I invest my own money and most of our clients' money this way: How multifactor investing can help YOU meet your investment goals

Over the years, factor-based investing has grown in popularity within developed markets.

Multifactor solutions are now widely used by sophisticated investors to help meet their goals.

But are almost unheard of here in the Middle East, or amongst retail investors.

I invest my own money and most of our client's money this way.

What benefits can they potentially bring to you?

Multifactor solutions differ in their choice of factors, their design, and their implementation.

This can ultimately mean big differences in performance.

For a summary of multifactor investing, watch this short video.

Dimensional Fund Advisors, the firm I use for my own family's investment, is all about implementing the great ideas in finance.

This means starting with the information on market prices, using rigorous research to identify systematic differences in expected returns, and implementing in a cost-efficient manner that adds value to investors and is easy to monitor.

In this first of a new blog series, we'll share how Dimensional thinks about multifactor investing, including their choice of factors and how multifactor solutions can be designed, managed, and monitored to help you seek your investment goals.

Since the 1960s leading academics have been producing groundbreaking work on fundamental concepts like asset pricing, risk and diversification.

Several of these academics—who would later be recognised as Nobel laureates in economic sciences—were involved with Dimensional in its early days and remain closely involved today.

Every dollar invested has financial science at its core.

"It's 10% having a good idea and 90% implementing that idea and making it work. Dimensional has been making it work for decades." - Robert Merton, Nobel laureate, 1997

Let's start with the market

We know, from history, capital markets have rewarded long-term investors.

Staying disciplined, particularly in tough times, takes having an investment framework.

Dimensional's framework centers on market prices. Prices are updated in real-time, all the time, and represent the most complete prediction of the future available.

Academics have long documented that there’s no compelling evidence to suggest that trying to find mistakes in markets has yielded better investment outcomes.

In fact, there are many challenges and costs for investors looking for "mistakes".

This evidence means market prices are the best model available for understanding expected returns.

It's possible to have higher returns than the market without having to outguess it... by using the market as a starting point and building from there.

Breakthroughs in financial science

Human ingenuity is amazing.

Modern finance has led to many breakthroughs, but these insights need to be organised in a meaningful way.

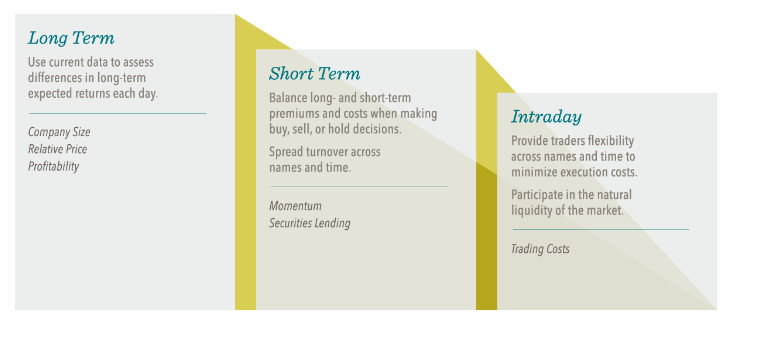

One way is by time horizon.

For example, does the research provide insights about expected returns over the next minute, the next month, or many years down the line?

Thinking this way helps Dimensional increase the likelihood of expected returns and manage risk each day.

Long-term drivers (impacting strategic allocations) which have tended to persist over many years might include differences in company size, relative price, or profitability.

At the same time, daily process are used to add value in other ways.

For example, Dimensional are able to keep trading costs low by identifying more buy and sell candidates with similar expected returns than they need each day.

Their process affords them flexibility, unlike many index fund managers who are constrained in what securities to hold and when to trade them.

A well-diversified market portfolio can be a good portfolio for many investors.

A well-diversified market portfolio can be a good portfolio for many investors.

And while Dimensional seeks to outperform a market portfolio in many ways, returns are noisy and there can be periods of time when a particular driver doesn’t deliver.

This is accounted for.

Markets may be disappointing at times, but the aim is for investors to not be surprised.

Millions of data points are processed each day.

By starting with the market and adding value through robust daily processes, the goal is to help minimise risk and increase the likelihood of a good outcome.

When considering any money manager, it’s helpful to evaluate how well they’ve performed—not just in one or two handpicked strategies but across a broad range and over the longest time period available.

Ask yourself:

- Did they deliver what they said they’d deliver?

- Did they remain consistent in their approach?

- Have their solutions survived the test of time?

- Why should you have confidence they can repeat any success?

Dimensional apply one philosophy and have strategies dating back decades—including some that have been serving investors for almost 40 years.

Through time, they've experienced a wide range of market conditions.

A track record this long is revealing and reinforces the importance of having an investment philosophy you can stick with.

Like Dimensional, we recognise that every dollar invested represents the hard work, savings, and dreams of investors all around the world.

Like them, we're committed to maximising expected returns so we can all contribute to our families, our communities and individually flourish and thrive.