I read a great blog recently from Ben Carlson, who answered a question I'm also asked a lot...

"What real return can I actually expect from the stock market?"

Many financial professionals will often quote '10% on average', but what should investors realistically expect, to help with their retirement planning?

One key factor in a successful investment plan is having sensible upfront expectations. The tricky part here is that most of these expectations are more like educated guesses, and they often turn out to be off the mark.

Why? Because, of course, no one knows what's going to happen.

The best any of us can do is look at what's happened before using the years of data and evidence at our disposal, look at what's happening now, and make educated guesses.

As for 'real' returns, this is a great question since, let's face it, they're going to be all that matter in the long run.

When looking at real returns, we're talking about inflation-adjusted (and thankfully stocks have historically been a great hedge against inflation).

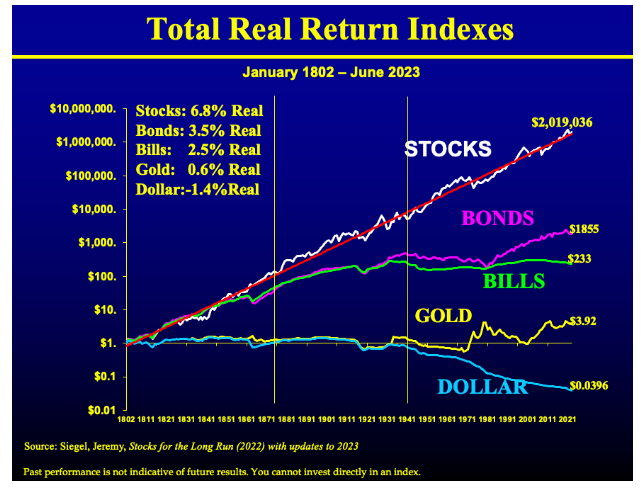

The below chart shows some long-term inflation-adjusted returns for stocks, bonds, cash, gold and the dollar going back more than 200 years.

Source: Stocks For the Long Run by Jeremy Siegel and Jeremy Schwartz

As the title of the book this chart is featured in suggests, stocks are the clear winner over the long term.

The reduction in the purchasing power of the dollar is down to inflation. The value of your cash, when kept under the mattress, simply erodes away.

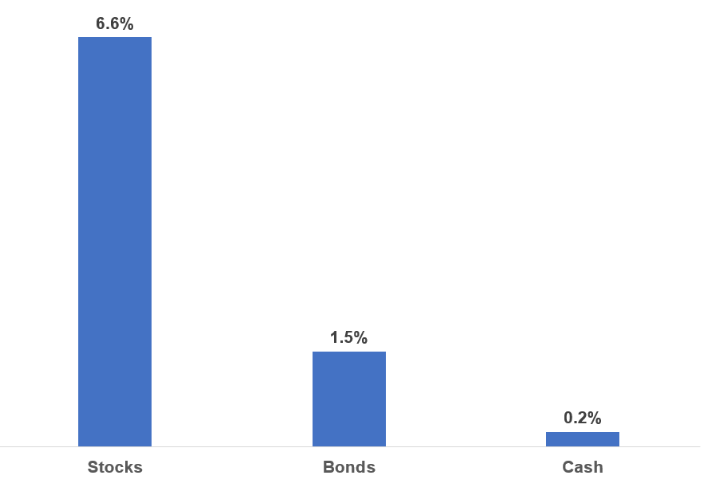

In Ben's blog, he included another chart, which shows real returns data for stocks, bonds and cash going back to 1928. You can see stocks are quite similar to that chart above, but bonds and cash come in lower.

