Anyone questioning their 60/40 investment portfolio right now needs to ignore the Google results, and read this

It's perhaps no surprise the tried-and-tested portfolio strategy is having a bad year.

One of its worst.

Go ahead, try Googling it.

This is what I saw on page one:

It's true, this go-to portfolio strategy (60% invested in stocks to drive long-term returns and 40% in bonds for some balance) has suffered one of its worst years on record.

Stocks have fallen badly and bonds are breaking records for all the wrong reasons.

But I'm convinced it remains the benchmark to beat for professional investors.

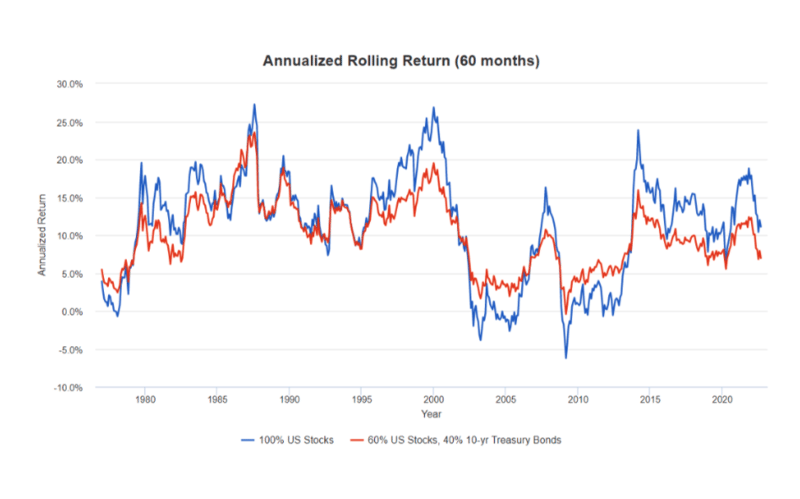

You only need to look at historical returns to see it's incredible performance.

Since 1972, it’s generated similar returns to stocks (9.3% per year vs 10.3% for stocks). And if you look at its performance over any five-year period (red line), it has easily rivalled that of a stocks-only portfolio (blue line).

Let's not forget, it's achieved those returns with much lower risks. Returns have been more stable because its volatility has been one-third lower than that of stocks.

Let's not forget, it's achieved those returns with much lower risks. Returns have been more stable because its volatility has been one-third lower than that of stocks.

If that wasn't impressive enough, below shows its performance during past market stress periods:

I'm not denying that now is a challenging time.

With inflation and interest rates rising, stocks and bonds are being hit simultaneously.

Why?

Because high inflation reduces the purchasing power of any financial asset.

And rising interest rates reduce the present value of future cash flows, whether they’re a stock dividend or a bond coupon.

If bonds can’t diversify a stock portfolio anymore, then many fear that the strong performance of the 60/40 might have come to an end.

Hence the Google results.

So, what's the opportunity here?

Most investors tend to gravitate to what’s performed best, and sell what’s performed worst. The worse an asset or strategy performs, the more abandon it, and the lower its price goes.

But...

There will come a point that the price drops so low that investors are tempted back in. They do this quickly, which forces prices up again.

So, right now, the 60/40 should look tempting.

It's experiencing some of its worst losses ever.

It's becoming 'oversold'.

And the current environment won't last forever.

Interest rates and inflation will cool (with a recession).

When this happens, bonds (whose diversification benefits are currently reduced) should do well and likely beat stocks.

Don’t get me wrong: I’m not saying that the 60/40 portfolio is perfect.

And I’m not saying it’s right for everyone.

An even more diversified portfolio may be better suited to today’s uncertain times.

But given the current attractive entry point, it does present more attractive option than just stocks.

And if you own the 60/40 and have already been through the painful losses, don’t sell it now. It may have fallen out of favour, but it won't last.

This is what makes investing so hard.

It's all about expectations.

Markets don’t move on good or bad, they move on better or worse, specifically better or worse than expected.

What makes it even trickier is you don’t know what’s expected until you see the market’s reaction.

But one thing is clear.

The logic behind the 60/40 portfolio still makes sense.