Have a plan...and take advantage of it

We recently wrote about the nature of investment markets and were delighted by the response from our clients and friends. A lot of people asked us about the investment plan that we referred to, so we thought it would be valuable to further explain how we think expat clients can set their portfolios up to ensure that they know how to respond when markets move around. In much of life, true 'opportunities' can be difficult to spot - much of the time, they're only obvious with hindsight. We think that an offshore investing plan helps you to identify opportunity, and pushes you to act even when volatility and headlines make it hard to do so.

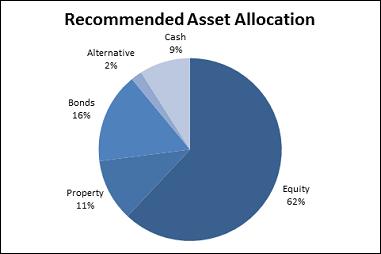

First, have a plan. I recently helped a friend to set up his investment plan. He is in his mid forties, has three children and a modest lifestyle. He knew he ought to be doing something smarter with his money, but wasn't quite sure what, or how. He asked what he ought to be buying; so we talked about what his money is for (he wants to fund his retirement), his hopes and fears (will he be able to fund the retirement he wants?) and how much he thinks he needs in retirement (quite a lot!). We sketched out a plan and a simple set of rules to follow. The relief he felt was evident. The asset allocation we came up with is illustrated below.

For most of us, the benefit of an investment plan lies not in the development of a highly sophisticated asset allocation, but in a basic set of principles that we set out and then use over the following months and years to manage our risk tolerance and return expectations - and also as triggers to invest, or to sell, when markets move. As you read this, you are probably immediately thinking 'I don't know what an asset allocation is', or 'I don't know what my asset allocation should be'.

Put simply, your investment management plan requires two things - first, a simple target asset allocation (the blend of assets which attempts to balance risk and reward, driven by your own risk appetite, goals and time frame) and second, some simple rules on how to get to it. The plan is there to keep you honest and to be used as a benchmark when you look periodically at your portfolio and wonder what, if anything, you should be doing.

More important was our discussion on how to get there.

The rules we settled on were simple: we defined the frequency with which he will review his portfolio (once a quarter); the amount he needs to invest in equity markets to bring himself up to his 'correct' allocation (£120,000), and when he should do this (in three slugs over the next six months, and to set dates at regular intervals at which to make these investments). For most people, this is as complicated as it needs to be: the problem is that fear of getting it wrong means that investors stay in the wrong asset allocation, which normally (in my experience) means that they have nowhere near enough growth exposure to meet their objectives. In my friend's case, we also agreed that he should accelerate his planned investments if equity markets fell below set levels. They fell, so he bought, and is now sitting on some attractive early gains. The point is, having a plan which was simple, thought-through and written down made it easier to act when the circumstances were right.

Defining your target asset allocation might sound daunting but is actually pretty easy. It's the most basic piece of advice that any Investment firm ought to offer its clients.

The short version?

If you're looking to grow your wealth, you need to own growth assets, which basically means equities. If you want income, you need yield assets, which basically means fixed income (bonds). You need to hold some cash (sleep easy money) and most people also own some property and possibly some other bits and pieces. Finding the balance between them is mostly science, but also something about art. We're happy to help with this, but you can work it out yourself with ease - Google is your friend, or why not download our brand new guide, DIY Investing.

The harder bit is implementing all of this. But it's still not that hard. The key is to avoid unnecessary fees (this is what affects returns the most), maintain flexibility, and think carefully about following advice. We'll share more on this another time. In the meantime, do think about your asset allocation, and follow my friend's example: set up a plan that means that you recognise opportunity when you see it, and take advantage accordingly.