Insider secrets: how salespeople make money on your investments in 2020

Many investment scandals have crawled out of the woodwork recently.

Cases of investors losing their life savings to hidden commissions and toxic products have dominated news headlines.

Investors want answers.

They want to avoid the same thing happening to them.

Here’s how.

If you’re reading this, you’re most likely someone who’s interested in the world of finance…

Perhaps even an investor with a fairly good grasp of how investments work…

Who’s often surprised to hear of other investors easily swindled out their money.

Why didn’t they read the fine print?

Why did they agree to pay their adviser such a high commission?

Why didn’t they scrutinise their charges in the first place?

Chances are, like many, you’re not aware of how easy it is to be misled by salespeople who are hungry to make a profit.

Here's how they do it.

In three bites.

The first bite

One of the most popular products salespeople favour is an offshore investment bond.

You'll see in most cases…

The bonds are fine.

It's the way they are sold that's the problem.

When a salesperson sells the bond, they can receive an upfront 8% in commission from the bond provider.

How?

Because you pay an annual establishment charge, typically around 0.85% to 1.5% per year, for up to 10 years.

If you try and escape the shackles of your offshore bond before paying off all these charges…

They're clawed back from you, resulting in horrible penalties, a staggering lack of flexibility, or both.

The second bite

If a salesperson recommends the investments wrapped up in your bond, they can also take a great big bite out of your wealth in the form of the investments' initial charges.

These are typically 4% to 8%.

On some investments, such as structured products and hedge funds, they can be even higher.

This is either directly deducted from your original investment...

Or ‘back-end loaded’...

Which means it's taken as a percentage each year for a period of years, just like the bond itself (thereby accentuating your structure's lack of flexibility).

Let’s put that into perspective.

Say you invest £100,000.

The salesperson receives at least £12,000 of that.

Realistically, it could be as much as £17,000.

Possibly more.

Let that sink in…

The third bite

You end up paying the product provider and the investment company as well.

So, once everything's added up, it’s not unusual for an expat investor like yourself to lose £88,000 in charges over twenty years on a £100,000 original investment.

It’s not easy to comprehend.

Our recent case study shows how anyone can be misinformed.

Even those who are knowledgeable investors like this lawyer in Dubai.

Despite his years of investment experience…

He still managed to be swayed by a salesperson, losing a staggering £66,000 instantly.

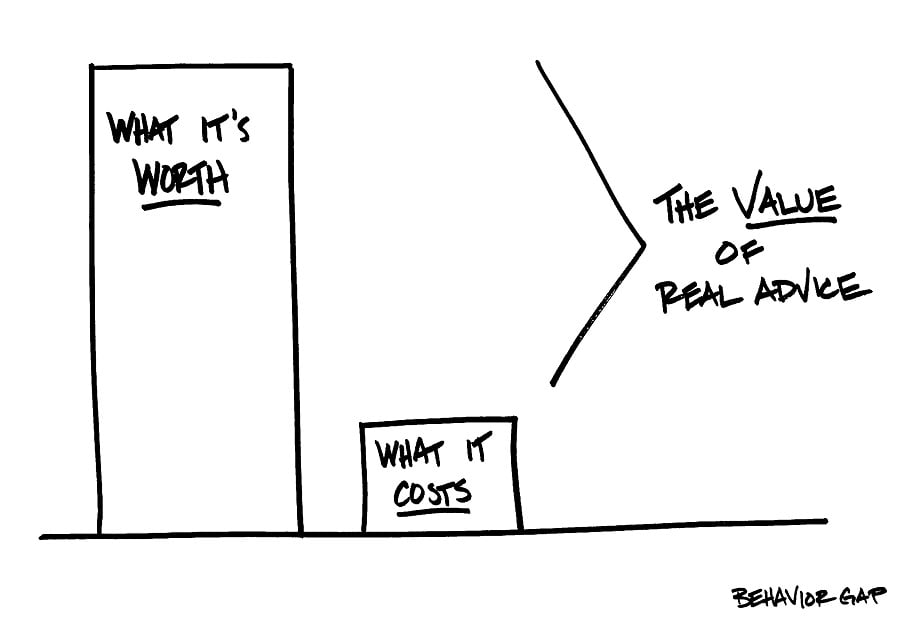

What do you get for the fees you pay?

In life, we’re prone to thinking that high cost equals better quality.

Cars, homes, suits, watches, mobile phones…

The more you pay, the more ‘added extras’ you enjoy.

But it doesn’t work that way in financial services.

The exorbitant charges your pay a salesperson for an offshore investment bond…

Only results in a poor-performing investments, huge losses and, quite possibly, a portfolio that’s misaligned with your future goals.

Final points to consider...

- Many well-regulated countries ensure investors get full commission disclosure. And some countries have banned commission because it can lead to worse outcomes for investors.

- Offshore investment bonds are hugely popular with expats. Allegedly, their popularity is due to the tax benefits they offer. Arguably however, those benefits are usually irrelevant for investors living in low or no-tax jurisdictions - like the UAE.

- Many offshore investment bonds are stuffed full of ‘alternative’, opaque and usually high-risk investments (such as hedge funds and structured products). Again, it’s arguable whether those products are the best option for the majority of investors. What cannot be argued, however, is that those investments tend to pay much more generous commissions than mainstream ones.

Ask yourself – how important is your financial future?

Are you afraid you're not doing the right things with your money?

With so much complexity and contradictory information in the world of financial services…

What you need is access to unbiased, trusted financial education.

AES Education's resources are designed to help you close the gap between where you are and where you want to be.

Subscribe today for insights and simple strategies from our experts, and get one step closer to your goals.