This week, I’m going on holiday.

Two weeks of creating memorable moments with my wife and kids.

Here’s what I’ve been reading in-between packing.

Everyone has their own unique experience on how the world works.

All of us – you, me, everyone – go through life anchored to a set of views (largely formed in childhood and early adulthood) about how money works.

The person who grew up in a war-ravaged region thinks about risk and reward in ways the son of a successful businessman cannot fathom if he tried.

You know stuff about money that I don’t and vice versa. You go through life with different beliefs, goals and forecasts to mine.

This is what I touch on in my new column in The National, titled The Psychology of Money. Inspired by my favourite authors, thinkers and educators, the first piece was published this week and will aim to use colourful stories and analogies to increase self-awareness around how we can all make better decisions about money and life.

I enjoyed Ben Carlson’s article on 16 unbelievable facts about the markets. For those who enjoy collecting random facts – give it a read. You’ll discover interesting bits like:

- Which period saw long-term bonds beat the US stock market for 25 years

- The incredible Japanese stock returns turning a $10k investment into $610k in just 19 years

- When the US stock market was up nearly 3000% in total

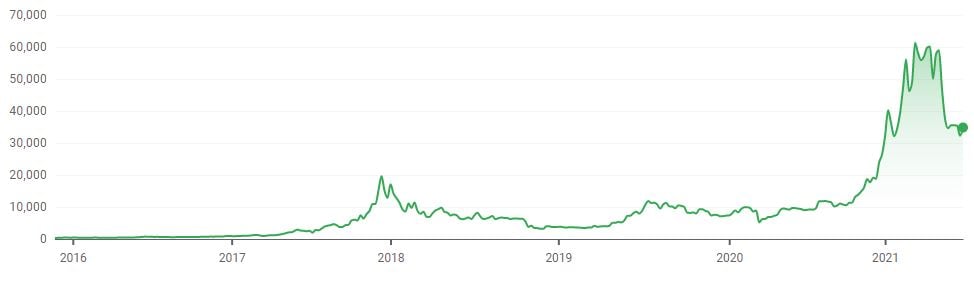

We've written about the increasing interest in Bitcoin. In its short existence, it has proved extraordinarily volatile, sometimes gaining or losing more than 40% in price in a month.

And as you know, no central bank issues the currency, and no regulator or nation state stands behind it.

There’s been a sharp rise in the market value of bitcoins over the past weeks and months.

What should investors make of it?

For the most part, goal setting seems to raise our well-being modestly in the short run, by increasing our optimism and sense of direction.

But, not all goals are associated with equal happiness.

As this article says: the magnitude of a dream matters.

Setting short-term, realistic goals is a reinforcing mechanism of success and happiness, provided these goals fit with your values and aren’t imposed on by others.

It’s why as financial planners, we often help investors plan for smaller milestones, while keeping the bigger goals within view.

There’s no point planning so far ahead that you forget to enjoy your life today.

Life’s precious and you need to make the most of it.

Which leads me to this…

How do you choose to spend your time?

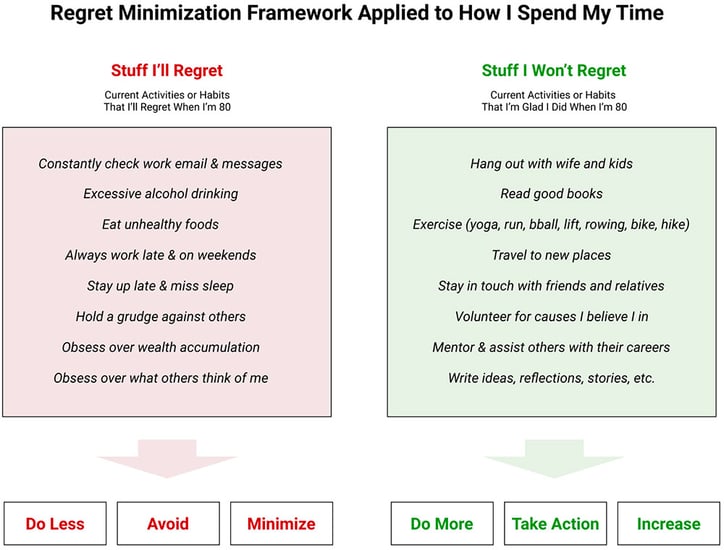

This article is inspired by Jeff Bezos and his Regret Minimizaton Framework.

“If you can project yourself out to age 80 and sort of think, ‘What will I think at that time?’ it gets you away from some of the daily pieces of confusion.” – Jeff Bezos, on his Regret Minimization Framework

The author of the article, Peter Kang, shares how he visualises his own framework:

Perhaps this inspires you to think about the way you spend your time.

Are you doing your best to take care of the life you’re given?

Go on holiday.

Take on that new job or project.

And pay for that gym membership.

Your future self will thank you for it.

A question for you:

When was the last time you truly focused on yourself and your needs?

This week’s mediations:

"The journey of a thousand miles begins with one step."

- Lao Tzu

“If you don't like the road you're walking, start paving another one.”

- Dolly Parton

If you liked this post, please share it using the social buttons at the top, or just forward them this blog.

Have a great weekend and enjoy the ‘light’ reading!

My column on The National.

Ben Carlson’s article on 16 unbelievable facts about the markets.

Our blog on 3 things you might not have considered about bitcoin.

Arthur C. Brooks' article Are you dreaming too big?

Peter Kang's article Minimizing regrets with how I spend my time.