How Dimensional’s globally diversified funds bring greater investment success

How do you enjoy the benefits of an interconnected world?

Days start with a cup of coffee that originated in South America.

Email is read on a smartphone designed in California and manufactured in Taiwan.

Clothes woven from Egyptian fabrics worn before you drive a German-made car.

Do you ever stop to think about this?

As consumers, we rarely think twice about our access to global goods.

Yet, as investors, we often concentrate our portfolios in favour of our home market…

At the expense of global diversification.

For example, while UK stock markets represent just six percent of the value of global equity markets, many UK investors tend to allocate around a third of their equity assets to domestic stocks.

This phenomenon can be observed across the world and is known as “home-country bias.”

While investing “at home” may feel safe and familiar, it can increase risks and decrease returns.

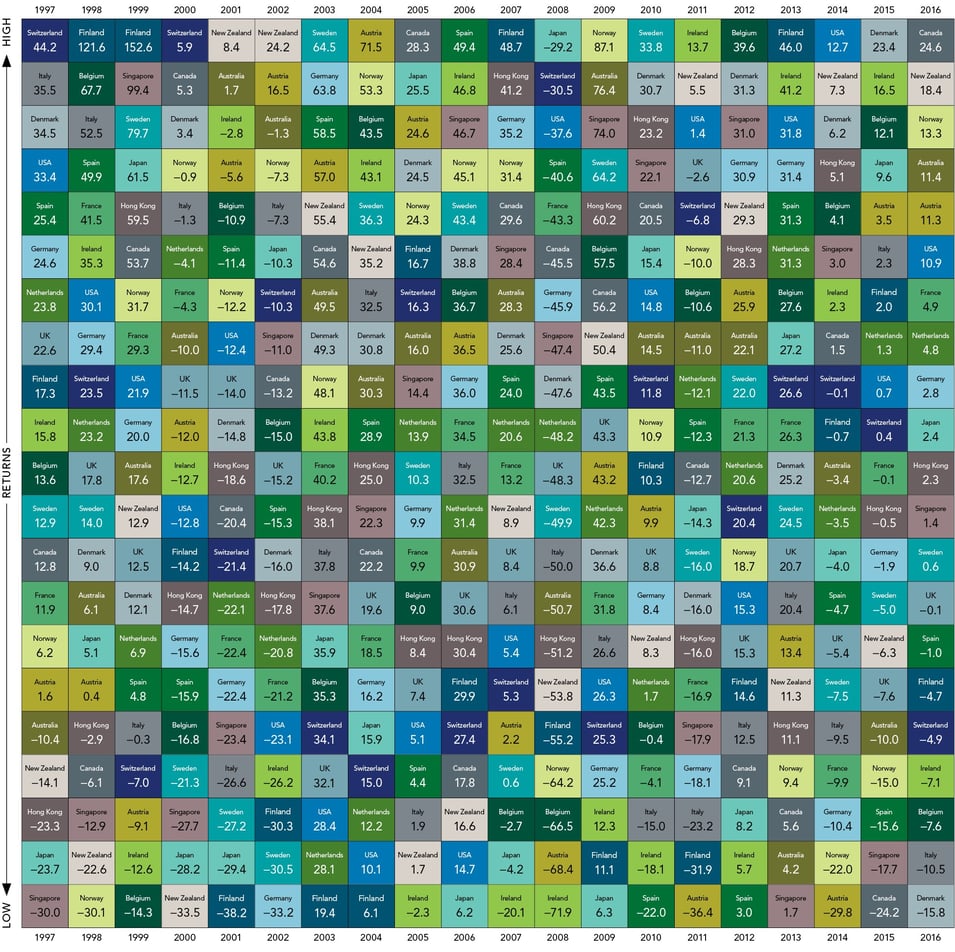

To illustrate this, below are 13 different developed countries (out of 21) which had the best performing equity market in a given calendar year for 20 years.

No country had the best-performing market for more than two consecutive years.

Just think about that...

