I'm still very positive about the stock market and believe it's an excellent time to deploy capital.

This is because we're currently able to purchase good companies at a cheaper price than they were coming into 2022.

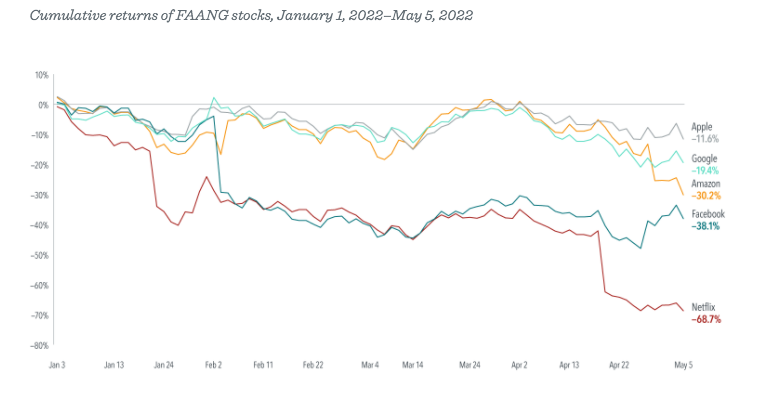

Investors expecting FAANG (Facebook-parent Meta; Amazon; Apple; Netflix; and Google-parent Alphabet) stocks to continue the extraordinary performance of recent years, must be disappointed by their returns in 2022.

Four of the five stocks lagged the broad US market through May 5, with Amazon, Facebook (now known as Meta), and Netflix suffering big-time losses.

This year’s dip follows a stellar decade.

The FAANGs returned 28.02% per year from 2012 to 2021.

Their returns dwarfed the performance of the Russell 3000 Index, which returned 16.3% per year.

This year’s reversal is a reminder that investors should be cautious when assuming past returns will continue in the future.

FAANG stock performance in recent years reflected these companies achieving financial success that exceeded most investors’ expectations.

That’s in the past, though.

Even if these companies sustain their success (and things have been looking gloomy for Netflix!), it may not translate to spectacular future returns.

Excellence from the FAANGs may now be the expectation and not the basis for above-market returns.

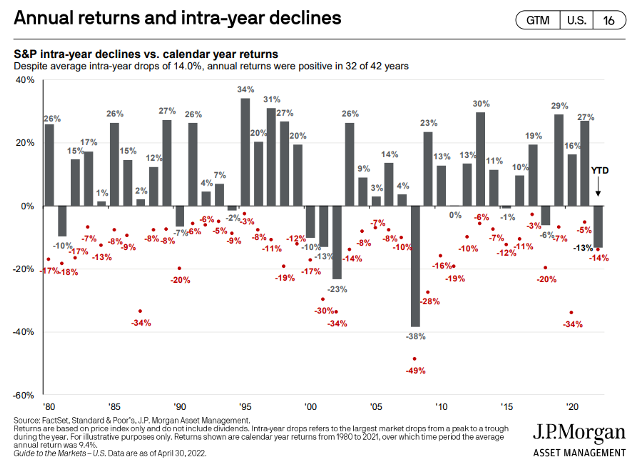

Stock market declines of c14%, which is the level we had witnessed year-to-date in the S&P, do happen frequently.

In fact, on average it’s around once a year, as shown in the graph from JP Morgan below.

But even with intra-year declines of 14%, the market has posted positive returns 32 out of the last 42 years…or 76% of the time.

My belief is that there were 5 issues that pressured markets in April:

1. Russia-Ukraine conflict

2. Earnings season

3. COVID lockdowns in China

4. Apprehension over Central Bank tightening

5. Stock market sell-off

1. Russia-Ukraine conflict

Although it's difficult to take positives from the ongoing invasion of Ukraine and the tragic humanitarian crimes that are being committed, I do believe the other 4 have signs that are likely to result in positive movements in the markets.

2. Earnings season

Earnings have been good, given the environment we are in.

With 55% of S&P 500 Index companies having reported thus far, 80% have reported a positive earnings surprise and 72% have reported a positive revenue surprise.

3. COVID lockdowns in China

While COVID lockdowns are certainly negatively impacting the Chinese economy for now, this could be a short-lived problem.

The Institute for Health Metrics and Evaluation provides projections on expected COVID-19 infections in coming months (I should note that in the past, the IHME has been quite accurate in its projections).

It shows that infection rates in China are expected to decline dramatically by July 2022.

This suggests a strong rebound in the back half of 2022 is still very possible, especially with substantial fiscal and monetary stimulus.

4. Apprehension over central bank tightening

This is likely to continue, but it can be a positive — investor and consumer behaviour can help tighten financial conditions and temper the stock market without central banks – especially the Fed – doing as much in the way of actual tightening.

Longer-term US consumer inflation expectations remain relatively well-anchored, which I believe will give the Fed confidence to take a more thoughtful, data-dependent approach to tightening.

In fact, not only have longer-term consumer inflation expectations remained relatively unchanged in recent months or even ticked downward, it is also important to note that they are actually far lower than they were in 1990.

5. Stock market sell-off

Global stocks have been beaten down globally, which means this could be an attractive entry point for those with longer-term time horizons.

I think this is an important time to remind ourselves of how behavioral finance biases can impact our investment decisions.

Most individuals have a “recency bias.”

That is a behavioural investing bias that can cause us to make mistakes by giving greater importance to what has occurred recently.

Given that we have seen a significant market sell-off in recent months, many individuals may assume this will continue and will therefore avoid investing.

Those with long-term investment horizons should not be frightened by current market gyrations, in my view.

While I expect continued volatility, I don’t get too concerned about stock-market sell-offs, especially when I feel comfortable with the longer-term economic environment.

Diversification and remaining invested has helped people achieve their goals over the long-run and we have annualised market returns of over 9%, despite 14% sell offs occurring every year.

If you are concerned or would like a second opinion on your portfolio of £500,000 or more, don't hesitate to get in touch.