[Estimated time to read: 3.5 minutes]

In 1976, one man quietly started a revolution.

That man was John Bogle.

He launched the Vanguard 500 Index Fund, the first index fund available to individuals, and transformed the investment landscape forever.

Bogle’s Folly trounces the competition

Quite rightly, Bogle believed that actively managed funds would struggle to outperform an index fund once fees, taxes and managers’ bonuses were subtracted from returns.

His competitors weren’t convinced: they labelled his fund Bogle's Folly…

Fast forward to today, and about 20% of all money invested in domestic stocks is invested in Bogle's Folly and its descendants.

What’s more, as Bogle predicted, 97.8% of actively managed funds fail to beat their index after fees and charges.

Jack Bogle’s latest insight

Jack Bogle recently gave an interview in the US.

Here’s a summary of what he had to say:

If he was starting his revolution all over again, he would still choose the Standard & Poor’s 500 Stock Index SPX, +0.28%

Bogle says:

“The reality is that it’s weighted by the market capitalisation of each stock, so if a big stock goes up in value, you don’t have to buy any more, it goes up in value by the exact same amount in the fund.

It is a very low-transaction costs investment. It’s the best index around.”

Despite the S&P 500 being a US stock index, it’s an international portfolio

“In the S&P 500, almost half of the revenues and half of the earnings of those 500 corporations come from outside the U.S. It is an international portfolio; it just doesn’t have a stock price that floats in the international market.”

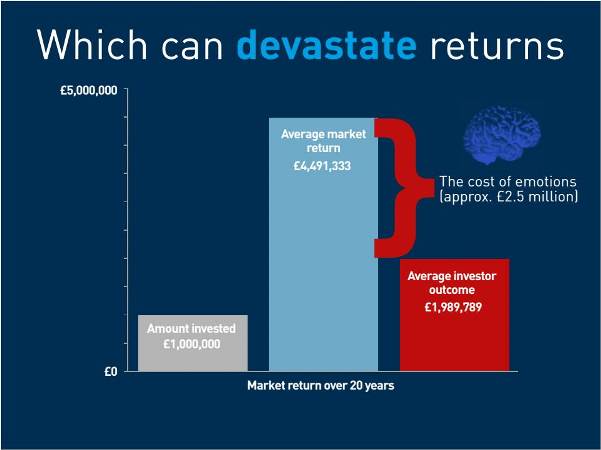

Even the best funds can fail if used badly

The Vanguard S&P 500 growth and value funds were created for investors with different requirements.

Investors could accumulate money with a little extra risk and a little more tax efficiency in the growth portfolio, and for investors who were approaching retirement for example, they could have a little lower risk and a higher income from the value portfolio.

“It made a lot of sense to me. In the early reports, I said, ‘Now, look, don’t switch between these funds back and forth. In the long run, they are apt to do the same, so it’s just a question of how you get your return, heavily on income or heavily on growth. And nobody listened to me …

The prediction was right; both the growth and value funds since then have had an identical return of 9% per year, separately.

For investors who traded back and forth, the investors earned a return of less than 5%, because they switched back and forth, they have changed the performance.

Two good funds, but badly used.”

Smart beta is stupid!

Definition: Smart beta strategies allow individuals to use investment ideas that actively managed portfolios have used for decades…investors can use smart beta to target a range of portfolio outcomes such as reducing risk, enhancing returns or generating income.

“Smart beta is stupid… Academics can find anything with these masses of data they have on their computers. They can find something that works in the past, it’s as easy as rolling off a log. But it almost never works in the future – and not for very long — because they all forget the most important single thing that happens in our markets … reversion to the mean.”

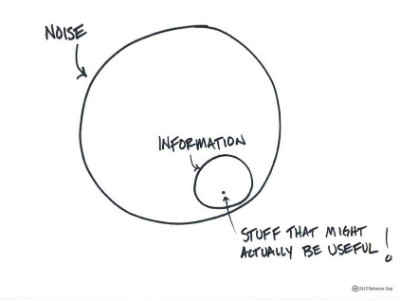

Ignore market noise

What the market is doing today won’t be what it’s doing tomorrow, next year or when you retire, so:

“Stop watching the market all of the time...

Think ‘Why am I doing this? Does it really matter?’

Be conscious of the fact that you are taking a risk, and if there’s some worldwide calamity … that’s going to be bad. But you can’t do anything about that”

How to apply Jack Bogle’s teaching to positively change your investment outcomes

Choose:

- Passive not active

- Low costs not hidden fees

- To do nothing rather than something!

- Average market returns instead of high risk

- Goal-focused financial planning not guesswork and greed

This free eBook details the difference between active and passive, or click below to receive 6 helpful investment ideas, all guaranteed to improve returns!