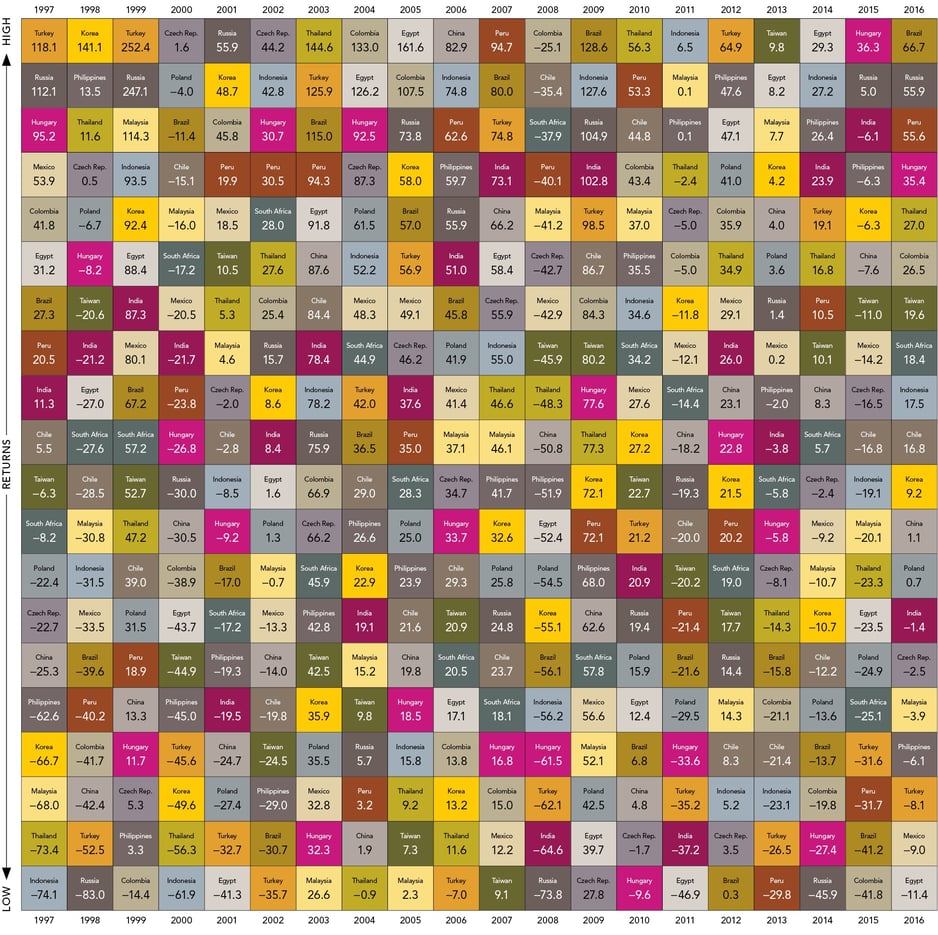

This trend was also observable in emerging markets.

The next table shows 13 different emerging market countries (out of 20) which had the best-performing market in a given year, and no country had the best-performing market in consecutive years.

The takeaway?

It’s difficult to know which markets will outperform from year to year.

By holding a globally diversified portfolio, investors are well positioned to capture returns wherever they occur.

Clearly, attempting to pick only winning markets in any given period is a challenging proposition.

Therefore, investment solutions deprived of broad diversification may miss out on the very stocks that deliver the premiums.

If you’ve been following us for a while, you’ll know we regularly talk about our relationship with Dimensional Fund Advisors.

It's how we invest our own money and how our CEO invests his.

Dimensional offers a suite of world allocation strategies that match the AES investment philosophy and help our valued clients achieve their long-term investment goals.

(Not to mention they are backed by Nobel prize-winning data).

Their expertise across asset classes enables firms like ours to offer world allocation funds, invested in directly-held securities that pursue higher expected returns in a cost-effective manner.

