Week 9: Money and happiness, sensible investing and financial health

As a weekly blogger, I need to curate articles that say almost exactly the same thing 52 times a year - in a way that no one realises I am doing it.

I’m sure you’ve read my scepticism about speculative fads, gimmicks, high investment costs, mainstream journalism, and anybody’s ability to predict the future.

It constitutes good advice.

And, like many pieces of age-old wisdom, doesn't change much over time.

You see, I believe a large part of the wealth planning profession is to tell people what they don’t want to hear, which is also probably something they need to know.

The key is to figure out how to frame this information so that people don’t completely ignore it and unsubscribe.

A good example of wisdom in motion is the picture below, featured in Darius Foroux's recent article 'the stoic path to wealth'.

I don’t know of any successful investor who hasn’t made a major mistake – even if they were entirely unaware of it at the time.

Everyone has been burnt.

Myself too, many times.

This is what gives us wisdom to learn how to do a better job – who to trust, how to react, what to expect.

Are you currently making mistakes when investing your money?

It's safe to say markets have been a bit erratic throughout the pandemic - bubbles, FAANG stocks, Bitcoin and the fear of missing out, all wreaking havoc with investors’ emotions.

Most of the time, it’s generally not a bad idea to ignore what’s going on in your portfolio. At the very least it can be distracting and, at worst, it can be a source of unnecessary anxiety.

Stick with your plan and try not to look at, or think about, your portfolio too much. Attempting to second guess the market is a fool’s errand.

So what should you do?

Last week I spoke about sensible investing. It’s about remaining highly diversified across markets, sectors, and companies to try to smooth out returns as much as possible over time. Maintaining this balance is important – it may not be as exciting as taking a punt on Tesla or Bitcoin, but it will reap its rewards in the long run.

Remember that being diversified means you will benefit from being in the companies and sectors that do well. In 2020, the developed global stock markets returned around 12% in GBP terms. Of this 12%, half was attributed to the top 10 stocks. The FAANGs alone represented 30%. That’s surely enough exposure for most!

On the topic of the pursuit of wealth, Larry Swedroe shares an interesting game you can play that looks at your appetite for risk and return in his blog called 'the odds of outperforming through active management'. The moral of the game is that achieving superior returns isn't about trying to outperform the market, but by establishing a plan and staying the course with it.

If you’re a regular subscriber to our blog, you’ll know I’m also focused on helping you live a healthier and more purposeful life.

I spent a lot of time researching ways for us to effectively improve ourselves so we can live with inner joy, tranquility, and certainty.

To me, the ultimate goal of life is to have more freedom, impact, inner peace and personal growth.

In addition to helping you get a handle on your money, a financial plan can also bring certain physical and mental health benefits, including less anxiety, better self-esteem, improved sleep and stronger relationships - all of which could help you develop a more optimistic outlook on life and feel good about the direction you’re headed in.

This leads me to the age-old question:

Can money buy happiness?

Perhaps the better question is: how important is the pursuit and accumulation of money to living a happy life?

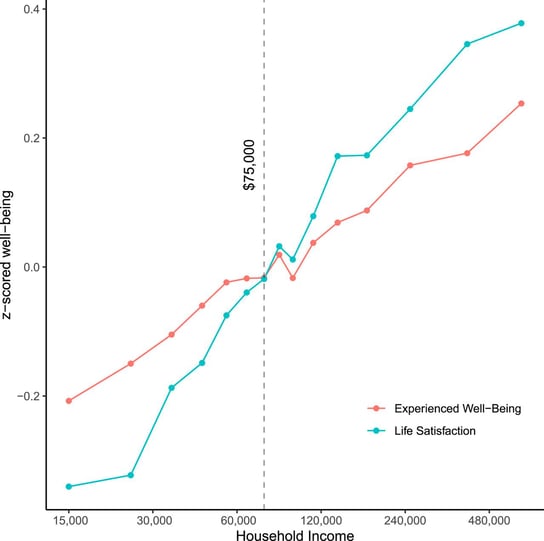

As people earn more money, their sense of well-being increases. That’s the conclusion of a study from The Wharton School at the University of Pennsylvania, published in Proceedings of the National Academy of Sciences.

This contradicts the well-known 2010 study from Daniel Kahneman and Angus Deaton that suggested our sense of well-being essentially plateaus after an income of $75,000 a year.

The reason high-earners are happier is because they feel in more control over life and better protected from hardships, according to Jacob Schroeder.

The money-happiness relationship is arguably more complex than that, though, which he discusses in his post 'the relationship between money and happiness'.

A question for you:

How much does your happiness depend on money?

Remember, money can buy a bed but not sleep. A house but not a home. Medicine but not health. Money can create the conditions for being happy but only you can manifest true happiness. You are the architect of your thoughts, values, behaviours and mindset.

Take care of yourself and have a great weekend!

This week's meditations

"True happiness isn’t out there. True happiness lies within."

– David Lynch

"Money does not buy you happiness, but lack of money certainly buys you misery."

– Daniel Kahneman

If you liked this post, please share it using the social buttons at the top, or just forward them this blog.

Have a great weekend and enjoy the ‘light’ reading!

Darius Foroux's article 'The Stoic Path to Wealth: An ancient investing strategy for the modern world'

Matthew A. Killingsworth for the University of Pennsylvania 'Experienced well-being rises with income, even above $75,000 per year'

Daniel Kahneman and Angus Deaton's article 'High income improves evaluation of life but not emotional well-being'

Jacob Schroeder's 'Are You Financially Resilient?' and 'The Relationship Between Money and Happiness'

Larry Swedroe for The Evidence Based Investor on 'The Odds Of Outperforming Through Active Management'