[Estimated time to read: 2.5 minutes]

I used Aesop’s tortoise and hare, from his fable about the race between unequal partners, to illustrate the two types of investment approach in our recently published Investment Code.

![]() On the one hand you have the conventional active investment management approach – think harebrained hare…and on the other, you have the evidence-based, passive approach – think steady and consistent tortoise…

On the one hand you have the conventional active investment management approach – think harebrained hare…and on the other, you have the evidence-based, passive approach – think steady and consistent tortoise…

Inspired by a recent article by evidence-based investing advocate Phil Huber, here are some more examples that illustrate the differences between the two approaches.

I hope you find them enlightening when choosing the best way for you to invest!

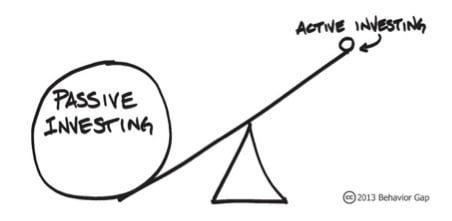

Active vs Passive investing

The industry believes forecasts, relationships and emotions should guide financial decisions, but the passive investor prefers facts, logic and reason.

Where the conventional investor is drawn to narratives, the passive investor prefers numbers.

The active manager sees black or white, but the passive investor sees plenty of room for grey.

The active manager is in charge of searching for the needle…meanwhile, the passive investor owns the haystack.

The actively managed investor has sleepless nights worrying about what the market might do the next day.

Meanwhile the passive investor sleeps well, knowing his portfolio is designed for decades, not the next day.

The active investment company boasts about pre-tax returns – the passive investor places value on net returns.

The active managers sell high costs as a benefit; it’s the price of admission to an exclusive club.

The passive investor knows the lower his costs, the better his outcome.

A conventional investor looks up horoscopes and star ratings on Financial Express…the passive investor looks up fund expenses.

The active manager is self-congratulatory one minute, and finger pointing the next. The passively managed investor is accepting.

The conventional investor confuses his luck for skill.

But that’s ok, because the passive investor appreciates that luck plays a larger role in outcomes as the aggregate level of skill increases among market participants!

The active investor is forever pursuing the perfect portfolio – the passive investor finds the right portfolio, and sticks with it.

The active manager has 20/20 hindsight – the passive investor has clear sight.

The active investor is influenced to BUY by adverts on Bloomberg TV and CNBC.

The passive investor is influenced by about 30 years of academic and empirical research and evidence.

(Click to view our investment code)

The active manager doesn’t just sit there, he does something – hastily hurrying, confusing results with activity.

The passive investor doesn’t do anything: he sits there – patiently waiting.

The active investor consumes the news and reacts to it.

The passive investor reads books and relaxes.

The active manager compounds mistakes – the passive investor compounds interest.

The active investor thinks timing the market is important – the passive investor understands the importance of time in the market.

The active investor plays the market – but the passive investor knows investing is not speculating, nor a game.

The industry sells the conventional investor advice that sounds good – the passive investor pays professionals for good advice, when needed.

The active investor likes to boast about his successful stock picks over dinner with anyone who’ll listen.

The passive investor enjoys his meals with family and friends, without giving his investments a second thought.

It’s hubris versus humility.

Which approach sounds more appealing to you?

Leave us a comment below.