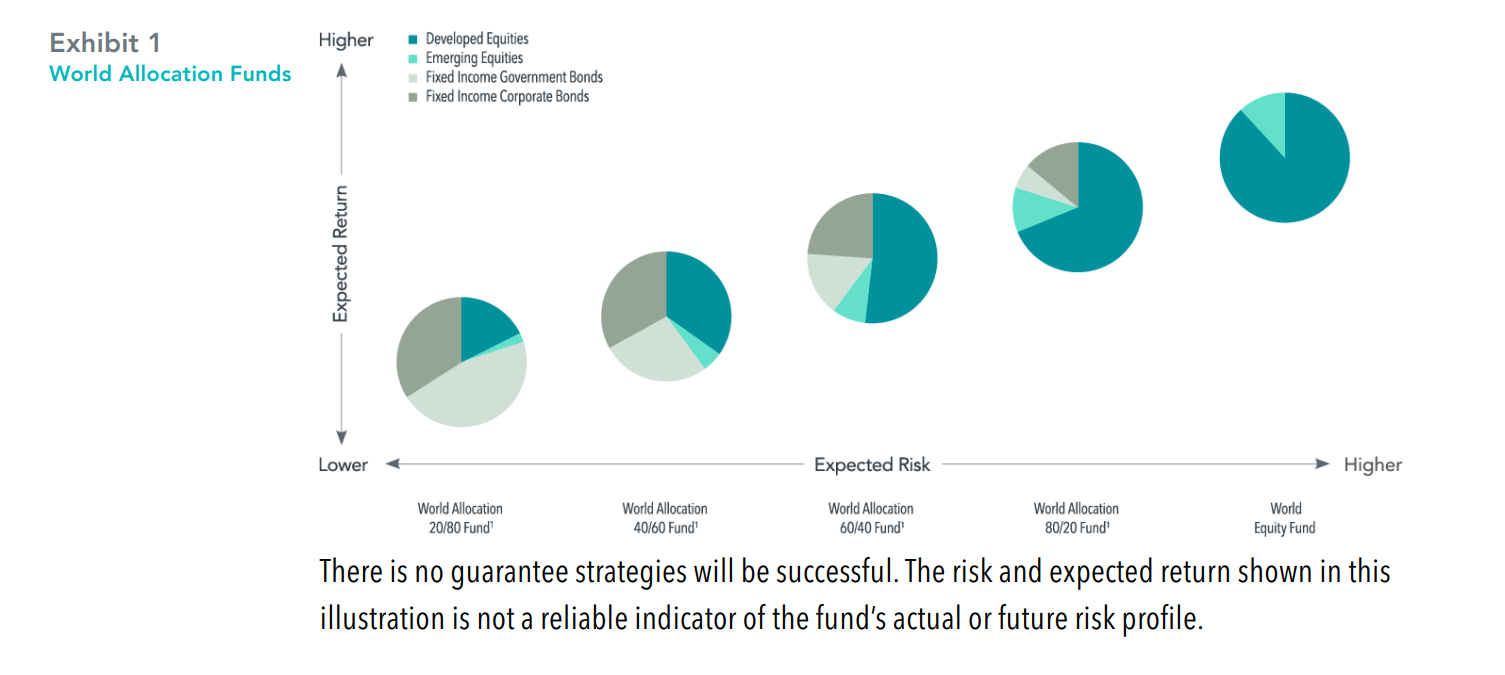

Each world allocation fund is broadly diversified across and within asset classes.

These underlying funds are combined using a long-term, strategic approach.

The funds also benefit from disciplined rebalancing procedures.

Seen below, Dimensional offers funds with target allocations of 20%, 40%, 60%, 80% and 100% in world equities.

These funds are designed to satisfy the asset allocation needs of many international investors.

In addition to maintaining the strategic equity and fixed income split, Dimensional seeks to add value within the underlying equity and fixed income funds.

Past performance is no guarantee of future results.

Remember that investments can go up and down in value, so you could get back less than you put in.

Whether or not a particular investment is appropriate for you will depend on many factors, including your individual needs, circumstances, approach to risk, and capacity for loss.

Dimensional’s world allocation funds are designed for investors looking for an all-in-one, globally diversified investment solution.

One that can weather any storm.

Here are the results from a client of ours who invested in Dimensional over the last year.

Amazing!

While the appropriate level of diversification should always be considered, broad diversification combined with long-term, systematic investing plays a key role in improving the reliability of investment outcomes.

As always, my team and I are here to empower your investment decisions and I hope this latest blog does just that.

If there’s anything you’d like us to specifically write about in the future, let me know.

And, of course, if this has inspired you to take action on your investment goals, feel free to book a Discovery Call to see if and how we can help.