Are being rich and being wealthy the same, or is there more to it than meets the eye?

These words might seem similar, but they hold entirely different meanings...

That can play a crucial role in shaping your financial destiny.

Many people incorrectly use the terms "rich" and "wealthy" interchangeably. But the common misconceptions surrounding these financial lifestyles often revolve around the belief that being rich automatically equates to being wealthy.

However, this is far from the truth.

To truly understand their differences and their impact on your financial prosperity, it's important to take a closer look at what each of these terms really means.

In doing so, you'll also see which path is best for you and your family.

What does it mean to be rich?

To be considered "rich," you typically earn a high income or accumulate a significant amount of wealth. This lifestyle is often associated with:

- A high salary or business income;

- A luxurious lifestyle and lavish spending;

- Expensive possessions such as cars, homes, and designer items; and

- A focus on short-term financial gains.

Although there's no universal standard for measuring wealth or what's considered "rich", a summary of the top 10%, top 5%, and top 1% of household incomes in the U.S. (based on the 2019 Survey of Consumer Finances) - is a helpful guide:

US household income for the top 10%, 5% and 1%

.jpg?width=600&height=450&name=US%20household%20income%20for%20the%20top%2010%25%2c%205%25%20and%201%25%20(1).jpg)

While these income benchmarks may qualify someone as "rich," it's important to consider other elements such as age, education, and geographic location when thinking about financial status.

Of course, having a large income doesn't necessarily ensure financial stability or long-term success. In reality, a high income may lead to a false sense of financial security, which can result in excessive spending and the neglect of important wealth-building tasks. Ultimately, being rich isn't solely defined by a specific income level, but is instead linked to a mindset that values consumption and a lavish lifestyle.

Throughout history, there have been numerous instances of wealthy celebrities and athletes who have squandered their fortunes due to poor financial decisions. However, one of my favourite examples is that of the Vanderbilts.

The Vanderbilt family not only purchased nine mansions on Fifth Avenue in New York City, some of the most expensive real estate in the world, but they also hosted extravagant parties and frequently used $100 bills to light their cigars. Unfortunately, their fortune took a drastic hit during the Great Depression.

Their story highlights a crucial lesson: placing excessive value on material possessions can result in a fragile financial position, even for those who are incredibly affluent. This is precisely why, as we'll explore in the next section, building wealth needs a totally different approach.

What does it mean to be wealthy?

True wealth is not just defined by having money; it's also about amassing assets and resources that generate consistent income for long-term financial stability. This state of financial well-being is typically marked by:

- Passive income streams;

- A diverse portfolio of investments;

- Financial independence; and

- The act of planning and organising finances to achieve long-term financial security.

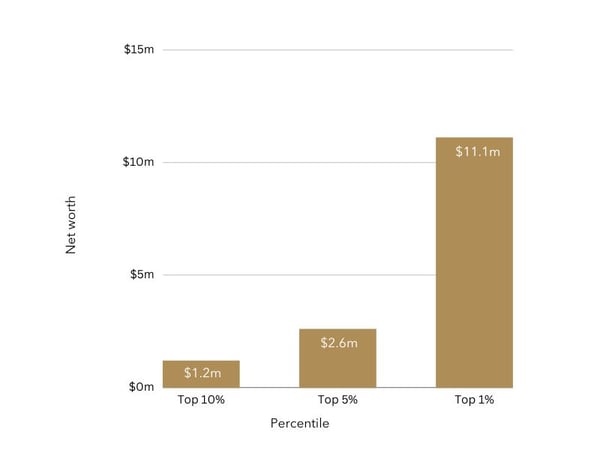

Again, there's no agreed definition of "wealthy" in financial terms. But, the net worth needed to be in the top 10%, 5% and 1% of US households from the same survey as earlier, can help:

US household net worth for the top 10%, 5% and 1%

If these numbers come as a surprise to you, don't panic.

As before, net worth figures are significantly influenced by age, education level, and location. But what does it really mean to be wealthy?

It's not simply a number; it's a way of life.

A way of life that provides you with the freedom to live without needing to work actively for your income. A way of life that allows you to pursue your interests and passions without restraint. A way of life that empowers you to do whatever you want, without any limitations.

So, if you want to feel wealthier, you have two choices:

- Enhance your net worth; and/or

- Minimise your desire for materialistic things.

This is the only way to have considerably less than someone else, yet feel as though you have much more.

I've seen thousands of families on their journeys towards wealth. It always surprises my just how similar they are.

It has to begin with a change in mindset. Away from material gain, towards a long-term approach to financial prosperity. So, what are the key differences between "rich" and "wealthy"?

Rich vs. wealthy

Let's imagine two international investors, Mr. Chocolate Cake and Mr. Broccoli.

Mr. Chocolate Cake earns an impressive salary and loves to spend it on lavish items for the world to see. He's at every party, has an 'exciting' investment portfolio of sexy meme stocks and Crypto, and appears to have it all.

Many people crave (like chocolate cake) a slice of his lifestyle.

But, because of his designer clothes and extravagant holidays, he has little in savings (or solid investments). If his income were to disappear tomorrow, his "rich" lifestyle would disappear with it.

Mr. Broccoli earns a similar amount but chooses to live more modestly.

He views investing as long term; requiring patience and discipline and the ability to ignore the madness of the crowds. He invests a significant portion of his earnings into a globally-diversified, low-cost portfolio consisting of some of the world's best companies. He may seem 'boring' at parties, but he enjoys true financial freedom, knowing that his assets and income will continue to support his lifestyle, regardless of whether he works, or not.

Most people's brains will tell them the Mr. Broccoli's approach is better for their financial health in the long run, but they have primal cravings...

So, the main differences can be summarised as:

- Spending vs. saving

- Active vs. passive income

- Perception vs. reality

The choices of these two individuals will shape their financial future considerably. As it would for you.

Once you acknowledge that true wealth encompasses more than just money, you can make a deliberate choice to not only concentrate on expanding your assets and income streams, but also on creating the lifestyle you genuinely crave.

This is of course simple, but not easy.

Wealth-building can take years, and self-discovery even longer.

However, if you invest the effort and dedicate the time to working out what you really want and what's needed for you and your family to flourish and thrive (broccoli or chocolate cake with lashings of cream), you'll realise that being truly wealthy is entirely possible.