We all have things we want to achieve …

- Getting fitter (or just fit, in my case!)

- Raising happy healthy children

- Achieving a promotion

![]()

…and the route to success for most of us begins with the goals we set.

Achieving financial success is the goal for my clients.

But…as I demonstrate…when it comes to making actual progress, it’s better to focus on your process not just your goal...

Make this 1 small change, and significant financial success follows.

Goals create problems

1. Goals create stress:

If I set a goal to lose 3 stone, every day until I achieve my target I will feel stressed and demoralised.Instead, by following a process of healthier eating and walking the stairs at work every day, I enjoy my life and self-improve at the same time.

2. Goals are limiting:

Once achieved, a goal is redundant, motivation is lost, and progress stops being made.

Following a process is about long-term, consistent achievement.

3. Goals set you up for failure:

Setting a goal relies on you being able to predict the future.

A process on the other hand, leads you forward - but can easily be adjusted when life throws you a curveball or an opportunity.

Process matters most

Mourinho’s goal is winning the UEFA Champions League (again).

His process is the practice he makes Manchester United’s players do every day.

J.K. Rowling’s goal is to write another captivating best-seller.

Her process is the writing schedule she follows relentlessly.

If your goal is to build a £2m pot for retirement…

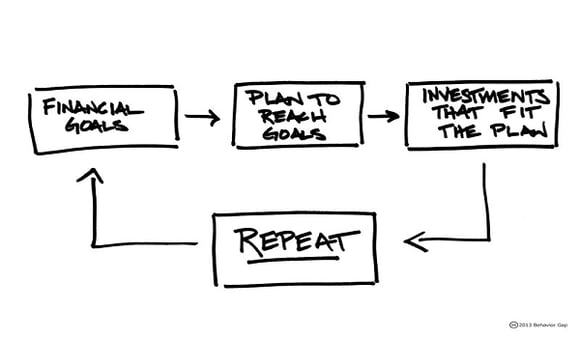

Your process should be investing every month in harmony with the 6 steps of successful investment.

The process that will secure your financial success

If you’re starting today with nothing in your pocket, and you’re focussing on building up to £2m, you’re going to feel stressed, demoralised and possibly even daunted…

And – I’d wager you’re going to give up on your goal somewhere between now and year 35…

So, with your goal defined, it’s time to set it aside and focus on your process…

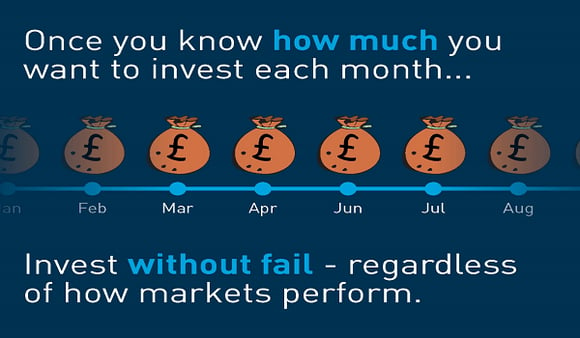

1. Invest as much money as you can afford to every payday

Set up a direct debit for £800 a month for 35 years (increasing deposits with inflation);

Assume an annual rate of return of 7%;

As effortlessly as that, you’ll hit £2m in 35 years.

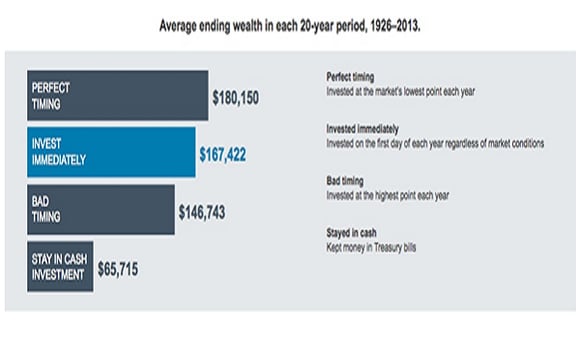

2. Invest as soon as money (bonus, inheritance) becomes available to you

According to evidence from the Schwab Center for Financial Research, waiting to invest is the costliest mistake you can make.

They compared four hypothetical investors who invested $2,000 a year for 20 years, and found that investing immediately, regardless of market conditions, almost always led to better outcomes.

Only an investor with an impossible track record of 20 years’ perfect timing could do better.

3. Invest in a well-diversified, low-cost portfolio of index funds

Warren Buffett says:“When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients. Both large and small investors should stick with low-cost index funds.”The evidence backs up his advice – if you heed it you’re likely to do far better than your actively managed peers: -

Over the past ten years, the S&P 500 index beat 82.87% of actively managed U.S. funds. And the S&P Eurozone BMI Index beat 90.41% of actively managed European stock market funds.

4. Ignore market fluctuations and accompanying media noise

Value investor Guy Spier says:“The vast majority of what purports to be analysis and information about the stock market is actually just designed to generate activity, to get us to pull the trigger because somebody out there will make money out of the fact that we’re being active.”The media has been calling the end to this current bull market run since Brexit…

But if you’d listened to their noise and fear mongering and pulled out of the FTSE 100 following the shock Brexit result, you’d have lost out on around 24% of returns and counting.

5. Stay in the market, no matter what

The much-feared bear market has occurred, on average, every 3 years over the last 115 years.

But over the last 75 years, bears have suddenly given way to bulls time and again…

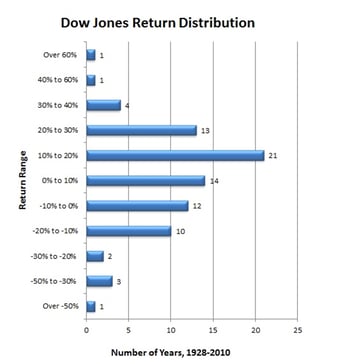

In an article entitled, Why you should stay invested, one Motley Fool journalist writes that whilst the long-term average annual return of the Dow Jones is between 7% and 9% - what happens in between is wild and terrifying!

“Stocks spend more years down more than 20% or up more than 20% than they do within the 7% to 9% range.”

Here's how that looks for the period 1928 to 2010:

To enjoy the average returns that will get you to your magic number, just get in the market, stay in the market - and the peaks and troughs will even out for you.

Process makes perfect

The final word goes to author Tony Robbins.

In his book, Unshakeable Your Guide to Financial Freedom, he summarises the process, and the value of it perfectly:

“If you harness the power of compounding, stay in the market for the long term, diversify intelligently, and keep your expenses and taxes as low as possible, your odds of attaining financial freedom are extremely high.”