Source: Aswath Damodaran

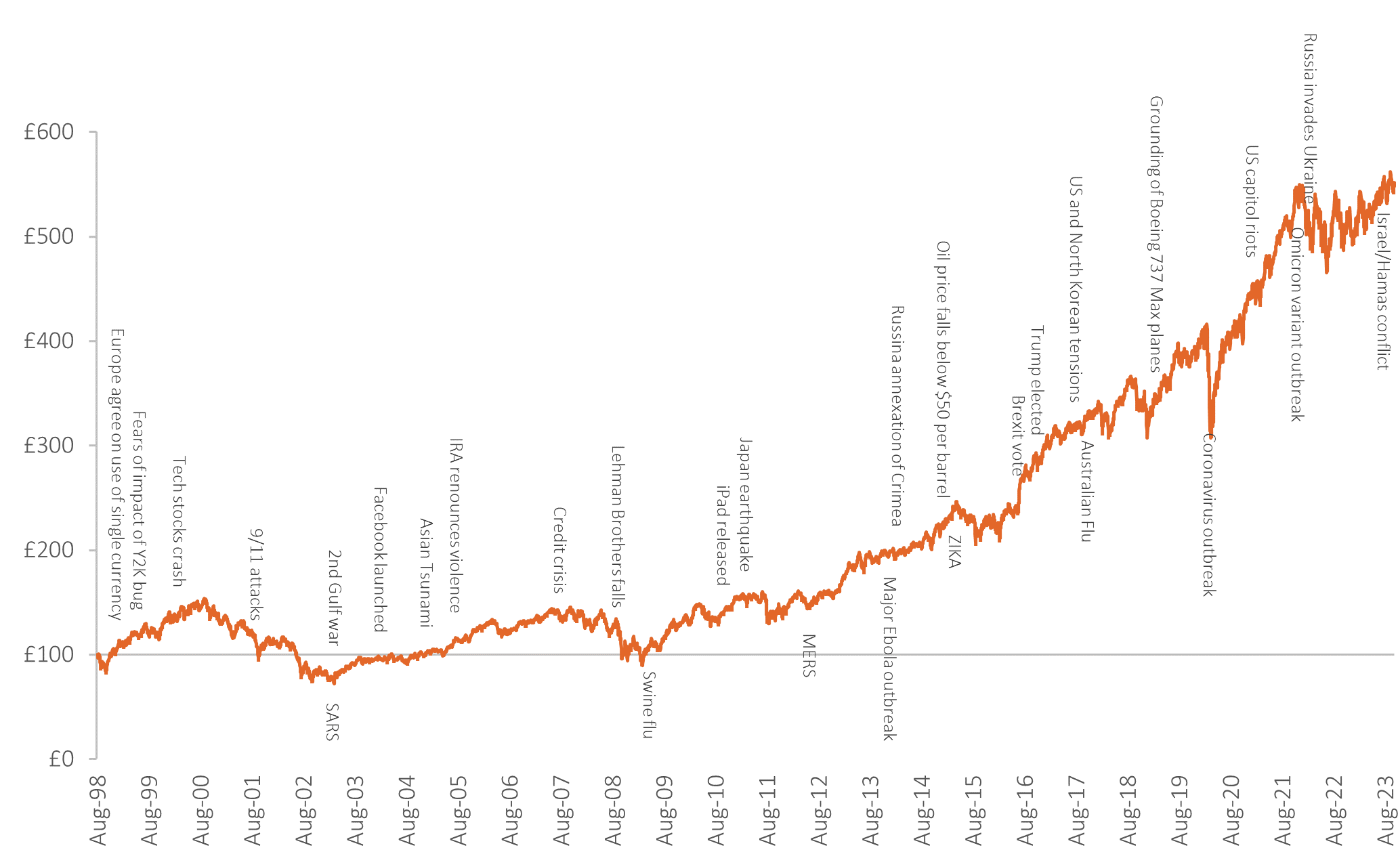

But, perhaps more interesting than any of the above, is how stable stock market returns tend to be over the long term, regardless of what's happening in the economy and the world.

Below is one of my favourite charts, which shows how investors who remain invested, are rewarded over time. Broad diversification will see you through any investment storms which come your way, today or in the future, as it has done for decades.

Global equities and world events Aug 1998 to Aug 2023

Data: Morningstar Direct © All rights reserved – Global equities Stock index $ Acc. In GBP

The answer remains that no one knows what will happen and we can't use historical stock market returns to set expectations for the future, with 100% certainty.

I am, however, confident the stock market will continue to remain undefeated over the long term, but what I don't know is how big that difference will be. That's what risk is all about.

Many also believe that because stock market valuations have been rising over time, this should mean lower returns moving forward. What goes up, must come down...

This could be true, but perhaps not based on valuations.

Let's not forget, accessing the stock market was much harder years ago. As Ben says:

"Costs were higher and the financial system was more unstable. Thus, investors rightly demanded higher returns on a gross basis. But net returns in the past were likely much lower since trading costs, fees and expense ratios were so much higher."

So, even if future returns are lower, it's still much easier these days to earn a return through things like index funds and ETFs.

Another consideration for whether returns will be lower going forwards is the US.

Its stock market has grown exponentially since 1900, relative to the rest of the world, sitting at 60% of the world stock market vs. 15% 120 years ago. As with any past performance, however, you can't expect it to repeat.

The best thing any investor can do is to use a range of real returns to help manage future expectations. 6% sounds reasonable based on current data.

If things go better than expected, adjust.

If things go worse than expected, adjust.

I'm a huge fan of simplicity. And life would certainly be simpler if assets with higher risk gave us fixed, predictable returns in the future.

But this means they aren't "risky" assets at all, and they wouldn't deliver the returns they do. This is the price you pay for achieving long-term results and therefore, your most cherished goals.