortage of actual things that people and businesses need – from semiconductors to energy.

What a recession means for investors

We could fall into an ‘official’ recession while the stock market hits all-time highs.

Or we could see the stock market fall even if the economy improves.

Sometimes these things don’t make sense.

But you don’t have to predict the future to be successful in the markets…

This week Warren Buffett celebrated his 92nd birthday.

During his life, he’s shared a lot of investing wisdom, including on recessions…

“Bad news is an investor's best friend. It lets you buy a slice of the future at a marked-down price.”

Because recessions are announced with a delay, rather than in real time, markets are often on the way toward recovery by the time the headlines hit the news.

For two-thirds of recessions since 1980, the stock market had already bottomed out prior to the announcement month.

In 2020’s recession, for example, the market’s low point came in March, three months before the announcement in June.

Recession announcements vs US stock market lows

| Peak month | Announcement month | US market low month | Months from announcement to market low |

| January 1980 | June 1980 | March 1980 | -3 |

| July 1981 | January 1982 | July 1982 | 6 |

| July 1990 | April 1991 | October 1990 | -6 |

| March 2001 | November 2001 | September 2001 | -2 |

| December 2007 | December 2008 | February 2009 | 2 |

| February 2020 | June 2020 | March 2020 | -3 |

Reducing your exposure to stocks if and when a recession is declared may likely mean you miss out on the brighter days ahead.

Cyclicality is part of the market, and the stock market tends to trend upwards over the long term.

Our ability to track share prices so closely in today’s world comes at a cost: it can lull you into a false sense of optimism when you see share prices that have risen consecutively for days/weeks/months in a row, or into panic if the reverse happens.

How a stock performed in the last week doesn’t tell you anything about how it will perform in the next few days, months, or years.

No one knows the future, and even the experts generally have a poor track record at predicting the market.

That’s why Buffett thinks dipping in and out of investing based on “the turn of tarot cards, the predictions of ‘experts’, or the ebb and flow of the economy and business activity” is one of the biggest mistakes we can make as investors.

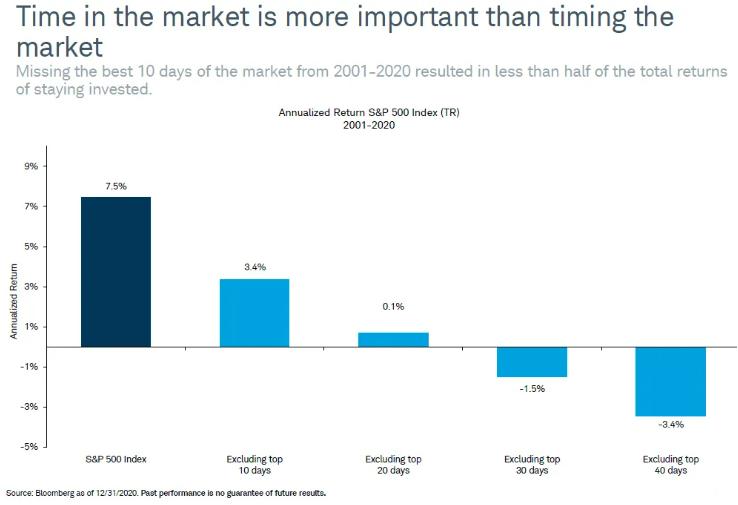

After all, if you just missed the best 10 days of the market between 2001 and 2020, (7300 days in total) your portfolio would have made less than half of what you’d have made if you never withdrew at all.

Our primal fear of losing money makes us all extremely skittish about bad economic news. However, Buffet's words and the key saying that titles the picture below are well worth bearing in mind. Simple to say, but not easy to do.

Further reading

How to live longer and happier with this financial planning secret

What I'm reading #34: Business, relationships and life - 45 years' worth of lessons